15, Jul 2023

Will 2024 Be A Good Year For Stocks?

Will 2024 Be a Good Year for Stocks?

Related Articles: Will 2024 Be a Good Year for Stocks?

- The 2025 Chevrolet Traverse: A Comprehensive Guide

- 2025 M2 CS: Unleashing The Potential Of 5G And Beyond

- Top Girls Basketball Recruits Of 2025: A Comprehensive Guide To The Future Stars

- Jd.com Stock Prediction 2025

- How Many Days Till December 12th, 2025: A Comprehensive Countdown

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Will 2024 Be a Good Year for Stocks?. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Will 2024 Be a Good Year for Stocks?

Will 2024 Be a Good Year for Stocks?

The stock market has been on a wild ride in recent years, with major swings in both directions. After a strong 2021, the market stumbled in 2022, with the S&P 500 index falling by nearly 20%. So, what’s in store for stocks in 2024?

There are a number of factors that could affect the stock market in 2024, including the economy, interest rates, and geopolitical events.

The Economy

The economy is one of the most important factors that affects the stock market. A strong economy typically leads to higher corporate profits, which in turn can lead to higher stock prices. Conversely, a weak economy can lead to lower corporate profits and stock prices.

The economic outlook for 2024 is mixed. Some economists believe that the economy will continue to grow, albeit at a slower pace than in recent years. Others believe that the economy is headed for a recession.

Interest Rates

Interest rates are another important factor that affects the stock market. Higher interest rates can make it more expensive for companies to borrow money, which can lead to lower corporate profits and stock prices. Conversely, lower interest rates can make it cheaper for companies to borrow money, which can lead to higher corporate profits and stock prices.

The Federal Reserve is expected to continue raising interest rates in 2024, although at a slower pace than in 2022. This could put some pressure on stock prices, but it is unlikely to cause a major sell-off.

Geopolitical Events

Geopolitical events can also have a significant impact on the stock market. For example, the war in Ukraine has caused uncertainty in the markets and led to increased volatility. Other geopolitical events, such as the US-China trade war, could also affect the stock market in 2024.

Overall Outlook

So, what’s the overall outlook for stocks in 2024? It is difficult to say with certainty, but there are a number of factors that could lead to a positive year for stocks. The economy is expected to continue to grow, albeit at a slower pace than in recent years. Interest rates are expected to continue rising, but at a slower pace than in 2022. And while geopolitical events could pose some challenges, they are unlikely to derail the stock market’s long-term growth trajectory.

Of course, there are also a number of risks that could lead to a negative year for stocks. A recession, a sharp increase in interest rates, or a major geopolitical event could all cause the stock market to decline.

Overall, the outlook for stocks in 2024 is mixed. There are a number of factors that could lead to a positive year, but there are also a number of risks that could lead to a negative year. Investors should be aware of these risks and make sure that their portfolios are diversified.

Here are some specific tips for investors in 2024:

- Stay diversified. Don’t put all of your eggs in one basket. Instead, diversify your portfolio across a variety of asset classes, such as stocks, bonds, and real estate.

- Rebalance your portfolio regularly. As your investments grow, you should rebalance your portfolio to ensure that your asset allocation remains aligned with your risk tolerance and investment goals.

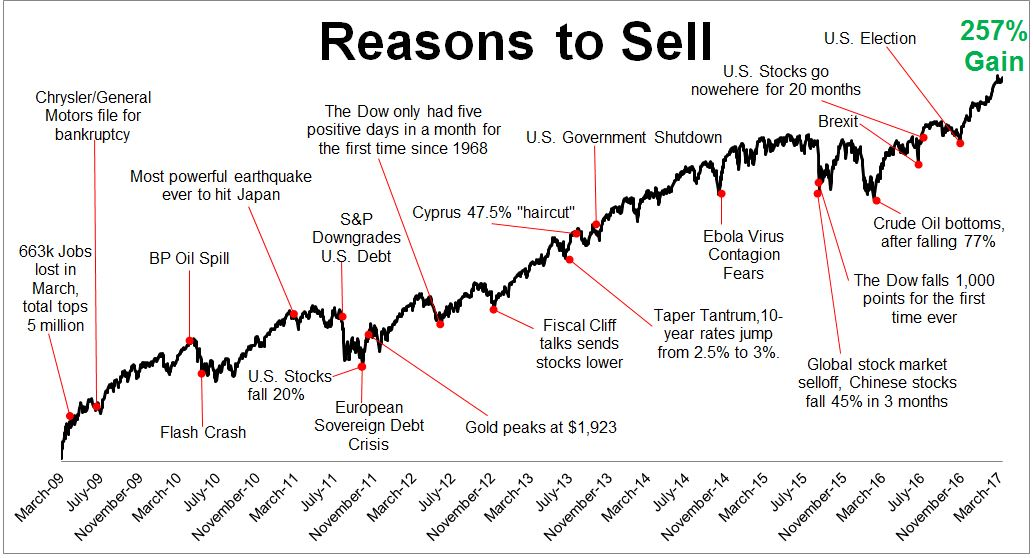

- Invest for the long term. The stock market is volatile in the short term, but it has historically trended upwards over the long term. If you invest for the long term, you are more likely to ride out any short-term fluctuations and achieve your investment goals.

- Don’t panic sell. It is easy to get caught up in the emotions of the market, but it is important to remember that panic selling is rarely a good strategy. If the market takes a downturn, stay calm and stick to your investment plan.

Investing in stocks can be a great way to grow your wealth over the long term. However, it is important to remember that there are risks involved. By following these tips, you can help to reduce your risk and improve your chances of success.

Closure

Thus, we hope this article has provided valuable insights into Will 2024 Be a Good Year for Stocks?. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin