17, Apr 2024

What Will Interest Rates Be In 2025 Canada?

What Will Interest Rates Be in 2025 Canada?

Related Articles: What Will Interest Rates Be in 2025 Canada?

- Dubai Holidays 2025: An Unforgettable Adventure Awaits

- Movies In 2025: A Glimpse Into The Future Of Cinema

- September 2025 Calendar

- Genesis EV 2025: A Glimpse Into The Future Of Luxury Electric Vehicles

- The 2025 BMW I3: A Vision Of The Future

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to What Will Interest Rates Be in 2025 Canada?. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about What Will Interest Rates Be in 2025 Canada?

What Will Interest Rates Be in 2025 Canada?

Introduction

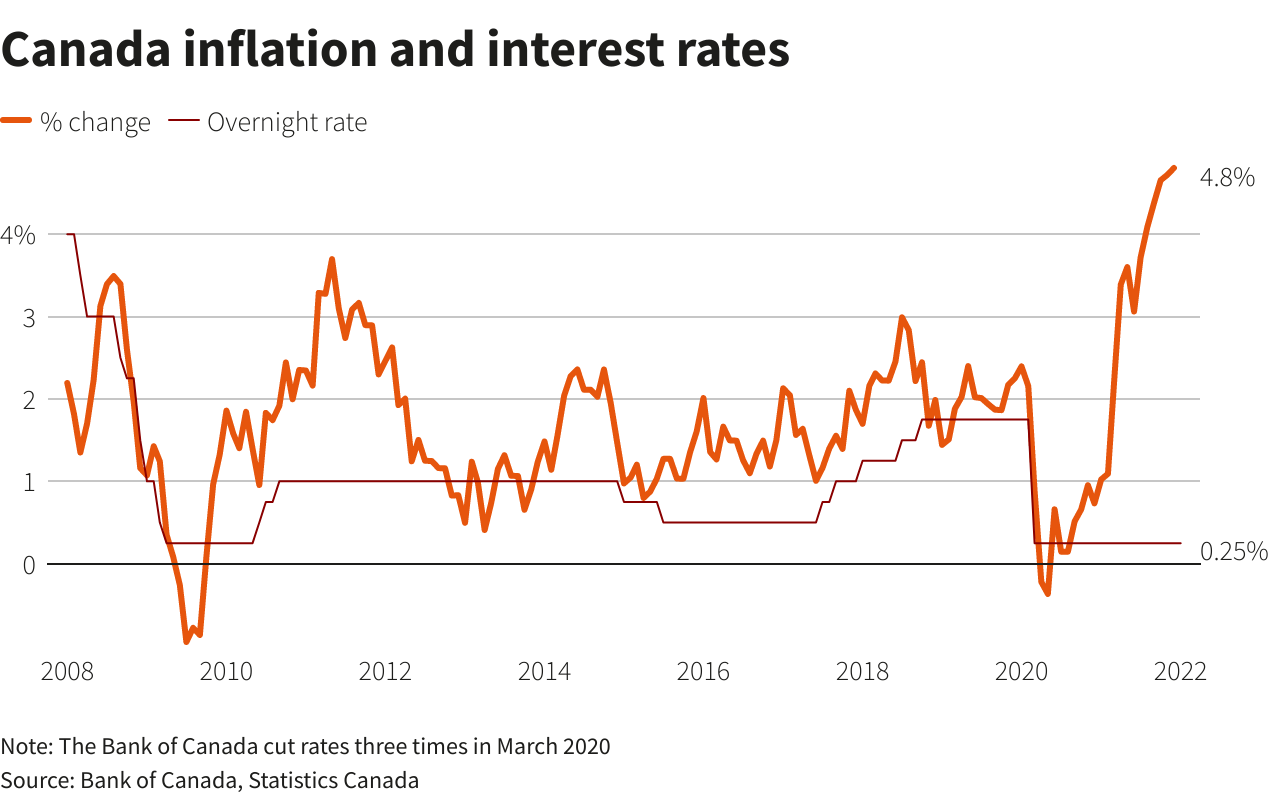

Interest rates are a crucial factor in shaping the financial landscape and economic outlook of a country. They influence borrowing costs, investment decisions, and overall economic activity. In Canada, the Bank of Canada (BoC) is responsible for setting the target for the overnight rate, which serves as the benchmark for other interest rates in the economy. Predicting future interest rates is a complex task, but it is essential for businesses, investors, and policymakers to make informed decisions. This article analyzes the factors that will likely influence interest rates in Canada in 2025 and provides projections for their potential trajectory.

Factors Influencing Interest Rates

- Inflation: The primary mandate of the BoC is to maintain price stability. When inflation is persistently above the target of 2%, the BoC typically raises interest rates to cool demand and bring inflation back to target. Conversely, when inflation is below target, the BoC may lower interest rates to stimulate economic activity.

- Economic Growth: Interest rates also play a role in managing economic growth. When the economy is growing rapidly, the BoC may raise interest rates to prevent overheating and unsustainable growth. On the other hand, when the economy is slowing down, the BoC may lower interest rates to stimulate growth.

- Global Economic Conditions: Canada’s economy is closely tied to the global economy. Economic conditions in major trading partners, such as the United States and China, can influence interest rates in Canada. For example, if the US Federal Reserve raises interest rates, it can put upward pressure on Canadian interest rates.

- Government Fiscal Policy: Government spending and taxation policies can also affect interest rates. When the government runs a budget deficit, it may need to borrow money, which can push interest rates higher. Conversely, when the government runs a budget surplus, it can reduce its borrowing and potentially lower interest rates.

Projections for 2025

Based on current economic conditions and market expectations, several factors suggest that interest rates in Canada will likely be higher in 2025 compared to today.

- Inflation: Inflation in Canada has been persistently above the BoC’s target of 2% since early 2021. The BoC has already begun raising interest rates to combat inflation, and it is likely to continue raising rates until inflation is brought back to target.

- Economic Growth: The Canadian economy is expected to continue growing in 2025, albeit at a slower pace than in 2022 and 2023. The BoC is likely to raise interest rates gradually to prevent the economy from overheating.

- Global Economic Conditions: The global economy is facing significant headwinds, including the war in Ukraine, supply chain disruptions, and rising commodity prices. These factors are likely to keep inflation elevated and put upward pressure on interest rates globally.

- Government Fiscal Policy: The Canadian government is currently running a budget deficit, which is likely to continue in the coming years. This may put upward pressure on interest rates as the government borrows more money.

Market Consensus

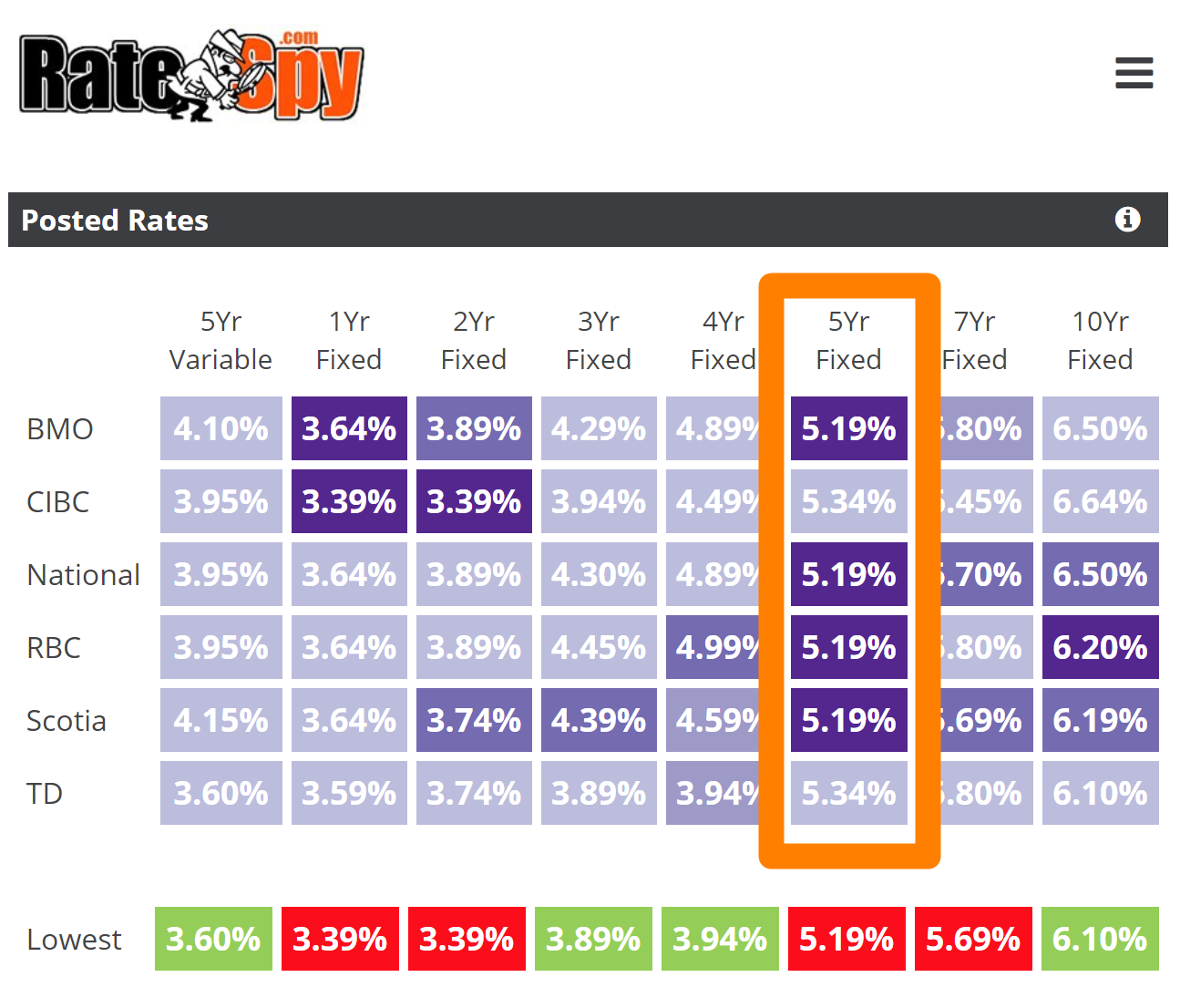

According to a recent survey of economists, the consensus forecast is for the BoC to raise its target for the overnight rate to 3.5% by the end of 2023. The overnight rate is then expected to remain at 3.5% throughout 2024 and 2025. This implies that interest rates in Canada will likely be higher in 2025 than they are today.

Implications

Higher interest rates in 2025 will have several implications for businesses, investors, and consumers.

- Businesses: Higher interest rates will increase borrowing costs for businesses, which may impact their investment and expansion plans.

- Investors: Higher interest rates will make fixed-income investments, such as bonds, more attractive. However, they may also lead to lower returns on equity investments, such as stocks.

- Consumers: Higher interest rates will increase the cost of borrowing for consumers, which may impact their spending and saving habits. For example, it may become more expensive to take out a mortgage or car loan.

Conclusion

Predicting interest rates in 2025 Canada is a challenging task, but several factors suggest that they will likely be higher than they are today. The BoC is expected to continue raising interest rates to combat inflation and manage economic growth. Global economic conditions and government fiscal policy are also likely to put upward pressure on interest rates. Businesses, investors, and consumers should be prepared for higher interest rates in 2025 and adjust their financial plans accordingly.

Closure

Thus, we hope this article has provided valuable insights into What Will Interest Rates Be in 2025 Canada?. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin