7, Aug 2023

What Is A 2025 Fund?

What is a 2025 Fund?

Related Articles: What is a 2025 Fund?

- Exceptional Waterfront Estate: 2125 1st Ave, Seattle, WA

- K2025 Filter: A Comprehensive Analysis For Enhanced Respiratory Protection

- 2024 Holiday Bookings: Plan Ahead For Unforgettable Travel Experiences

- 2025 Honda CR-V: A Comprehensive Review Of The Upcoming Compact SUV

- CR2025 Coin Battery: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to What is a 2025 Fund?. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about What is a 2025 Fund?

What is a 2025 Fund?

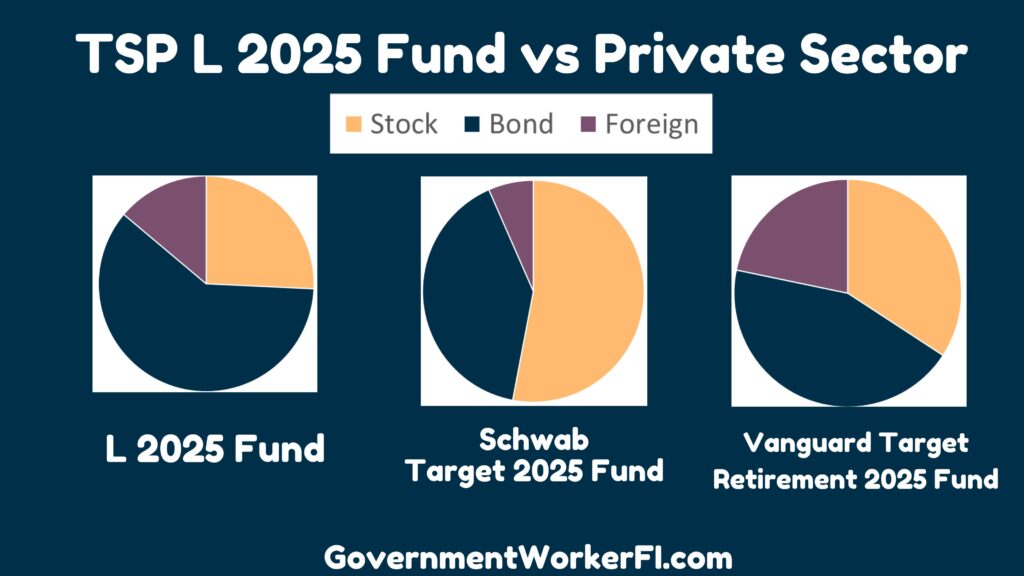

A 2025 fund is a type of investment fund that is designed to help investors reach their financial goals by the year 2025. These funds typically invest in a mix of stocks, bonds, and other assets, and they are managed by professional investment managers.

2025 funds are often marketed to investors who are approaching retirement or who are already retired. These funds can be a good way to preserve capital and generate income, while also providing the potential for growth.

How Do 2025 Funds Work?

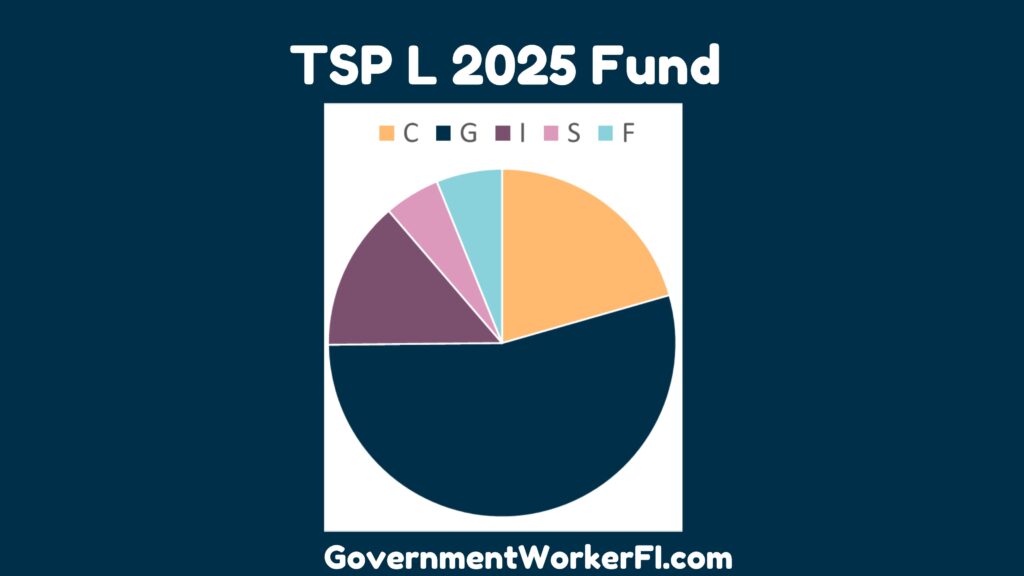

2025 funds typically invest in a mix of assets, including:

- Stocks: Stocks are shares of ownership in a company. They can be a good way to generate growth over the long term, but they also come with more risk than bonds.

- Bonds: Bonds are loans that you make to a company or government. They typically pay a fixed rate of interest, and they are less risky than stocks.

- Cash: Cash is the most liquid asset, and it can be a good place to park your money if you need to access it quickly.

The mix of assets in a 2025 fund will vary depending on the fund’s investment objective. Some funds may be more conservative, with a higher allocation to bonds and cash. Others may be more aggressive, with a higher allocation to stocks.

What Are the Benefits of Investing in a 2025 Fund?

There are several benefits to investing in a 2025 fund, including:

- Professional management: 2025 funds are managed by professional investment managers who have the experience and expertise to make sound investment decisions.

- Diversification: 2025 funds typically invest in a mix of assets, which can help to reduce risk.

- Potential for growth: 2025 funds have the potential to generate growth over the long term, which can help you reach your financial goals.

- Income: 2025 funds can also provide income, which can be helpful for retirees or investors who are approaching retirement.

What Are the Risks of Investing in a 2025 Fund?

There are also some risks associated with investing in a 2025 fund, including:

- Market risk: The value of the fund’s investments can fluctuate with the market, which could result in losses.

- Interest rate risk: Interest rates can affect the value of the fund’s investments. If interest rates rise, the value of the fund’s investments could decline.

- Inflation risk: Inflation can erode the purchasing power of the fund’s investments over time.

Is a 2025 Fund Right for Me?

Whether or not a 2025 fund is right for you depends on your individual circumstances and investment goals. If you are approaching retirement or are already retired, and you are looking for a way to preserve capital and generate income, then a 2025 fund could be a good option for you.

However, it is important to remember that all investments come with some degree of risk. Before investing in a 2025 fund, you should carefully consider your investment goals, risk tolerance, and time horizon. You should also consult with a financial advisor to make sure that a 2025 fund is right for you.

How to Choose a 2025 Fund

If you are considering investing in a 2025 fund, there are a few things you should keep in mind:

- Investment objective: What are your investment goals? Are you looking for growth, income, or a combination of both?

- Risk tolerance: How much risk are you comfortable with? 2025 funds can range from conservative to aggressive, so it is important to choose a fund that matches your risk tolerance.

- Time horizon: When do you need the money? If you need the money in the next few years, you may want to choose a more conservative fund. If you have a longer time horizon, you may be able to afford to take on more risk.

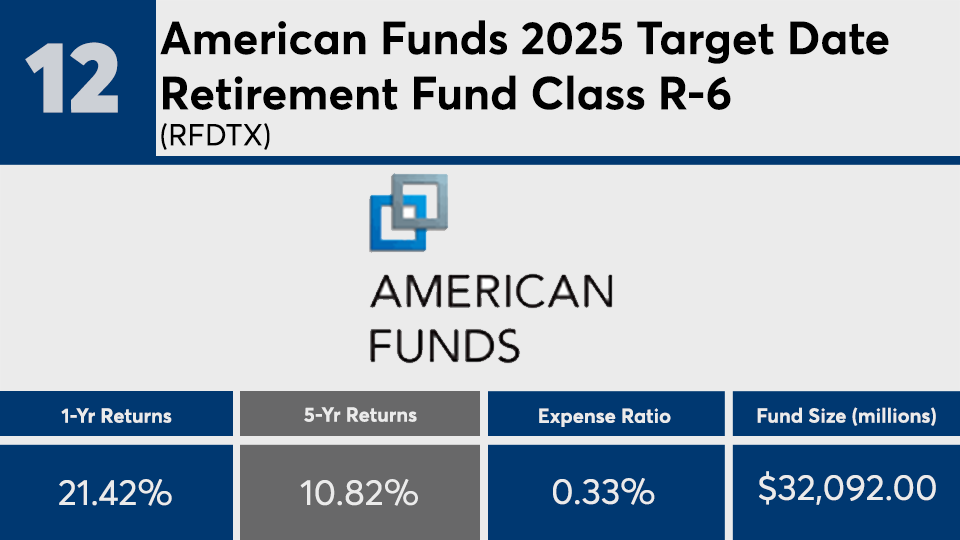

- Fees: 2025 funds typically charge fees, so it is important to compare the fees of different funds before you invest.

Once you have considered these factors, you can start shopping for a 2025 fund. There are a number of different 2025 funds available, so it is important to compare the features of different funds before you invest. You can also consult with a financial advisor to help you choose a 2025 fund that is right for you.

Closure

Thus, we hope this article has provided valuable insights into What is a 2025 Fund?. We appreciate your attention to our article. See you in our next article!

- 0

- By admin