4, Feb 2024

Vanguard 2025 Index Fund: A Comprehensive Guide For Investors

Vanguard 2025 Index Fund: A Comprehensive Guide for Investors

Related Articles: Vanguard 2025 Index Fund: A Comprehensive Guide for Investors

- Grand Theft Auto V: Reimagined In 2025

- MLB All-Star Game 2025: Secure Your Tickets For The Baseball Extravaganza

- How To Train Your Dragon: The Epic Sequel In 2025

- Chinese New Year 2025: The Year Of The Green Wood Serpent

- AS 2056: A Comprehensive Guide To The Australian Standard For Timber Structures

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Vanguard 2025 Index Fund: A Comprehensive Guide for Investors. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Vanguard 2025 Index Fund: A Comprehensive Guide for Investors

Vanguard 2025 Index Fund: A Comprehensive Guide for Investors

Introduction

Vanguard 2025 Index Fund (VTWNX) is a target-date fund designed to meet the investment needs of individuals approaching retirement in or around the year 2025. Target-date funds automatically adjust their asset allocation based on the investor’s age and risk tolerance, gradually reducing exposure to equities and increasing exposure to bonds as the target retirement date approaches.

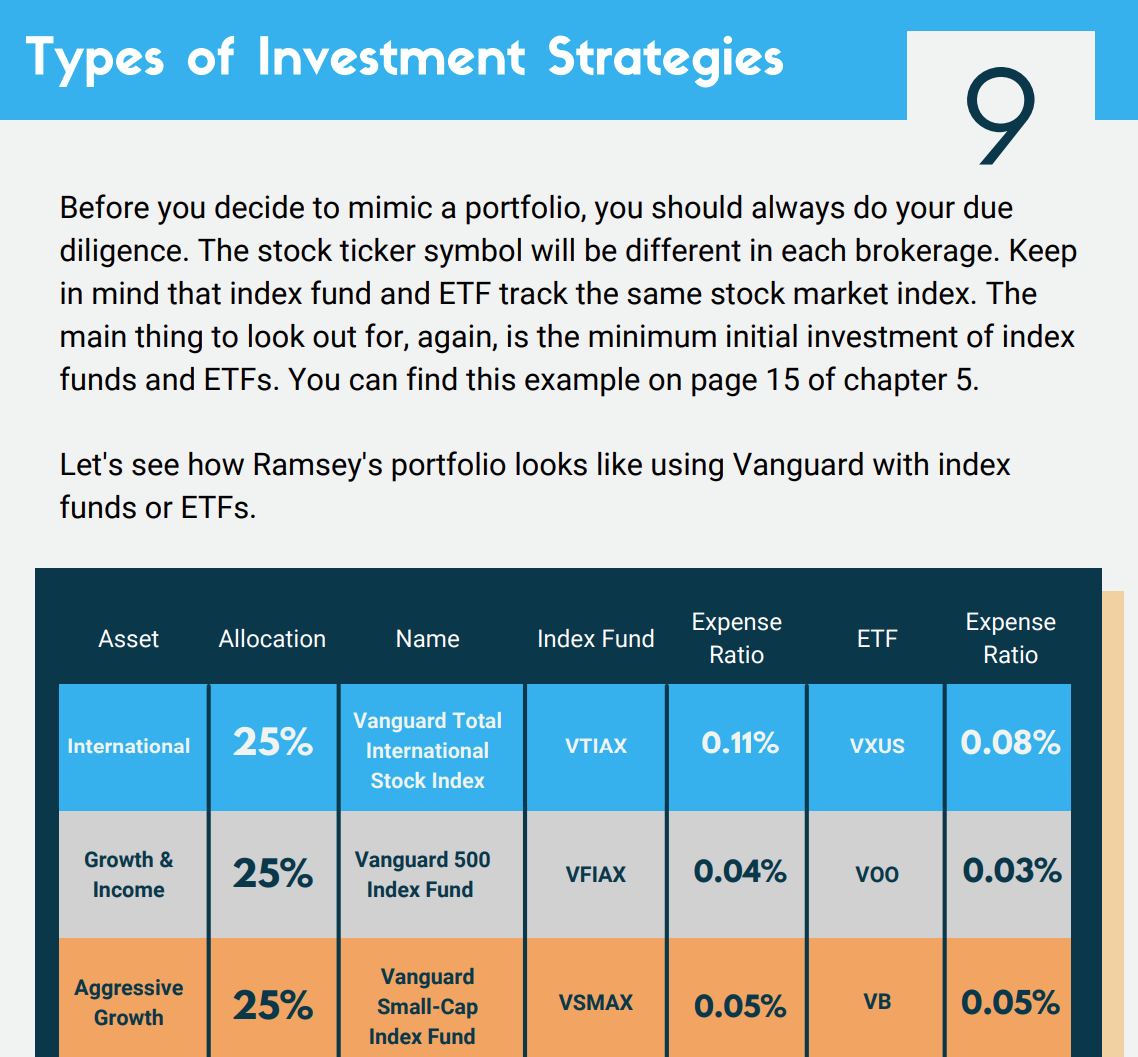

Investment Strategy

VTWNX invests primarily in a blend of U.S. and international stocks and bonds. The fund’s asset allocation is determined by a team of Vanguard investment professionals and is designed to provide a moderate level of risk and potential return. The fund’s portfolio is diversified across various asset classes, including:

- U.S. stocks (approximately 55%)

- International stocks (approximately 30%)

- U.S. bonds (approximately 15%)

Target Retirement Date

VTWNX is designed for investors who plan to retire in or around the year 2025. However, investors can choose to invest in the fund at any age and adjust their investment strategy as they get closer to retirement. The fund’s target retirement date serves as a general guideline, and investors should consider their individual circumstances when making investment decisions.

Glide Path

As the target retirement date approaches, VTWNX gradually shifts its asset allocation from equities to bonds. This process, known as a glide path, is designed to reduce risk and preserve capital as investors near retirement. The fund’s glide path is based on the following schedule:

- Age 60 and below: 80% stocks, 20% bonds

- Age 61-65: 70% stocks, 30% bonds

- Age 66-70: 60% stocks, 40% bonds

- Age 71-75: 50% stocks, 50% bonds

- Age 76 and older: 40% stocks, 60% bonds

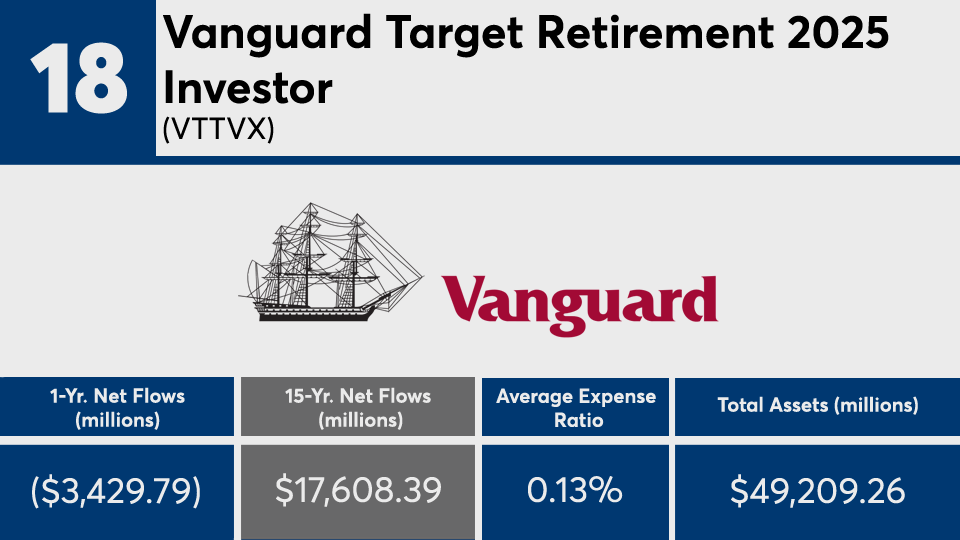

Expense Ratio

The expense ratio of VTWNX is 0.15%, which is considered low compared to other target-date funds. The expense ratio represents the annual operating costs of the fund, including management fees and other expenses.

Minimum Investment

The minimum investment required to open an account in VTWNX is $1,000. However, subsequent investments can be made in any amount.

Performance

VTWNX has a track record of consistent performance over the long term. The fund has outperformed its benchmark, the Vanguard Target Retirement 2025 Index Fund (VTTHX), in most years. The fund’s performance is influenced by various factors, including market conditions, interest rates, and the performance of its underlying investments.

Tax Implications

Distributions from VTWNX are subject to ordinary income tax. However, investors may be able to defer taxes on earnings if they hold the fund in a tax-advantaged account, such as an IRA or 401(k).

Suitability

VTWNX is a suitable investment option for individuals who:

- Are approaching retirement in or around the year 2025

- Seek a moderate level of risk and potential return

- Prefer a diversified portfolio that includes a mix of stocks and bonds

- Are comfortable with the fund’s automatic glide path

Considerations

Before investing in VTWNX, investors should consider the following:

- Risk tolerance: VTWNX is a moderate-risk fund, but it still involves some risk of loss. Investors should ensure that they are comfortable with the fund’s risk level before investing.

- Time horizon: VTWNX is designed for investors with a long-term investment horizon. Investors should be prepared to hold the fund for at least 10 years, preferably longer.

- Fees: While VTWNX has a low expense ratio, there may be other fees associated with investing in the fund, such as account fees or transaction fees.

- Alternatives: There are other target-date funds and retirement savings options available. Investors should compare VTWNX to other funds before making a decision.

Conclusion

Vanguard 2025 Index Fund (VTWNX) is a well-managed target-date fund that provides a convenient and cost-effective way for investors to prepare for retirement. The fund’s moderate risk level, diversified portfolio, and automatic glide path make it a suitable option for individuals approaching retirement in or around the year 2025. However, investors should carefully consider their risk tolerance, time horizon, and investment goals before investing in VTWNX or any other target-date fund.

Closure

Thus, we hope this article has provided valuable insights into Vanguard 2025 Index Fund: A Comprehensive Guide for Investors. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin