11, May 2024

The Lifetime Federal Gift Tax Exemption In 2025: A Comprehensive Guide

The Lifetime Federal Gift Tax Exemption in 2025: A Comprehensive Guide

Related Articles: The Lifetime Federal Gift Tax Exemption in 2025: A Comprehensive Guide

- Volvo Trucks Unveils Ambitious Vision For 2025: A Future Of Sustainable, Autonomous, And Connected Transportation

- Flights To Barbados In 2025: A Comprehensive Guide

- What Will The 2025 Toyota 4Runner Look Like?

- Calendar Quickly Monthly 2025: A Comprehensive Guide To Planning Your Year

- How Many Days Until Christmas 2025: The Countdown Begins

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Lifetime Federal Gift Tax Exemption in 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about The Lifetime Federal Gift Tax Exemption in 2025: A Comprehensive Guide

The Lifetime Federal Gift Tax Exemption in 2025: A Comprehensive Guide

Introduction

The lifetime federal gift tax exemption is a crucial aspect of estate planning, allowing individuals to transfer assets to their beneficiaries without incurring gift taxes. The exemption amount is adjusted periodically to account for inflation, and the current exemption amount for 2023 and 2024 is $12.92 million per person. However, the exemption is scheduled to revert to $5 million in 2026, indexed for inflation. This article provides a comprehensive overview of the lifetime federal gift tax exemption in 2025, discussing its implications for estate planning and strategies to maximize its benefits.

Understanding the Lifetime Federal Gift Tax Exemption

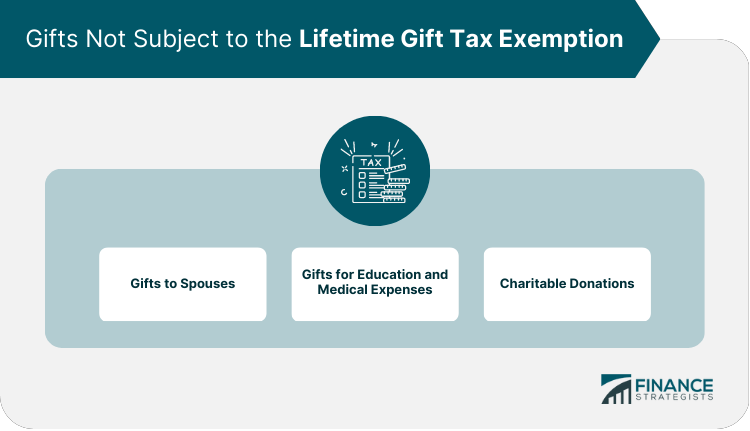

The lifetime federal gift tax exemption is a threshold amount that individuals can transfer as gifts during their lifetime without incurring any gift tax. Any gifts exceeding the exemption amount are subject to a tax rate of up to 40%. The exemption is designed to encourage charitable giving and to prevent the accumulation of wealth in the hands of a few individuals.

Changes in the Lifetime Federal Gift Tax Exemption

The lifetime federal gift tax exemption has undergone significant changes over the years. In 2017, the Tax Cuts and Jobs Act doubled the exemption amount from $5 million to $10 million, indexed for inflation. This increase was set to expire in 2026, but the American Rescue Plan Act of 2021 extended the higher exemption amount through 2025.

The Lifetime Federal Gift Tax Exemption in 2025

For 2025, the lifetime federal gift tax exemption is $12.92 million per person. This means that individuals can transfer up to $12.92 million in assets as gifts without incurring any gift tax. The exemption is indexed for inflation, which means that it will increase slightly each year to account for the rising cost of living.

Implications for Estate Planning

The lifetime federal gift tax exemption plays a significant role in estate planning. By utilizing the exemption, individuals can reduce the size of their taxable estate and minimize estate taxes. This can be particularly beneficial for individuals with large estates or those who wish to pass on substantial assets to their heirs.

Strategies to Maximize the Lifetime Federal Gift Tax Exemption

There are several strategies that individuals can employ to maximize the benefits of the lifetime federal gift tax exemption:

- Make annual exclusion gifts: Each year, individuals can make gifts of up to $16,000 per recipient without using any of their lifetime exemption. This strategy can be particularly effective for gradually transferring assets to beneficiaries over time.

- Use a spousal lifetime access trust: A spousal lifetime access trust (SLAT) is a type of irrevocable trust that allows individuals to transfer assets to their spouse without using any of their lifetime exemption. The spouse can then access the assets as needed, and upon their death, the assets pass to the beneficiaries.

- Make gifts to qualified charities: Gifts to qualified charities are not subject to gift tax, regardless of the amount. This strategy can be used to reduce the size of one’s taxable estate while also supporting charitable causes.

- Consider a generation-skipping transfer: A generation-skipping transfer is a gift that is made to a beneficiary who is two or more generations below the donor. These transfers are subject to a separate generation-skipping transfer tax, but they can be used to reduce the size of the taxable estate by transferring assets to future generations.

Conclusion

The lifetime federal gift tax exemption is a valuable tool for estate planning. By understanding the exemption amount and the strategies available to maximize its benefits, individuals can reduce their estate taxes and ensure that their assets are distributed according to their wishes. It is important to consult with an experienced estate planning attorney to determine the best strategies for your individual circumstances.

Closure

Thus, we hope this article has provided valuable insights into The Lifetime Federal Gift Tax Exemption in 2025: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin