13, Jan 2024

Tax Brackets After 2025: A Comprehensive Overview

Tax Brackets After 2025: A Comprehensive Overview

Related Articles: Tax Brackets After 2025: A Comprehensive Overview

- The New Dodge Viper: A Return To Form

- Celebrate The Dawn Of 2025 With Stunning New Year Wallpapers

- The 2025 BMW M8 Sedan: A Symphony Of Power And Grace

- The All-New 2024 Toyota 4Runner: Unveiling An Icon Reborn

- DV Lottery 2025 Registration Start Date: Everything You Need To Know

Introduction

With great pleasure, we will explore the intriguing topic related to Tax Brackets After 2025: A Comprehensive Overview. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Tax Brackets After 2025: A Comprehensive Overview

Tax Brackets After 2025: A Comprehensive Overview

Introduction

The tax brackets in the United States are the ranges of taxable income that are subject to different tax rates. These brackets are adjusted annually for inflation, and they play a crucial role in determining how much income tax individuals and businesses owe. The tax brackets for 2023 and 2024 have already been announced, but there is still uncertainty about what the tax brackets will look like after 2025.

Current Tax Brackets

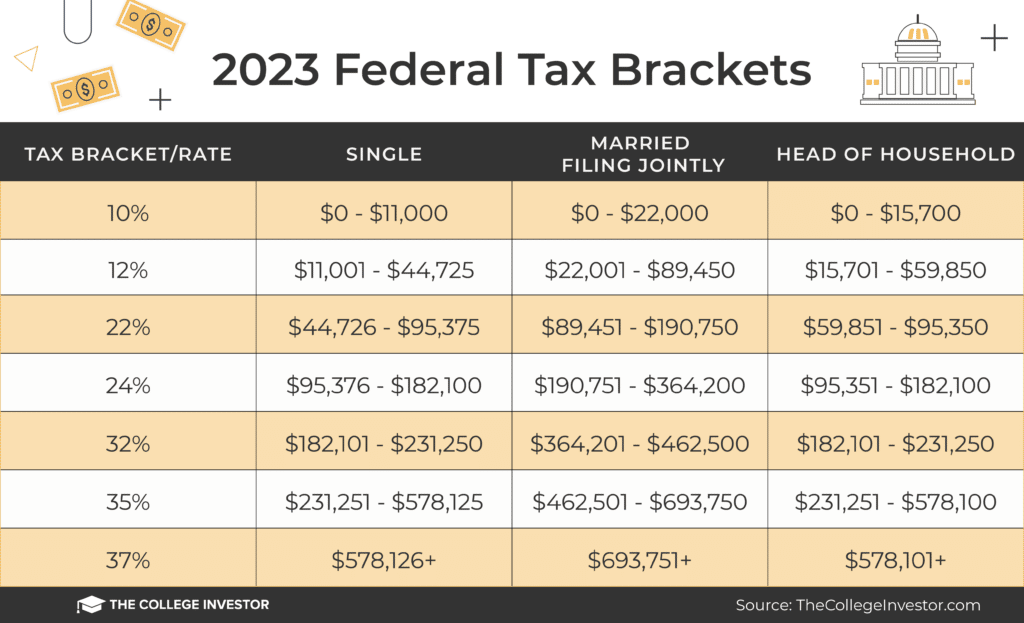

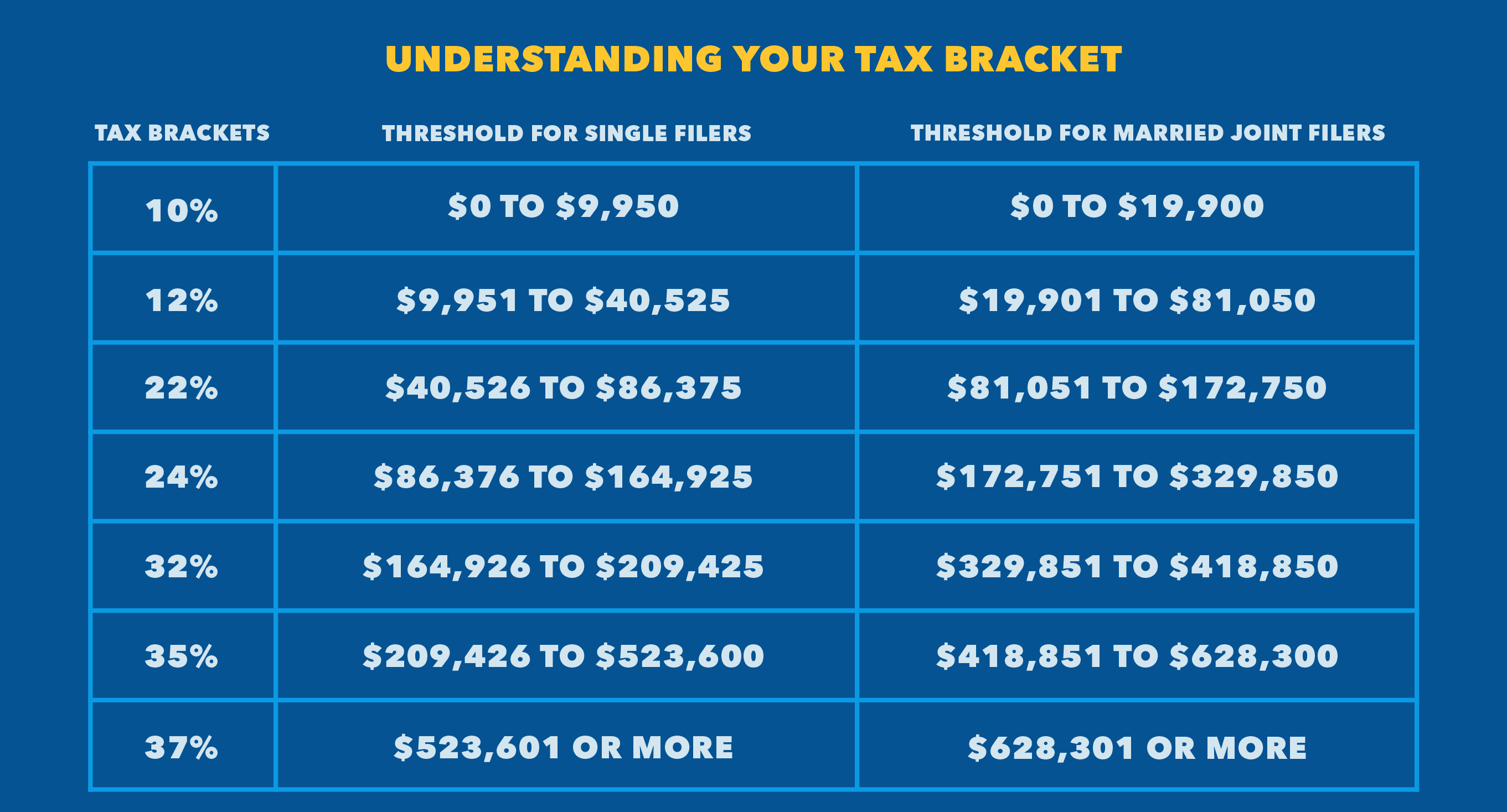

For the 2023 tax year, the tax brackets for individuals are as follows:

- 10% bracket: $0 to $10,275

- 12% bracket: $10,275 to $41,775

- 22% bracket: $41,775 to $89,075

- 24% bracket: $89,075 to $170,500

- 32% bracket: $170,500 to $215,950

- 35% bracket: $215,950 to $539,900

- 37% bracket: $539,900 and above

For the 2024 tax year, the tax brackets for individuals will be adjusted for inflation. The exact amounts of the brackets have not yet been announced, but they are expected to be slightly higher than the 2023 brackets.

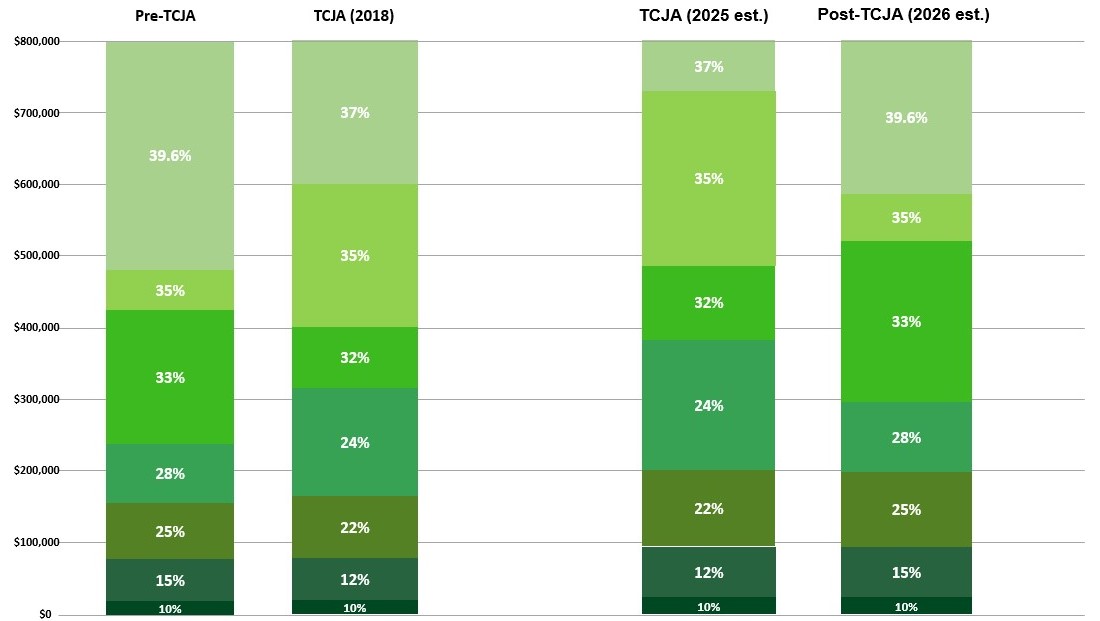

Tax Brackets After 2025

The tax brackets for 2025 and beyond have not yet been announced, and there is some uncertainty about what they will look like. However, there are a few possible scenarios that could play out.

One possibility is that the tax brackets will remain relatively stable after 2025. This means that the income ranges for each bracket would not change significantly, and the tax rates would remain the same.

Another possibility is that the tax brackets will be expanded. This means that the income ranges for each bracket would be increased, and the tax rates would be lowered. This would result in lower taxes for individuals and businesses.

A third possibility is that the tax brackets will be compressed. This means that the income ranges for each bracket would be decreased, and the tax rates would be increased. This would result in higher taxes for individuals and businesses.

Factors that Will Affect the Tax Brackets

There are a number of factors that will affect the tax brackets after 2025. These factors include:

- The rate of inflation

- The economic outlook

- The political climate

- The federal budget deficit

Impact of Tax Brackets on Individuals and Businesses

The tax brackets have a significant impact on individuals and businesses. The brackets determine how much income tax individuals and businesses owe, and they can also affect investment decisions and economic growth.

If the tax brackets are expanded, it would result in lower taxes for individuals and businesses. This would increase disposable income and stimulate economic growth. However, it would also increase the federal budget deficit.

If the tax brackets are compressed, it would result in higher taxes for individuals and businesses. This would reduce disposable income and slow economic growth. However, it would also reduce the federal budget deficit.

Conclusion

The tax brackets for 2025 and beyond are still uncertain. However, there are a number of factors that will affect the brackets, including the rate of inflation, the economic outlook, the political climate, and the federal budget deficit. The brackets will have a significant impact on individuals and businesses, and they will play a key role in shaping the future of the U.S. economy.

Closure

Thus, we hope this article has provided valuable insights into Tax Brackets After 2025: A Comprehensive Overview. We appreciate your attention to our article. See you in our next article!

- 0

- By admin