15, Oct 2023

Target Retirement Fund 2025: A Comprehensive Guide

Target Retirement Fund 2025: A Comprehensive Guide

Related Articles: Target Retirement Fund 2025: A Comprehensive Guide

- List Of SBF Available May 2025

- 2025 IRMAA Brackets For Medicare Premiums: A Comprehensive Guide

- 2025 Mascot Revealed: Embracing The Spirit Of Unity And Progress

- When Should I Take The LSAT For Fall 2024?

- 2025 Subaru Forester: Unveiling The Next-Generation Adventure Companion

Introduction

With great pleasure, we will explore the intriguing topic related to Target Retirement Fund 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Target Retirement Fund 2025: A Comprehensive Guide

Target Retirement Fund 2025: A Comprehensive Guide

Introduction

Retirement planning is crucial for securing a financially stable future. The target retirement fund 2025 is a comprehensive plan designed to help individuals achieve their retirement goals by 2025. This article provides an in-depth guide to the target retirement fund 2025, covering its key components, investment strategies, and retirement planning tips.

Components of the Target Retirement Fund 2025

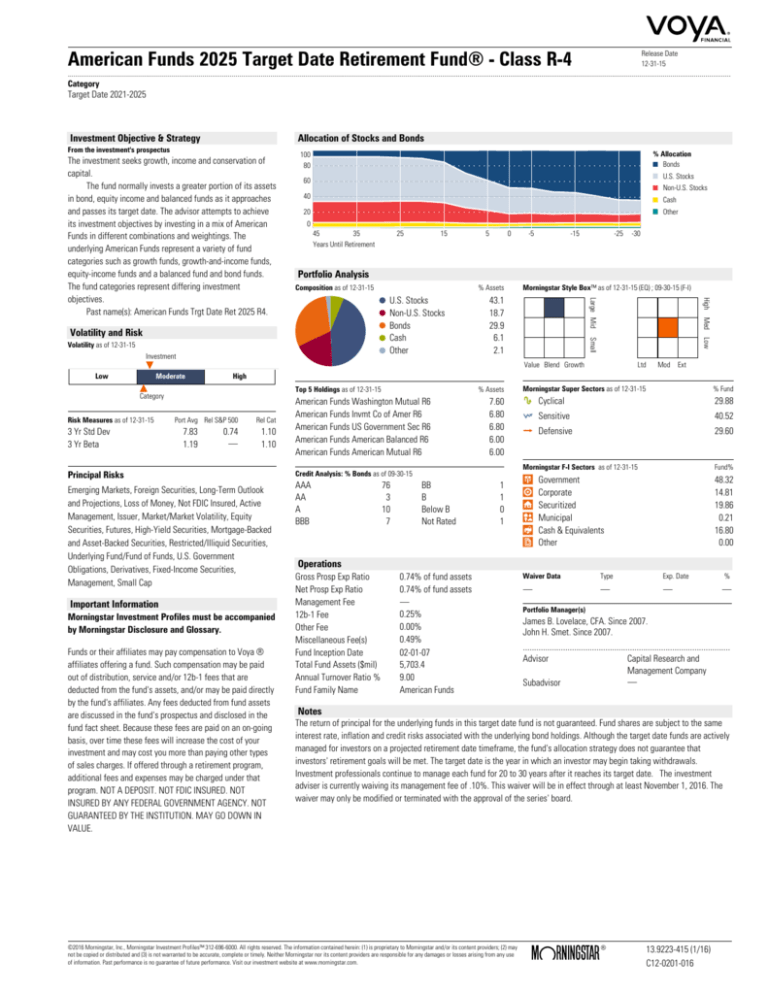

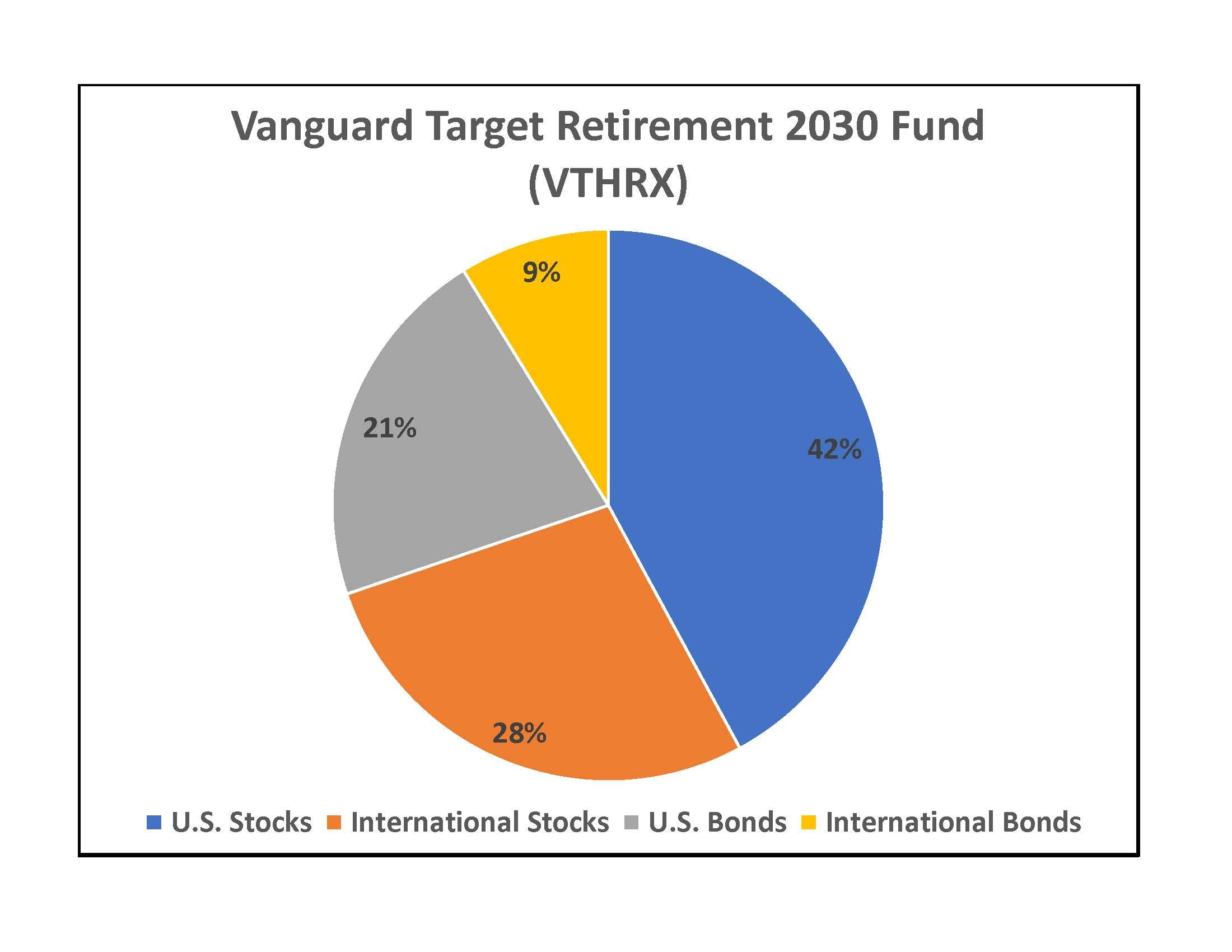

The target retirement fund 2025 is a diversified portfolio of investments that are tailored to the specific needs and risk tolerance of individuals nearing retirement in 2025. It typically includes the following components:

- Stocks: Stocks represent ownership in companies and have the potential for higher returns over the long term.

- Bonds: Bonds are loans made to governments or corporations and provide a more stable source of income.

- Mutual Funds: Mutual funds are professionally managed investments that offer diversification and access to a wide range of assets.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but are traded on stock exchanges like individual stocks.

- Target-Date Funds: Target-date funds are a type of mutual fund that automatically adjusts its asset allocation based on the investor’s target retirement date.

Investment Strategies

The investment strategy for the target retirement fund 2025 is designed to balance risk and return, with a focus on long-term growth. The following strategies are commonly employed:

- Asset Allocation: Asset allocation involves dividing the portfolio among different types of investments, such as stocks, bonds, and cash. The allocation is based on the investor’s risk tolerance and time horizon.

- Rebalancing: Rebalancing is the process of periodically adjusting the asset allocation to maintain the desired risk and return profile.

- Dollar-Cost Averaging: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps reduce the impact of market volatility.

- Diversification: Diversification involves investing in a variety of assets to reduce overall risk.

Retirement Planning Tips

In addition to investing in the target retirement fund 2025, individuals should consider the following retirement planning tips:

- Set Realistic Goals: Determine the amount of money needed for retirement based on estimated expenses and desired lifestyle.

- Start Saving Early: The earlier savings begin, the more time investments have to grow.

- Maximize Contributions: Contribute as much as possible to retirement accounts, such as 401(k)s and IRAs.

- Consider Catch-Up Contributions: Individuals over age 50 are eligible to make catch-up contributions to retirement accounts.

- Plan for Healthcare Expenses: Healthcare costs in retirement can be substantial, so it is important to plan accordingly.

- Seek Professional Advice: Consult with a financial advisor to develop a personalized retirement plan.

Conclusion

The target retirement fund 2025 is a valuable tool for individuals nearing retirement in 2025. By understanding the components, investment strategies, and retirement planning tips associated with this fund, individuals can take steps to secure a financially secure retirement future. It is important to remember that retirement planning is an ongoing process that requires regular monitoring and adjustments to ensure that goals are being met.

Closure

Thus, we hope this article has provided valuable insights into Target Retirement Fund 2025: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!

- 0

- By admin