4, Apr 2024

Standard Tax Deduction For Seniors Over 65: A Comprehensive Guide

Standard Tax Deduction for Seniors Over 65: A Comprehensive Guide

Related Articles: Standard Tax Deduction for Seniors Over 65: A Comprehensive Guide

- Lakewood Ranch Newest Communities: A Comprehensive Guide

- Super Bowl 2024: Quotes From The Biggest Game Of The Year

- The 2025 Lexus RX 350: A Refined And Advanced SUV

- Infiniti QX80 Interior 2025: A Luxurious Oasis Of Comfort And Technology

- Earth Day 2025: A Call For Global Action

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Standard Tax Deduction for Seniors Over 65: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Standard Tax Deduction for Seniors Over 65: A Comprehensive Guide

Standard Tax Deduction for Seniors Over 65: A Comprehensive Guide

Introduction

As individuals reach the age of 65, they become eligible for a higher standard tax deduction, a significant tax break that reduces their taxable income. This deduction is designed to provide financial relief to seniors who may have reduced income due to retirement or other factors. Understanding the standard tax deduction for seniors over 65 is crucial for maximizing tax savings and ensuring accurate tax filing.

Understanding the Standard Tax Deduction

The standard tax deduction is a dollar amount that can be subtracted from one’s gross income before calculating taxable income. It is a simpler alternative to itemized deductions, which involve deducting specific expenses such as medical expenses, charitable donations, and mortgage interest.

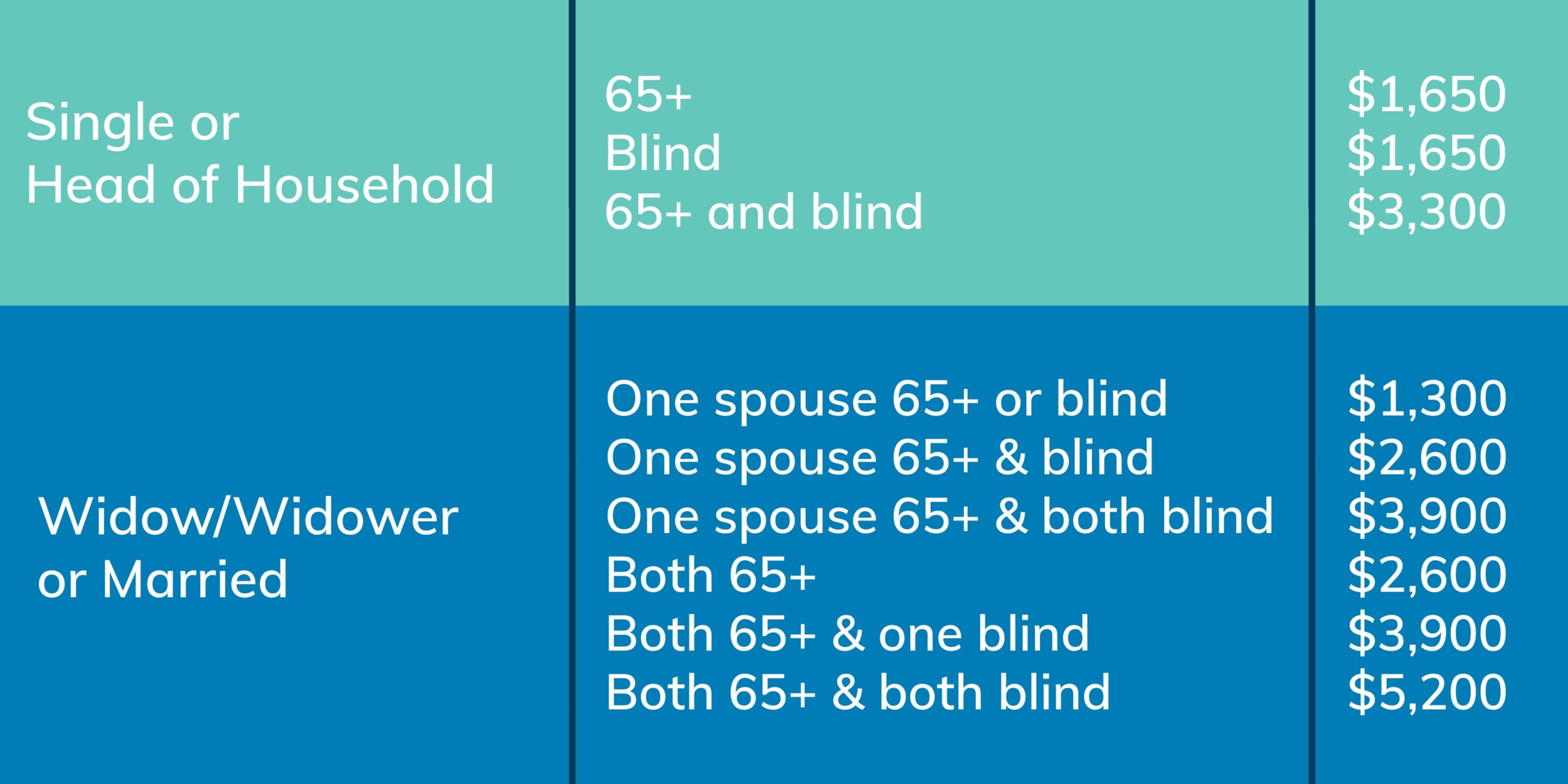

For tax year 2023, the standard tax deduction for seniors over 65 is:

- $15,500 for single filers

- $25,900 for married couples filing jointly

Eligibility for the Senior Standard Tax Deduction

To qualify for the increased standard tax deduction for seniors, you must meet the following criteria:

- Be age 65 or older by the end of the tax year

- Not be claimed as a dependent on someone else’s tax return

Benefits of the Senior Standard Tax Deduction

The senior standard tax deduction provides several benefits:

- Reduced taxable income: By subtracting the standard deduction from your gross income, you lower your taxable income, which can result in lower tax liability.

- Simplified tax filing: The standard deduction eliminates the need to itemize deductions, making tax preparation easier and less time-consuming.

- Increased tax savings: The higher standard deduction for seniors translates into greater tax savings compared to younger individuals.

Additional Considerations

- Phase-out for high earners: For high-income earners, the standard deduction may be phased out or reduced. The phase-out begins at certain income thresholds, which vary depending on filing status.

- Itemized deductions: If your total itemized deductions exceed the standard deduction, it may be more beneficial to itemize your deductions. However, this requires careful record-keeping and can be more complex.

- Other tax benefits for seniors: In addition to the standard tax deduction, seniors may also be eligible for other tax breaks such as the Social Security tax exemption and the Medicare Part B premium deduction.

Conclusion

The standard tax deduction for seniors over 65 is a valuable tax-saving tool that provides financial relief to older individuals. Understanding the eligibility requirements, benefits, and potential limitations of this deduction is essential for accurate tax filing and maximizing tax savings. By taking advantage of the senior standard tax deduction, seniors can reduce their tax liability and enjoy a more secure financial future.

Additional Tips for Seniors

- Consult with a tax professional to determine the best tax filing strategy for your individual circumstances.

- Keep accurate records of your income and expenses to support your tax deductions.

- Consider using tax software or online resources to assist with tax preparation.

- File your taxes on time to avoid penalties and interest charges.

- Stay informed about tax laws and changes that may affect your eligibility for the senior standard tax deduction.

Closure

Thus, we hope this article has provided valuable insights into Standard Tax Deduction for Seniors Over 65: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin