21, Oct 2023

Projected IRMAA Brackets For 2025: Implications For Medicare Beneficiaries

Projected IRMAA Brackets for 2025: Implications for Medicare Beneficiaries

Related Articles: Projected IRMAA Brackets for 2025: Implications for Medicare Beneficiaries

- G20 2025: A Vision For A Sustainable, Inclusive, And Resilient Future

- Nissan Murano 2025: A Glimpse Into The Future Of SUVs

- GATE Result 2025: A Comprehensive Analysis

- 2025 Honda CR-V: A Comprehensive Review Of The Upcoming Compact SUV

- Dodge Scat Pack 2025: The Epitome Of Raw Muscle And Unbridled Power

Introduction

With great pleasure, we will explore the intriguing topic related to Projected IRMAA Brackets for 2025: Implications for Medicare Beneficiaries. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Projected IRMAA Brackets for 2025: Implications for Medicare Beneficiaries

Projected IRMAA Brackets for 2025: Implications for Medicare Beneficiaries

Introduction

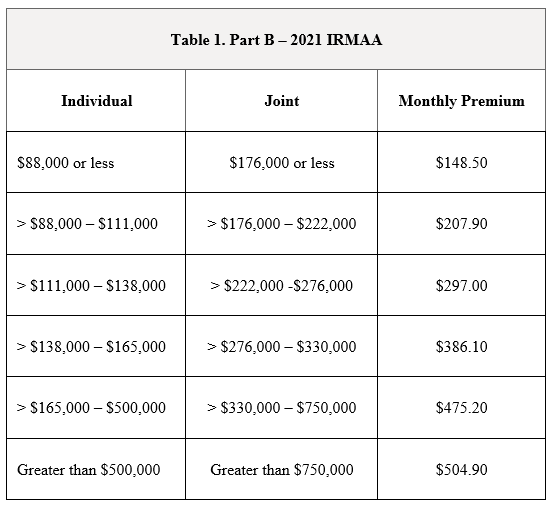

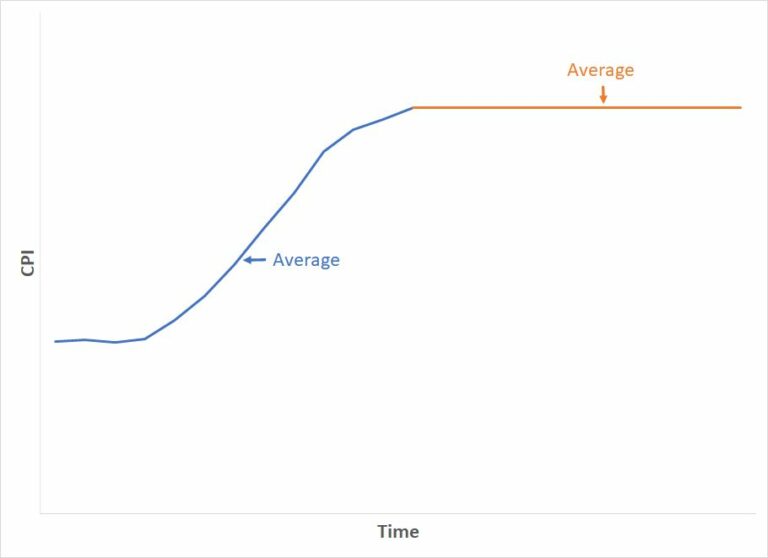

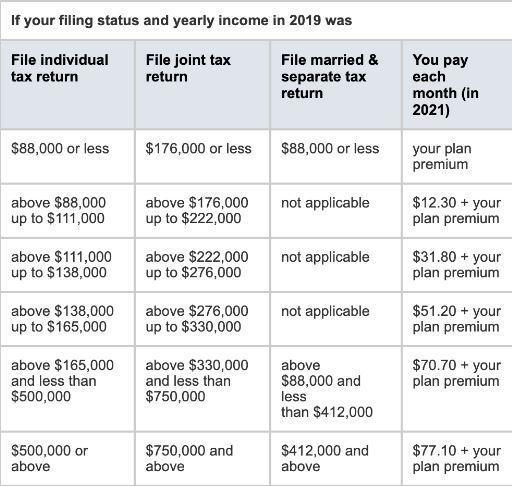

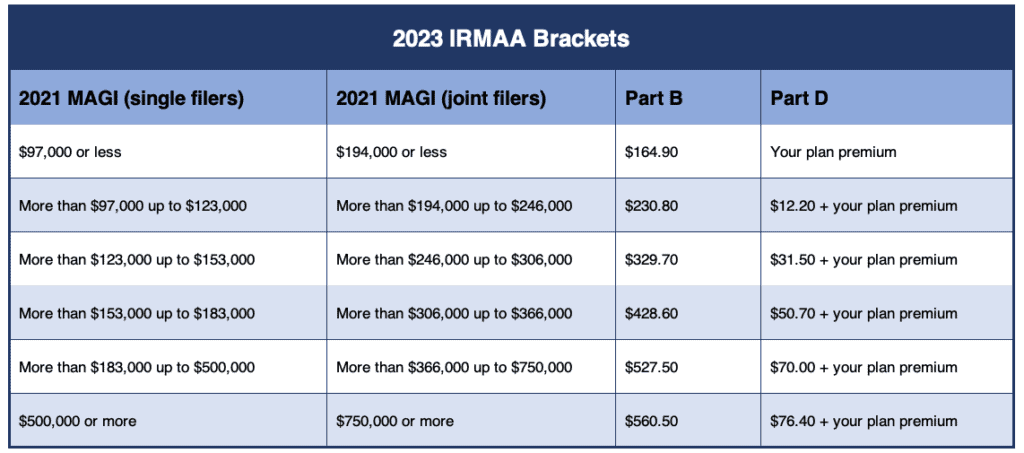

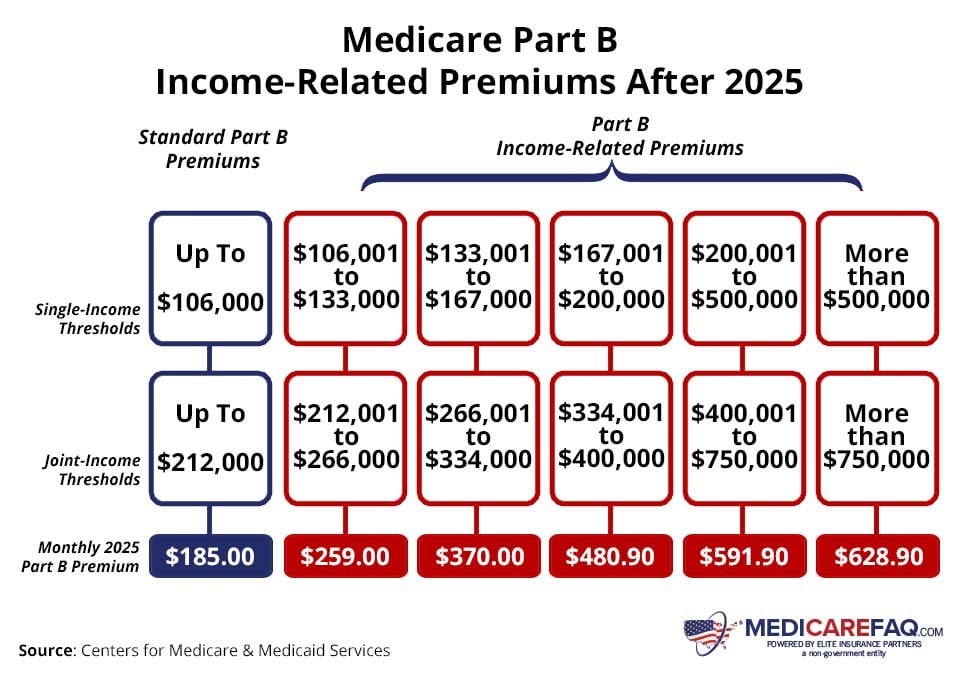

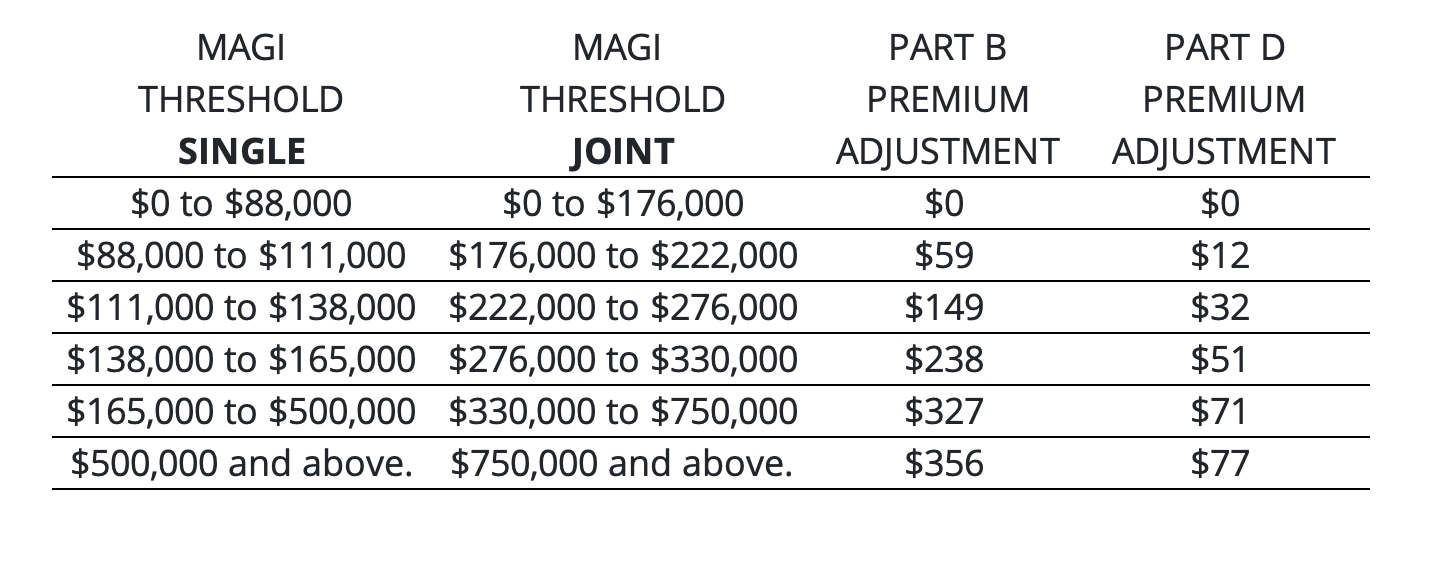

The Income-Related Monthly Adjustment Amount (IRMAA) is a surcharge imposed on Medicare Part B and Part D premiums for individuals with higher incomes. The IRMAA brackets are adjusted annually to reflect changes in the cost of living. In recent years, the IRMAA brackets have been increasing, leading to higher premium costs for many Medicare beneficiaries.

2025 Projected IRMAA Brackets

The Centers for Medicare & Medicaid Services (CMS) has released the projected IRMAA brackets for 2025. The brackets are based on the latest estimates of the cost of living and are subject to change.

IRMAA Brackets for 2025

| Filing Status | Modified Adjusted Gross Income (MAGI) | Part B Premium Surcharge | Part D Premium Surcharge |

|---|---|---|---|

| Single | Over $97,000 | $117.10 | $39.60 |

| Married Filing Jointly | Over $194,000 | $117.10 | $39.60 |

| Married Filing Separately | Over $97,000 | $58.55 | $19.80 |

| Head of Household | Over $145,500 | $117.10 | $39.60 |

Implications for Medicare Beneficiaries

The projected IRMAA brackets for 2025 indicate that many Medicare beneficiaries will face higher premium costs. Individuals with MAGIs above the IRMAA thresholds will be subject to the surcharge.

The Part B premium surcharge will increase by $11.30 for all filing statuses. The Part D premium surcharge will also increase by $3.20 for all filing statuses.

Strategies to Minimize IRMAA Surcharges

There are several strategies that Medicare beneficiaries can use to minimize their IRMAA surcharges:

- Reduce MAGI: Beneficiaries can reduce their MAGI by contributing to tax-advantaged retirement accounts, such as 401(k)s and IRAs.

- Delay claiming Social Security benefits: Claiming Social Security benefits before full retirement age can increase MAGI and trigger IRMAA surcharges.

- Consider a Medicare Savings Account (MSA): MSAs are tax-advantaged accounts that can be used to pay for qualified medical expenses, including Medicare premiums.

- Explore low-income assistance programs: Beneficiaries with limited incomes may qualify for low-income assistance programs, such as Medicare Savings Programs and Extra Help.

Conclusion

The projected IRMAA brackets for 2025 indicate that many Medicare beneficiaries will face higher premium costs. Beneficiaries should be aware of the IRMAA brackets and consider strategies to minimize their surcharges. By taking steps to reduce MAGI and explore assistance programs, beneficiaries can help manage their Medicare expenses.

Additional Resources

Closure

Thus, we hope this article has provided valuable insights into Projected IRMAA Brackets for 2025: Implications for Medicare Beneficiaries. We appreciate your attention to our article. See you in our next article!

- 0

- By admin