2, Feb 2024

Payroll Calendar For 2025

Payroll Calendar for 2025

Related Articles: Payroll Calendar for 2025

- Exceptional Waterfront Estate: 2125 1st Ave, Seattle, WA

- Commercial License Plate Sticker Renewal: A Comprehensive Guide

- 2025 Honda S2000: A Revival Of An Iconic Sports Car

- Dodge Scat Pack 2025: The Epitome Of Raw Muscle And Unbridled Power

- 2025 Cadillac XT5: A Comprehensive Guide To The Used Market

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Payroll Calendar for 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Payroll Calendar for 2025

Payroll Calendar for 2025

Introduction

Payroll management is a critical aspect of any organization, ensuring that employees are paid accurately and on time. To facilitate this process, a comprehensive payroll calendar is essential for planning and executing payroll activities throughout the year. This article provides a detailed payroll calendar for 2025, outlining the key dates and deadlines for payroll processing.

Payroll Calendar for 2025

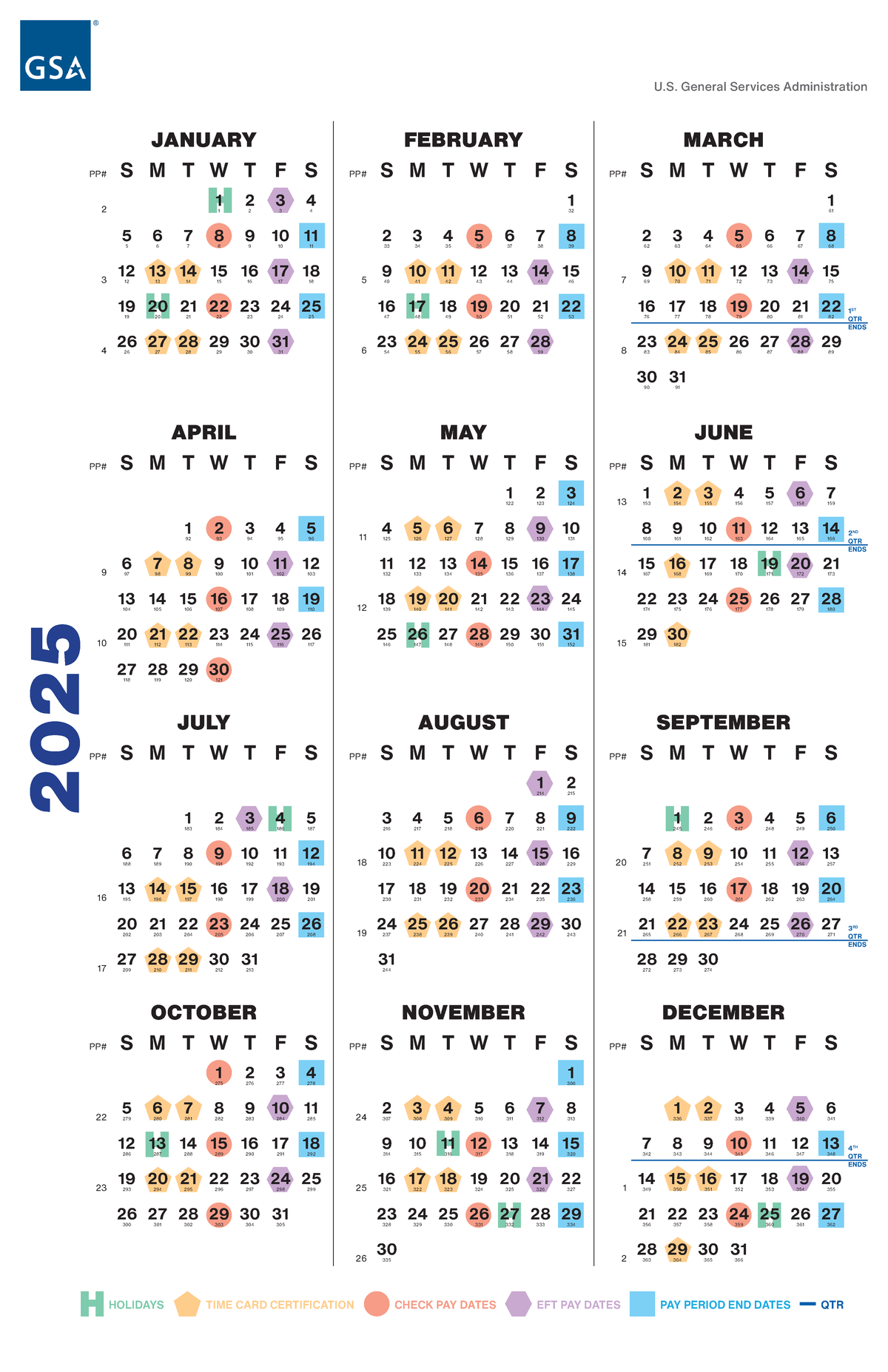

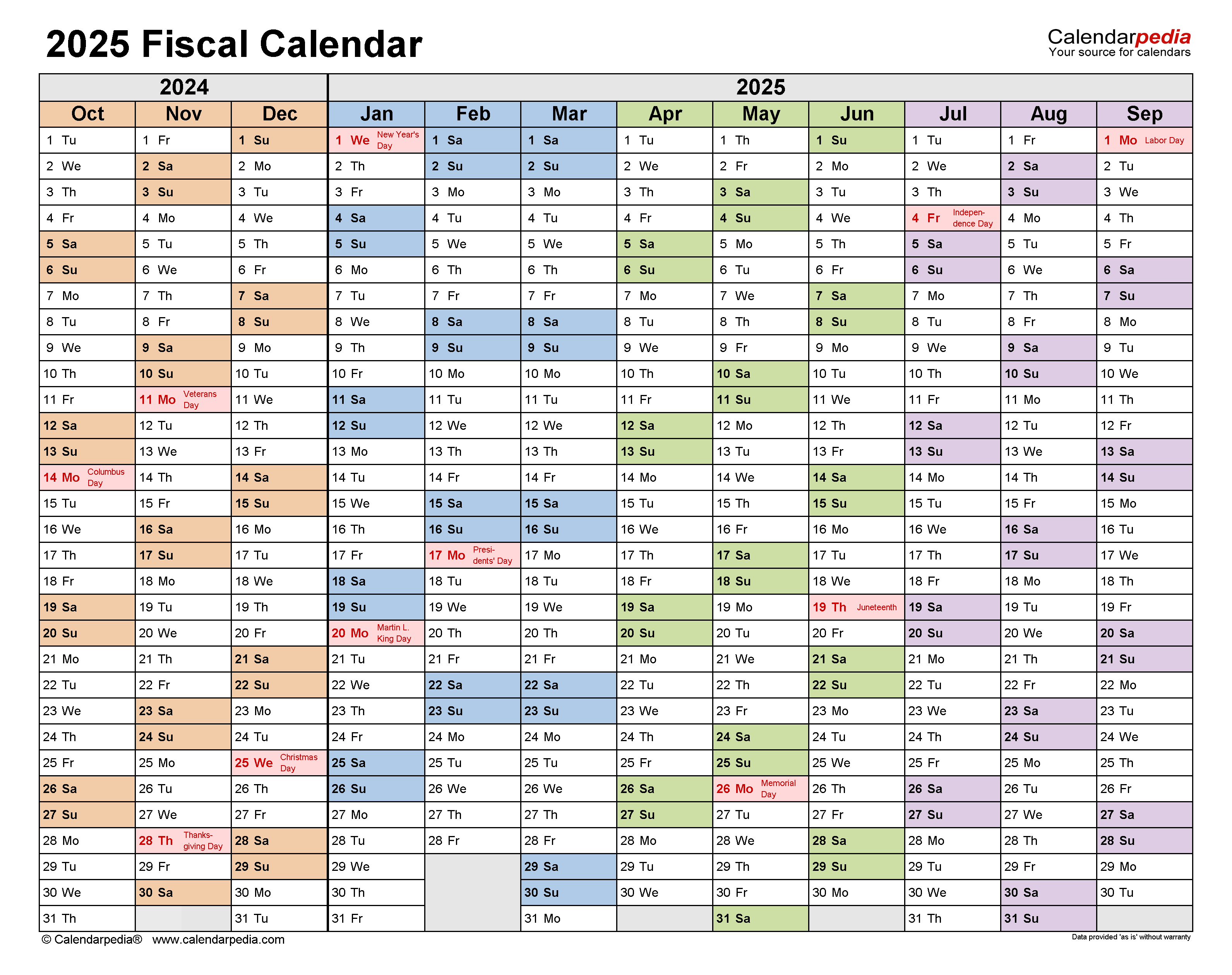

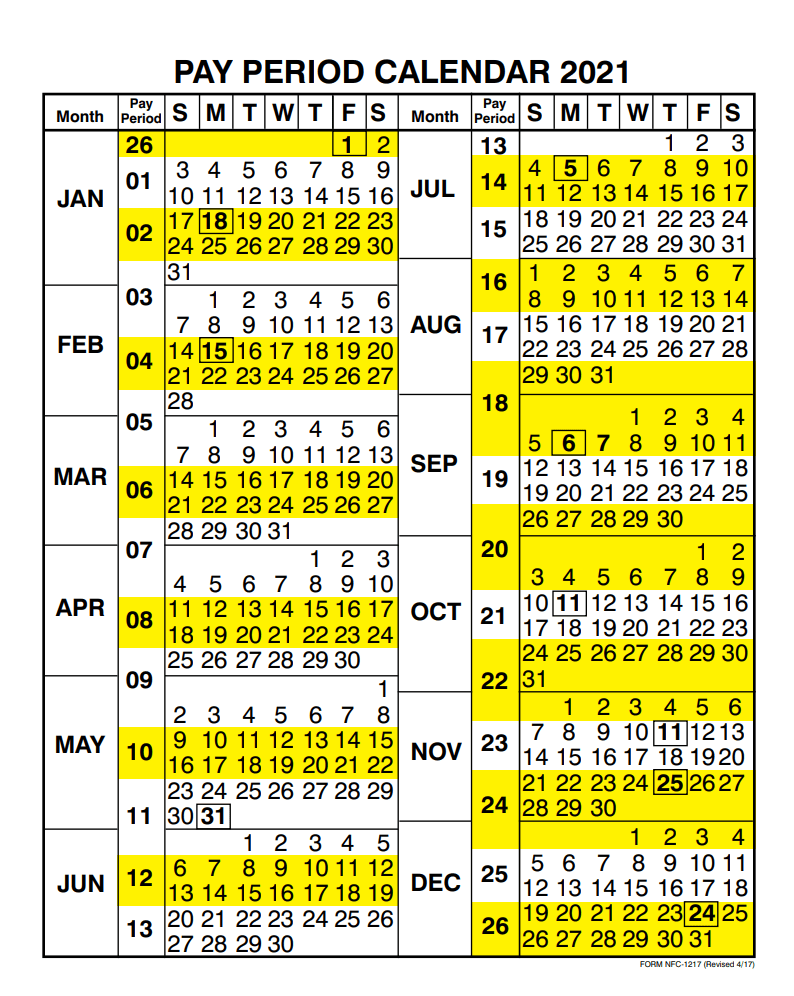

The following table presents a comprehensive payroll calendar for 2025, including the pay dates, cutoff dates, and holiday observances:

| Month | Pay Date | Cutoff Date | Holiday Observances |

|---|---|---|---|

| January | January 15 | January 8 | New Year’s Day (January 1) |

| February | February 15 | February 8 | Presidents’ Day (February 17) |

| March | March 15 | March 8 | |

| April | April 15 | April 8 | Good Friday (April 11), Easter Monday (April 14) |

| May | May 15 | May 8 | Memorial Day (May 26) |

| June | June 15 | June 8 | |

| July | July 15 | July 8 | Independence Day (July 4) |

| August | August 15 | August 8 | |

| September | September 15 | September 8 | Labor Day (September 1) |

| October | October 15 | October 8 | Columbus Day (October 13) |

| November | November 15 | November 8 | Veterans Day (November 11), Thanksgiving Day (November 27) |

| December | December 15 | December 8 | Christmas Day (December 25) |

Key Dates and Deadlines

Pay Dates:

- Pay dates represent the specific dates on which employees will receive their salaries or wages. In 2025, pay dates fall on the 15th of each month, except for December, which has a pay date of December 15.

Cutoff Dates:

- Cutoff dates are the deadlines by which employees must submit their timesheets or other necessary payroll information. This information is used to calculate employee earnings for the upcoming pay period. In 2025, cutoff dates typically fall on the 8th of each month.

Holiday Observances:

- Holiday observances are days designated as paid holidays for employees. In 2025, there are a total of 11 federal holidays, including New Year’s Day, Presidents’ Day, Memorial Day, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving Day, and Christmas Day.

Payroll Processing Timeline

The payroll processing timeline typically involves the following steps:

- Time Entry and Approval: Employees submit their timesheets or other time-tracking records by the cutoff date. Supervisors review and approve the submissions.

- Payroll Calculation: Payroll personnel use the approved time records to calculate employee earnings, deductions, and net pay.

- Payroll Verification: The calculated payroll is reviewed and verified for accuracy before finalizing.

- Payroll Distribution: Employees receive their salaries or wages on the designated pay date.

Considerations for 2025

- Holiday Schedule: The 2025 payroll calendar includes 11 federal holidays. Employers should consider the impact of these holidays on payroll processing and staffing.

- Tax Laws: Payroll processing is subject to various tax laws and regulations. Employers should stay informed of any changes in tax laws that may affect payroll calculations.

- Pay Frequency: The payroll calendar assumes a semi-monthly pay frequency. Employers may adjust the pay dates and cutoff dates based on their specific payroll schedule.

- Payroll Software: Utilizing payroll software can streamline payroll processing and ensure accuracy. Employers should consider investing in reliable payroll software to automate tasks and reduce errors.

Conclusion

A comprehensive payroll calendar for 2025 is essential for efficient and timely payroll processing. By understanding the key dates and deadlines outlined in this article, employers can effectively plan their payroll activities throughout the year. Adhering to the payroll calendar ensures that employees are paid accurately and on time, contributing to employee satisfaction and maintaining a positive workplace environment.

Closure

Thus, we hope this article has provided valuable insights into Payroll Calendar for 2025. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin