13, Apr 2024

Netflix Stock Predictions 2025: A Comprehensive Analysis

Netflix Stock Predictions 2025: A Comprehensive Analysis

Related Articles: Netflix Stock Predictions 2025: A Comprehensive Analysis

- Asteroid Impact 2025: A Global Catastrophe Or A Distant Threat?

- Where Will The Super Bowl Be In 2025? A Comprehensive Guide To The Host City

- Princess Cruises Unveils 2025 Schedule: A Voyage Of Discovery And Adventure

- John Wick: Chapter 5 – The Final Chapter

- Africa Cup Of Nations 2025: Thrilling Contests And Unforgettable Moments

Introduction

With great pleasure, we will explore the intriguing topic related to Netflix Stock Predictions 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Netflix Stock Predictions 2025: A Comprehensive Analysis

Netflix Stock Predictions 2025: A Comprehensive Analysis

Introduction

Netflix, the global streaming giant, has been a dominant force in the entertainment industry for over two decades. As the company continues to expand its reach and offerings, investors are eager to know the future prospects of its stock. This comprehensive analysis delves into the key factors that will shape Netflix’s performance in the coming years, providing insights and predictions for its stock price in 2025.

Current Market Performance

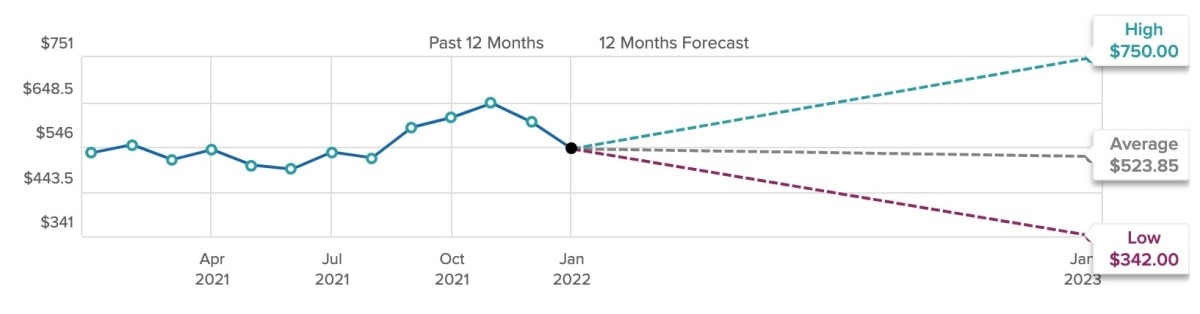

Netflix stock (NFLX) has experienced significant volatility in recent years. After reaching an all-time high of $700.99 in November 2021, the stock plunged to a low of $162.71 in May 2022. However, it has since rebounded to around $300, indicating investor confidence in the company’s long-term prospects.

Growth Drivers

1. Expanding Global Reach: Netflix continues to expand its global footprint, with a presence in over 190 countries. As it enters new markets and taps into untapped audiences, the company’s subscriber base is expected to grow significantly.

2. Content Investment: Netflix invests heavily in original content, which has been a key driver of its success. The company’s vast library of movies, TV shows, and documentaries attracts and retains subscribers.

3. Technological Advancements: Netflix is constantly innovating its platform and developing new technologies to enhance the user experience. These advancements, such as personalized recommendations and interactive content, are expected to further drive subscription growth.

4. Advertising Revenue: In 2023, Netflix introduced an ad-supported subscription tier, which is expected to generate additional revenue and expand the company’s reach.

Challenges

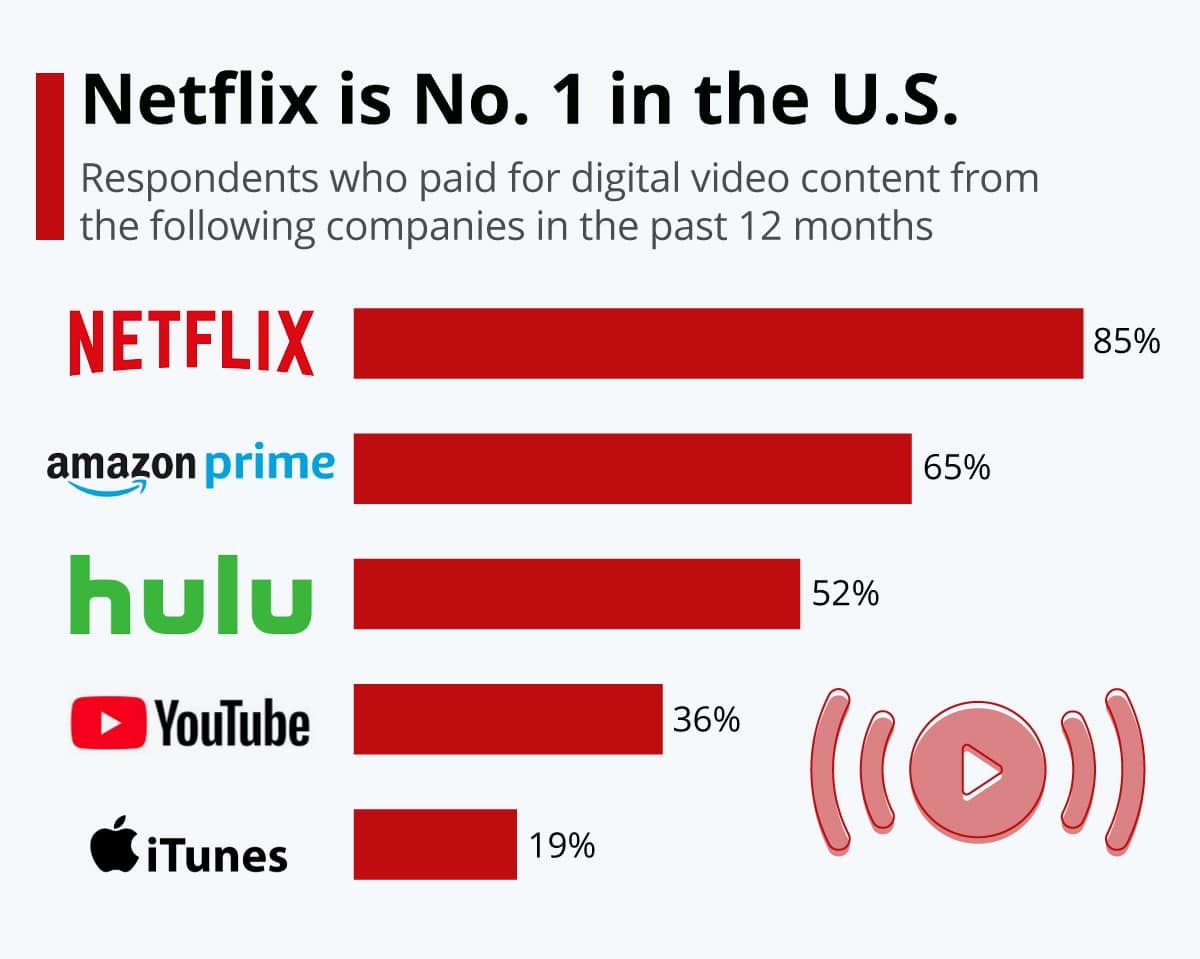

1. Competition: The streaming market is becoming increasingly competitive, with rivals such as Disney+, Amazon Prime Video, and HBO Max vying for subscribers.

2. Content Costs: The rising cost of producing and acquiring original content poses a challenge for Netflix.

3. Economic Headwinds: Economic downturns can impact consumer spending on entertainment, potentially affecting Netflix’s subscriber growth.

4. Regulatory Risks: Netflix faces potential regulatory challenges, such as content censorship and data privacy concerns.

Financial Projections

Analysts’ financial projections for Netflix vary depending on their assumptions about future growth and challenges. According to a recent survey by FactSet, the average analyst estimate for Netflix’s revenue in 2025 is $42.3 billion, with an earnings per share (EPS) of $12.50.

Stock Price Predictions

Based on the financial projections and an analysis of the growth drivers and challenges, several analysts have provided stock price predictions for Netflix in 2025.

1. Goldman Sachs: Goldman Sachs has a price target of $400 for Netflix in 2025, citing the company’s strong content pipeline and expanding global reach.

2. Morgan Stanley: Morgan Stanley predicts a stock price of $350 for Netflix in 2025, acknowledging the competitive landscape but emphasizing the company’s brand recognition and innovation.

3. Bank of America: Bank of America has a price target of $325 for Netflix in 2025, highlighting the potential impact of economic headwinds and regulatory risks.

Factors to Consider

It is important to note that stock price predictions are subject to change and should be taken with caution. Investors should consider the following factors when making investment decisions:

1. Economic Conditions: Economic downturns can affect Netflix’s subscriber growth and advertising revenue.

2. Competitive Landscape: The intensity of competition in the streaming market will impact Netflix’s market share and profitability.

3. Content Quality and Success: The success of Netflix’s original content will be crucial for attracting and retaining subscribers.

4. Regulatory Environment: Changes in regulations could affect Netflix’s operations and financial performance.

Conclusion

Netflix is well-positioned to continue its growth trajectory in the coming years. The company’s expanding global reach, investment in original content, and technological advancements are expected to drive subscriber growth and revenue. However, the competitive landscape, content costs, economic headwinds, and regulatory risks pose challenges that investors should consider. Based on analysts’ projections and a comprehensive analysis, Netflix stock is predicted to reach a price range of $325-$400 by 2025. However, investors should exercise caution and monitor the company’s performance and the evolving market dynamics closely.

Closure

Thus, we hope this article has provided valuable insights into Netflix Stock Predictions 2025: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin