4, Jan 2024

Maximum Income For ACA Subsidies In 2025: Eligibility And Implications

Maximum Income for ACA Subsidies in 2025: Eligibility and Implications

Related Articles: Maximum Income for ACA Subsidies in 2025: Eligibility and Implications

- John Wick: Chapter 5 – The Final Chapter

- Holidays For 2025: A Comprehensive Guide To Planning Your Time Off

- Dodge Price Prediction 2025: A Comprehensive Analysis Of The Meme Coin’s Potential

- 1Edge 2025: The Future Of Edge Computing

- Chucky 11: Blood Of Chucky (2026) DVD (2025)

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Maximum Income for ACA Subsidies in 2025: Eligibility and Implications. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Maximum Income for ACA Subsidies in 2025: Eligibility and Implications

Maximum Income for ACA Subsidies in 2025: Eligibility and Implications

The Affordable Care Act (ACA), also known as Obamacare, has been a transformative piece of legislation in the United States healthcare system. One of the key components of the ACA is the provision of subsidies to help low- and middle-income individuals and families afford health insurance coverage through the health insurance marketplaces. These subsidies are based on income, and the maximum income for eligibility changes annually. This article explores the maximum income for ACA subsidies in 2025, its implications, and eligibility criteria.

Maximum Income for ACA Subsidies in 2025

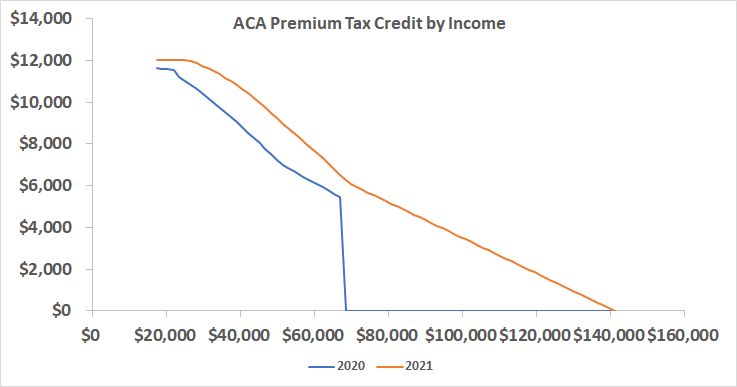

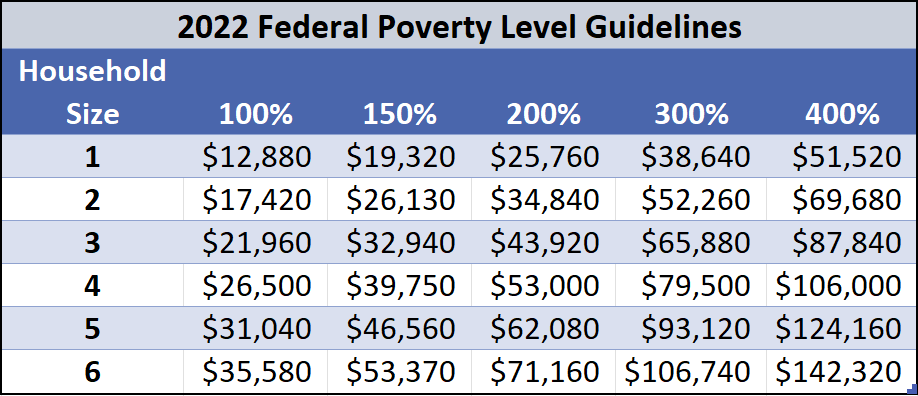

For 2025, the maximum income for ACA subsidies is projected to be $54,360 for an individual and $111,000 for a family of four. This means that individuals and families with incomes below these thresholds may be eligible for subsidies to help them purchase health insurance through the health insurance marketplaces.

Eligibility Criteria for ACA Subsidies

To be eligible for ACA subsidies, individuals and families must meet certain criteria, including:

- Income: Income must be below the maximum income thresholds for the year.

- Citizenship or Lawful Presence: Individuals must be U.S. citizens, nationals, or lawful permanent residents.

- Age: Individuals must be under age 65 and not eligible for Medicare.

- Tax Filing: Individuals must file federal income taxes.

- Dependent Status: Individuals cannot be claimed as dependents on someone else’s tax return.

Implications of the Maximum Income Threshold

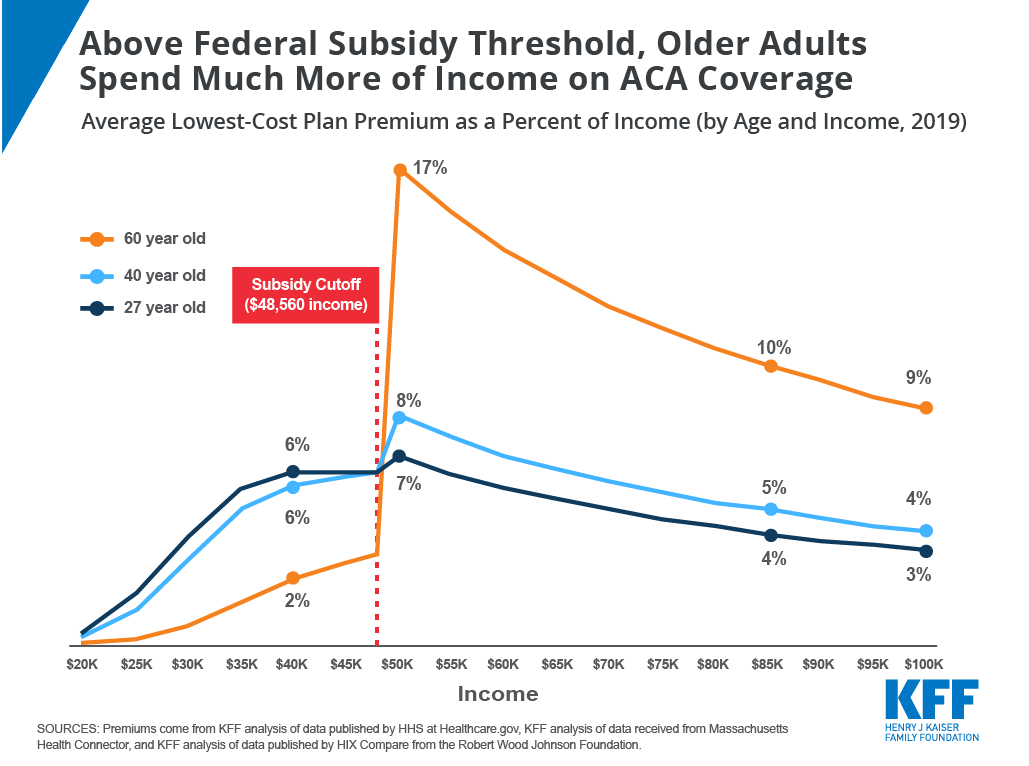

The maximum income threshold for ACA subsidies has significant implications for the accessibility and affordability of health insurance for low- and middle-income individuals and families.

- Expanded Coverage: The subsidies help make health insurance more affordable for individuals and families with incomes below the maximum threshold. This has led to a significant expansion of health insurance coverage in the United States, particularly among low-income populations.

- Financial Assistance: The subsidies provide financial assistance to help individuals and families pay for health insurance premiums. This assistance can make a substantial difference in the ability of individuals to afford health insurance coverage.

- Health Outcomes: Access to affordable health insurance coverage has been linked to improved health outcomes, including reduced mortality rates and increased access to preventive care.

Factors Affecting Maximum Income Threshold

The maximum income threshold for ACA subsidies is determined by several factors, including:

- Federal Poverty Level (FPL): The FPL is a measure of income used to determine eligibility for various government programs. The maximum income threshold for ACA subsidies is typically set at a multiple of the FPL.

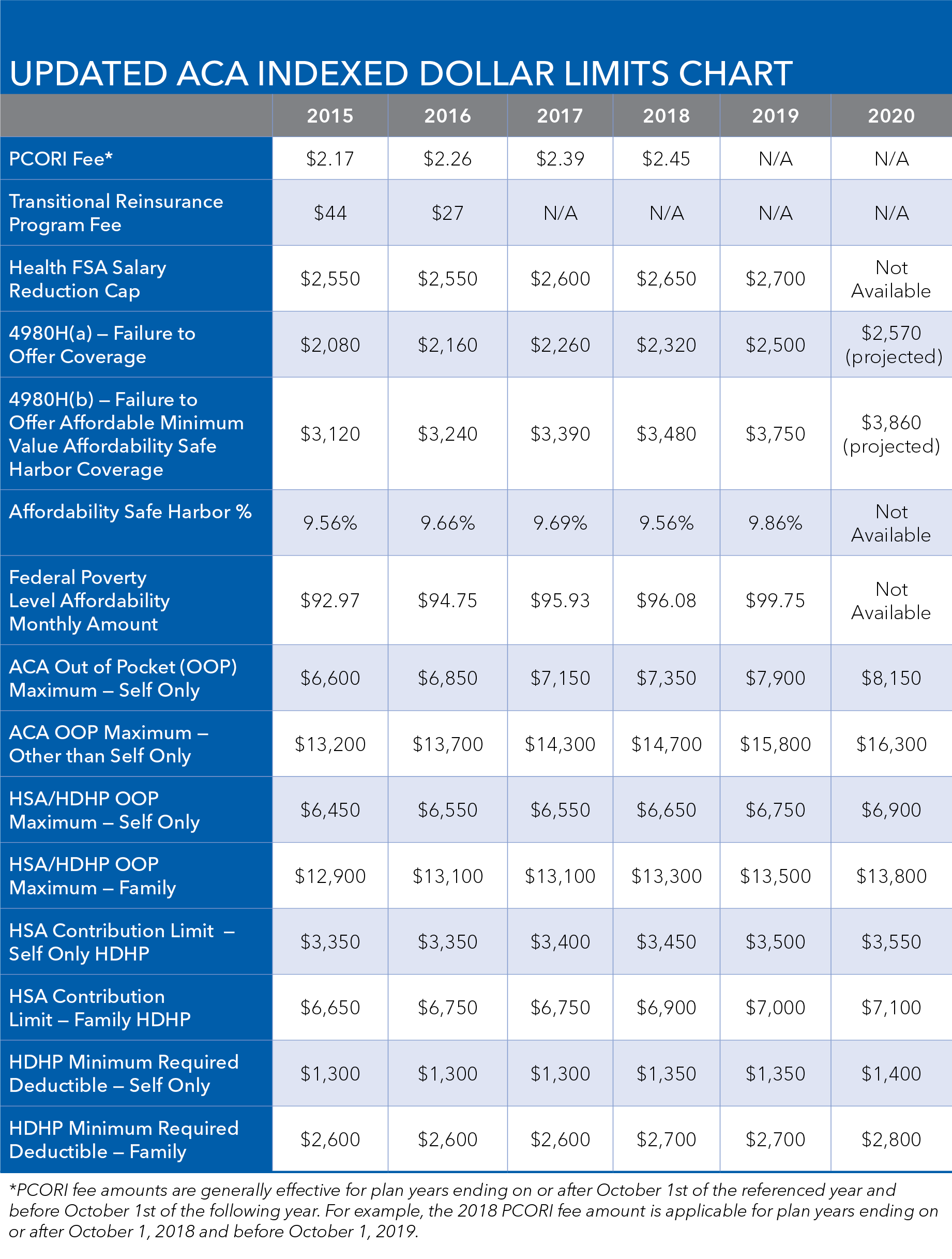

- Inflation: The maximum income threshold is adjusted annually for inflation to ensure that it keeps pace with rising healthcare costs.

- Political Considerations: The maximum income threshold is also influenced by political considerations, such as the availability of funding and the balance between expanding coverage and controlling costs.

Conclusion

The maximum income for ACA subsidies in 2025 is projected to be $54,360 for an individual and $111,000 for a family of four. Individuals and families with incomes below these thresholds may be eligible for subsidies to help them purchase health insurance through the health insurance marketplaces. The subsidies have expanded coverage, provided financial assistance, and improved health outcomes for low- and middle-income individuals and families. The maximum income threshold is determined by factors such as the FPL, inflation, and political considerations. Understanding the maximum income threshold is crucial for individuals and families seeking affordable health insurance coverage through the ACA.

Closure

Thus, we hope this article has provided valuable insights into Maximum Income for ACA Subsidies in 2025: Eligibility and Implications. We appreciate your attention to our article. See you in our next article!

- 0

- By admin