14, Aug 2023

Lifetime Gift Exemption 2025: A Comprehensive Guide

Lifetime Gift Exemption 2025: A Comprehensive Guide

Related Articles: Lifetime Gift Exemption 2025: A Comprehensive Guide

- 2025 Honda S2000: A Revival Of An Iconic Sports Car

- Fat Tuesday 2025: The Ultimate Guide To The Pre-Lenten Extravaganza

- The 2025 XT5 Refresh: A Comprehensive Overview

- Infiniti Q50 2025: A Premium Used Sedan With Cutting-Edge Technology

- The Open Championship 2025: A Historic Gathering At Royal Portrush

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Lifetime Gift Exemption 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Lifetime Gift Exemption 2025: A Comprehensive Guide

Lifetime Gift Exemption 2025: A Comprehensive Guide

The lifetime gift tax exemption is a crucial estate planning tool that allows individuals to transfer assets to others during their lifetime without incurring gift tax. This exemption is subject to periodic adjustments to keep pace with inflation, and the latest adjustment will take effect in 2025. In this article, we will explore the lifetime gift exemption for 2025, its implications, and strategies for maximizing its benefits.

What is the Lifetime Gift Exemption?

The lifetime gift tax exemption is a dollar amount that individuals can give away tax-free during their lifetime. Any gifts that exceed this exemption are subject to gift tax, which is currently levied at a rate of 40%. The exemption amount is adjusted periodically to account for inflation, ensuring that it remains relevant to the changing economic landscape.

Lifetime Gift Exemption for 2025

The American Taxpayer Relief Act of 2012 (ATRA) permanently indexed the lifetime gift tax exemption to inflation. As a result, the exemption amount increases annually based on the Consumer Price Index for All Urban Consumers (CPI-U). For 2025, the lifetime gift tax exemption is projected to be:

- $12,920,000 for individuals

- $25,840,000 for married couples (if both spouses consent to split gifts)

Implications of the Lifetime Gift Exemption

The lifetime gift tax exemption has significant implications for estate planning. By utilizing the exemption, individuals can effectively reduce the value of their taxable estate, minimizing the amount of estate tax their heirs will owe upon their death. Additionally, lifetime gifts can provide financial assistance to loved ones during the donor’s lifetime, enabling them to pursue educational opportunities, purchase homes, or start businesses.

Strategies for Maximizing the Lifetime Gift Exemption

There are several strategies that individuals can employ to maximize the benefits of the lifetime gift exemption:

- Make Annual Gifts: The lifetime gift tax exemption applies on a per-year basis. By making annual gifts of up to the exemption amount, individuals can gradually reduce the value of their taxable estate.

- Use the Gift Tax Marital Deduction: Married couples can double their lifetime gift tax exemption by utilizing the gift tax marital deduction. This deduction allows one spouse to make unlimited gifts to the other spouse without incurring gift tax.

- Consider a Dynasty Trust: A dynasty trust is an irrevocable trust that can hold assets for multiple generations, effectively removing them from the donor’s taxable estate. Gifts to a dynasty trust qualify for the lifetime gift tax exemption.

- Utilize Gift Splitting: Married couples can split gifts to third parties, effectively doubling the annual gift tax exemption. This strategy is particularly beneficial when one spouse has a significantly higher net worth than the other.

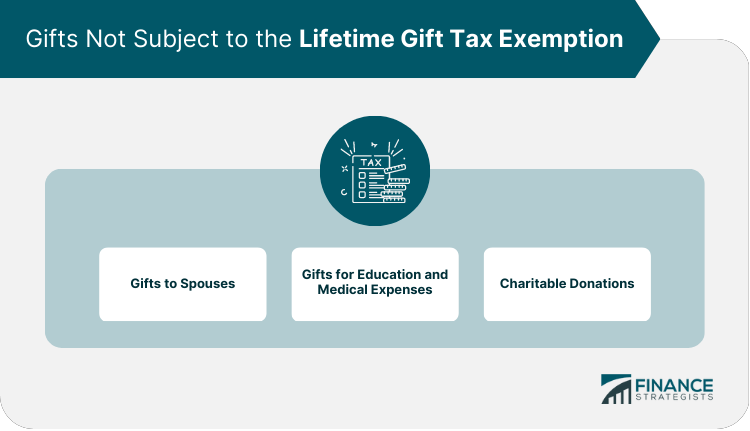

Exceptions to the Lifetime Gift Exemption

There are certain exceptions to the lifetime gift tax exemption, including:

- Gifts to Non-U.S. Citizens: Gifts to non-U.S. citizens are not eligible for the lifetime gift tax exemption.

- Gifts to Political Organizations: Gifts to political organizations are not eligible for the lifetime gift tax exemption.

- Gifts Subject to Generation-Skipping Transfer Tax: Gifts that are designed to skip a generation (e.g., gifts to grandchildren) may be subject to generation-skipping transfer tax, which is levied at a rate of 40%.

Conclusion

The lifetime gift tax exemption is a powerful tool for estate planning. By understanding the exemption amount, its implications, and strategies for maximizing its benefits, individuals can effectively reduce their taxable estate and provide financial assistance to loved ones during their lifetime. It is important to consult with a qualified estate planning attorney to develop a comprehensive plan that aligns with individual financial goals and objectives.

Closure

Thus, we hope this article has provided valuable insights into Lifetime Gift Exemption 2025: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin