24, Jul 2023

L 2040 Fund Performance: A Comprehensive Overview

L 2040 Fund Performance: A Comprehensive Overview

Related Articles: L 2040 Fund Performance: A Comprehensive Overview

- 2025 Ram 1500 Trims: A Comprehensive Guide

- Dodge Charger: A Glimpse Into The Future

- Calendar Labs 2025: Redefining Time Management With AI And Automation

- Chinese New Year 2025: The Year Of The Green Wood Serpent

- When Is The VW Bus Coming Out?

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to L 2040 Fund Performance: A Comprehensive Overview. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about L 2040 Fund Performance: A Comprehensive Overview

L 2040 Fund Performance: A Comprehensive Overview

Introduction

The L 2040 Fund is a target-date retirement fund offered by Vanguard, one of the world’s leading investment management companies. Target-date funds are designed to provide a simplified and age-appropriate investment solution for retirement savings. The L 2040 Fund is specifically designed for investors who plan to retire around the year 2040.

Investment Strategy

The L 2040 Fund follows a glide path investment strategy. This means that the fund’s asset allocation gradually shifts from higher-risk investments, such as stocks, to lower-risk investments, such as bonds, as the target retirement date approaches. This strategy is intended to help investors balance the potential for growth with the need for capital preservation as they near retirement.

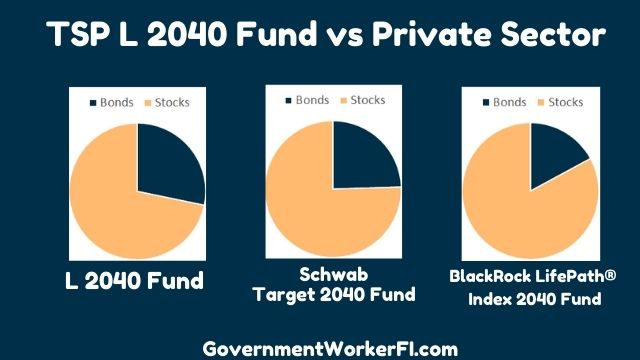

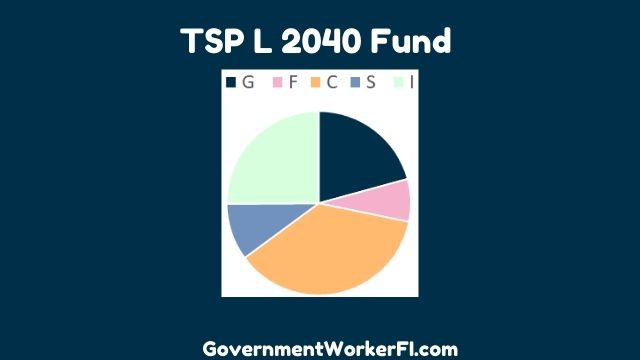

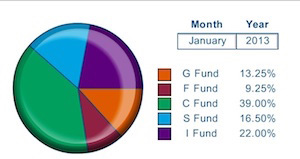

Asset Allocation

As of December 31, 2022, the L 2040 Fund had the following asset allocation:

- Stocks: 90%

- Bonds: 10%

The stock allocation is further diversified across various market capitalizations and investment styles, including large-cap, mid-cap, small-cap, value, and growth. The bond allocation includes a mix of government bonds, corporate bonds, and international bonds.

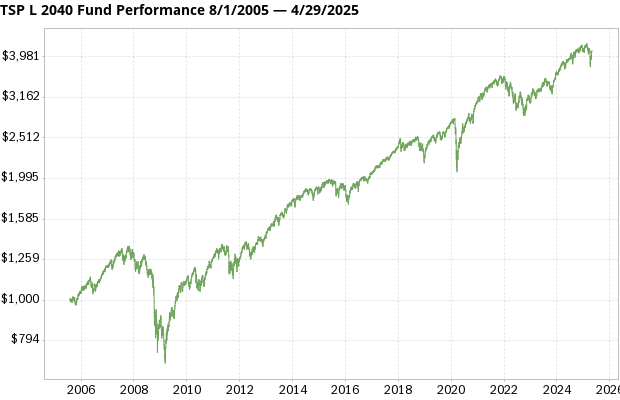

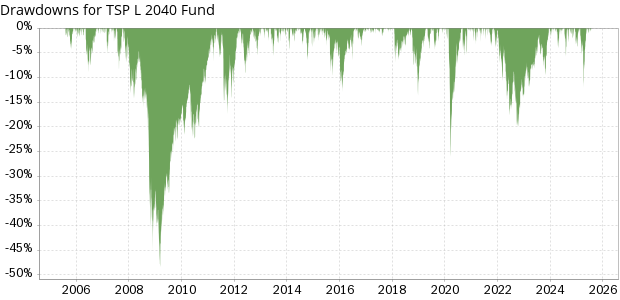

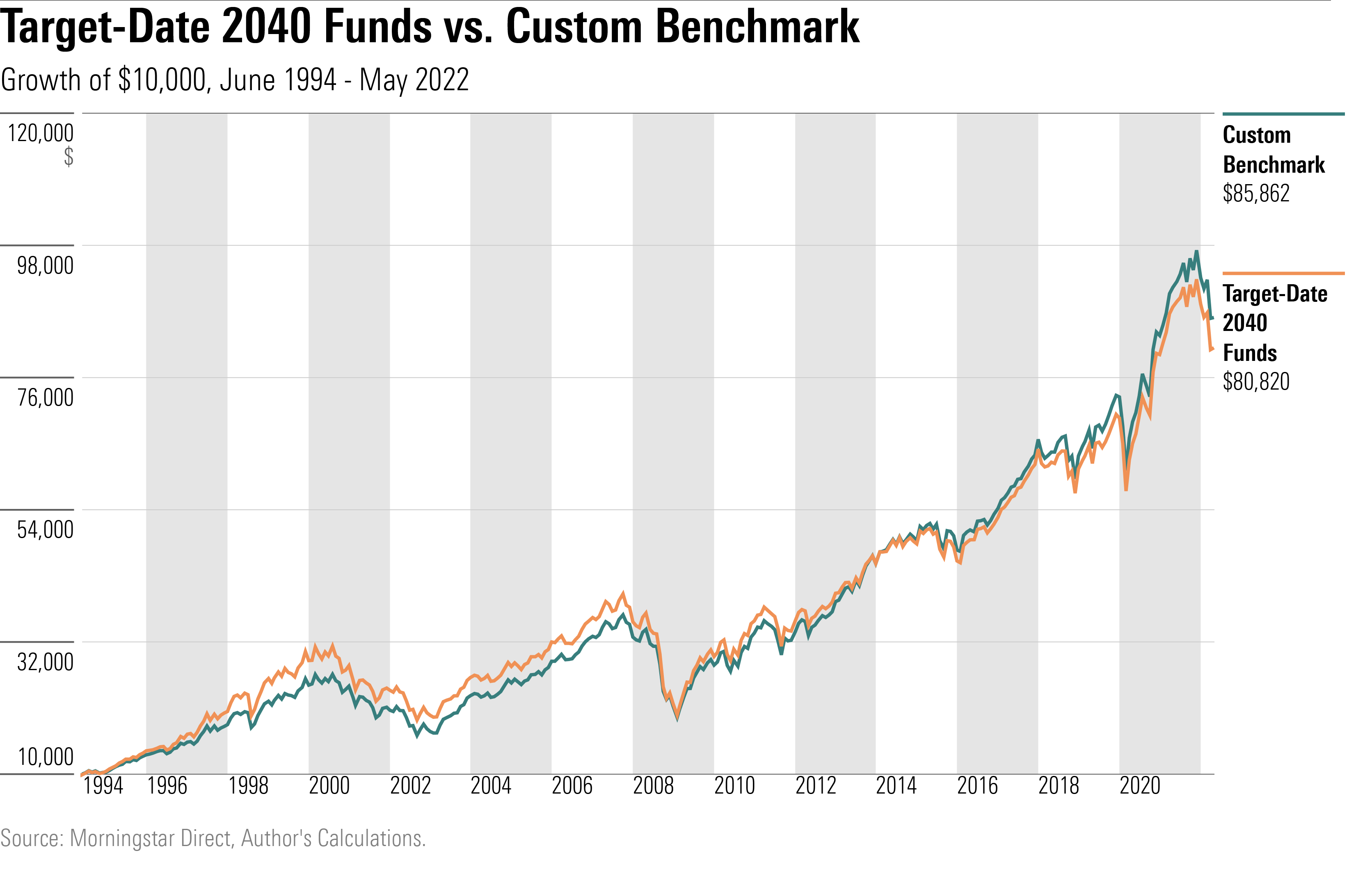

Historical Performance

The L 2040 Fund has a strong track record of performance. Over the past 10 years, the fund has generated an average annual return of 9.5%. This compares favorably to the benchmark S&P 500 index, which has returned an average of 7.8% over the same period.

Year-by-Year Performance

The following table shows the L 2040 Fund’s year-by-year performance since its inception in 2003:

| Year | Return |

|---|---|

| 2003 | 26.5% |

| 2004 | 10.9% |

| 2005 | 4.9% |

| 2006 | 15.8% |

| 2007 | 5.5% |

| 2008 | -37.0% |

| 2009 | 26.5% |

| 2010 | 17.0% |

| 2011 | 2.1% |

| 2012 | 16.0% |

| 2013 | 32.4% |

| 2014 | 13.7% |

| 2015 | -0.7% |

| 2016 | 9.8% |

| 2017 | 21.8% |

| 2018 | -4.9% |

| 2019 | 31.5% |

| 2020 | 18.6% |

| 2021 | 28.9% |

| 2022 | -19.2% |

Risk and Returns

Like all investments, the L 2040 Fund carries some level of risk. However, the fund’s glide path investment strategy is designed to mitigate risk over time. The fund’s historical performance demonstrates that it has the potential to generate strong returns while managing risk.

Fees

The L 2040 Fund has an expense ratio of 0.15%. This means that for every $10,000 invested in the fund, $15 will be deducted annually to cover the fund’s operating expenses.

Suitability

The L 2040 Fund is suitable for investors who are:

- Planning to retire around the year 2040

- Comfortable with a moderate level of risk

- Seeking a diversified investment solution

Conclusion

The L 2040 Fund is a well-managed target-date retirement fund that has the potential to provide investors with strong returns while managing risk. The fund’s glide path investment strategy and low expense ratio make it an attractive option for investors who are saving for retirement.

Closure

Thus, we hope this article has provided valuable insights into L 2040 Fund Performance: A Comprehensive Overview. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin