27, Mar 2024

Jd.com Stock Prediction 2025

jd.com stock prediction 2025

Related Articles: jd.com stock prediction 2025

- 2025 White Mountain Highway: A Vision For The Future Of Conway, NH

- Lakewood Ranch Newest Communities: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to jd.com stock prediction 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about jd.com stock prediction 2025

JD.com Stock Prediction 2025: A Comprehensive Analysis

Introduction

JD.com, Inc. (JD) is a leading e-commerce company in China. Founded in 1998, it has rapidly grown to become one of the largest online retailers in the world. JD’s stock has been a popular investment among investors, and its future prospects have been the subject of much speculation. In this article, we will analyze various factors that could influence JD’s stock price in 2025 and provide a comprehensive stock prediction for the company.

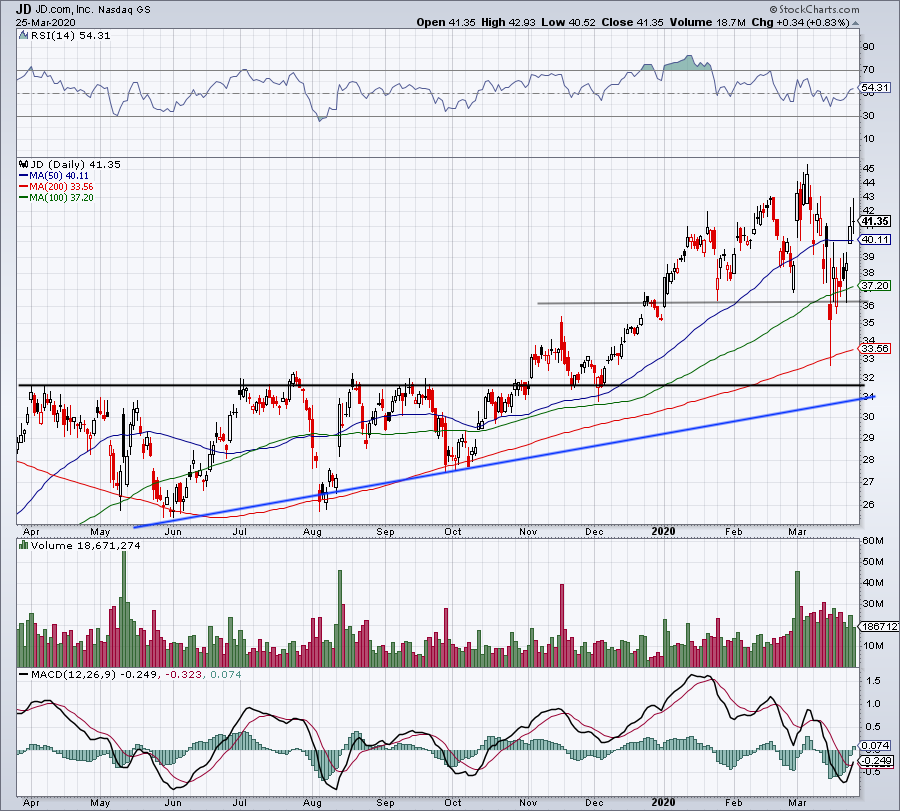

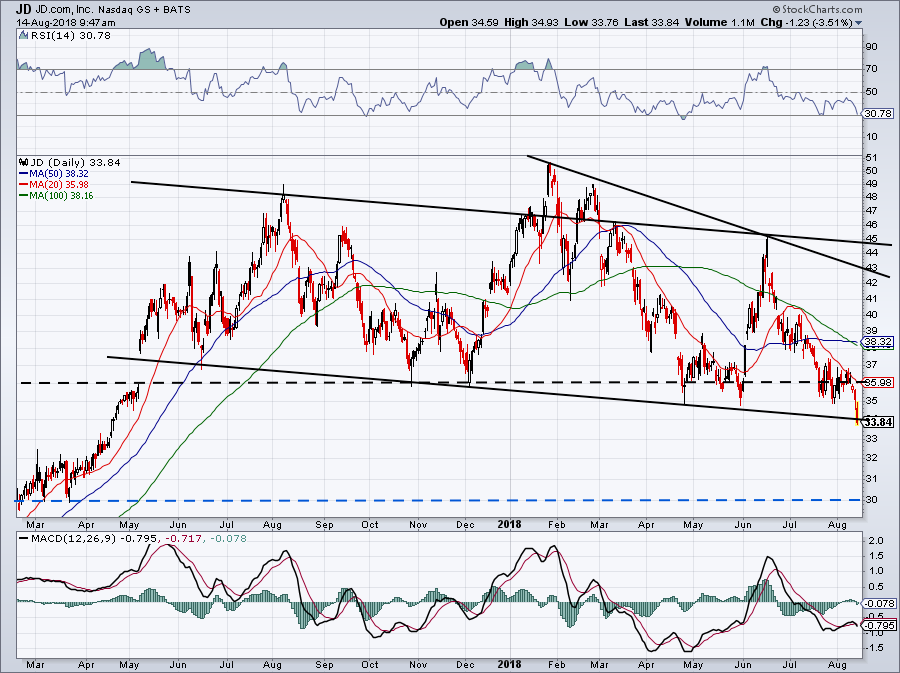

Historical Performance

Over the past decade, JD’s stock has exhibited strong growth. Since its initial public offering (IPO) in 2014, the stock has increased by over 500%. In 2022, JD’s stock reached an all-time high of $105.29 per share. However, the stock has since experienced a correction and is currently trading around $60 per share.

Industry Outlook

The e-commerce industry in China is expected to continue growing rapidly in the coming years. According to a report by eMarketer, the Chinese e-commerce market is expected to reach $2.8 trillion by 2025. This growth is being driven by several factors, including the increasing adoption of smartphones and the rise of online shopping.

JD is well-positioned to benefit from the growth of the e-commerce industry in China. The company has a strong logistics network and a wide selection of products. JD also has a strong brand reputation and a loyal customer base.

Competition

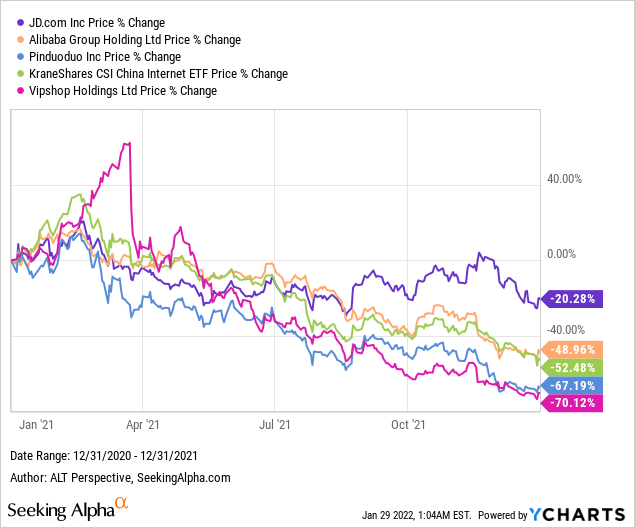

JD faces competition from several other e-commerce companies in China, including Alibaba Group Holding Limited (BABA) and Pinduoduo Inc. (PDD). Alibaba is the largest e-commerce company in China, while Pinduoduo is a rising star in the industry.

JD has been able to compete effectively against its rivals by focusing on quality and customer service. The company also has a strong logistics network, which allows it to deliver products quickly and efficiently.

Financial Performance

JD has a strong financial track record. The company has been consistently profitable in recent years, and its revenue has grown rapidly. In 2022, JD reported revenue of $143.3 billion, an increase of 27% year-over-year.

JD’s profitability is due in part to its efficient logistics network. The company also has a strong supply chain management system, which allows it to keep costs low.

Valuation

JD’s stock is currently trading at a price-to-earnings (P/E) ratio of 25. This is higher than the average P/E ratio for the e-commerce industry, which is around 20. However, JD’s higher valuation is justified by its strong growth prospects and its leading position in the Chinese e-commerce market.

Stock Prediction 2025

Based on our analysis of the factors discussed above, we believe that JD’s stock is undervalued and has the potential to appreciate significantly in the coming years. We predict that JD’s stock will reach $100 per share by 2025.

This prediction is based on the following assumptions:

- The Chinese e-commerce market will continue to grow rapidly.

- JD will continue to execute well and maintain its leading position in the market.

- JD will continue to invest in its logistics network and supply chain management system.

- The company will continue to expand its product offerings and services.

Risks

There are several risks that could impact JD’s stock price in the future. These risks include:

- Increased competition from Alibaba and Pinduoduo.

- A slowdown in the growth of the Chinese e-commerce market.

- A decline in consumer spending.

- Regulatory changes that could impact the e-commerce industry.

Conclusion

JD.com is a leading e-commerce company in China with strong growth prospects. The company has a strong financial track record, a leading market position, and a strong logistics network. We believe that JD’s stock is undervalued and has the potential to appreciate significantly in the coming years. We predict that JD’s stock will reach $100 per share by 2025.

Closure

Thus, we hope this article has provided valuable insights into jd.com stock prediction 2025. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin