25, Jan 2024

Income Tax Rates For 2024 And 2025: A Comprehensive Overview

Income Tax Rates for 2024 and 2025: A Comprehensive Overview

Related Articles: Income Tax Rates for 2024 and 2025: A Comprehensive Overview

- World Juniors Tickets 2025: Secure Your Spot For The Unforgettable Hockey Spectacle

- Who Will Conduct JEE Advanced 2025?

- Upcoming Jewish Holidays In 2025: A Comprehensive Guide

- Standard Tax Deduction For Seniors Over 65: A Comprehensive Guide

- XRP 2025 Price Prediction: A Comprehensive Analysis

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Income Tax Rates for 2024 and 2025: A Comprehensive Overview. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Income Tax Rates for 2024 and 2025: A Comprehensive Overview

Income Tax Rates for 2024 and 2025: A Comprehensive Overview

Introduction

The United States federal income tax system is a progressive system, meaning that individuals with higher incomes pay a higher percentage of their income in taxes. The tax rates for 2024 and 2025 are set by the Tax Cuts and Jobs Act of 2017 (TCJA), which made significant changes to the tax code. This article provides a comprehensive overview of the income tax rates for 2024 and 2025, including the different tax brackets, standard deductions, and personal exemptions.

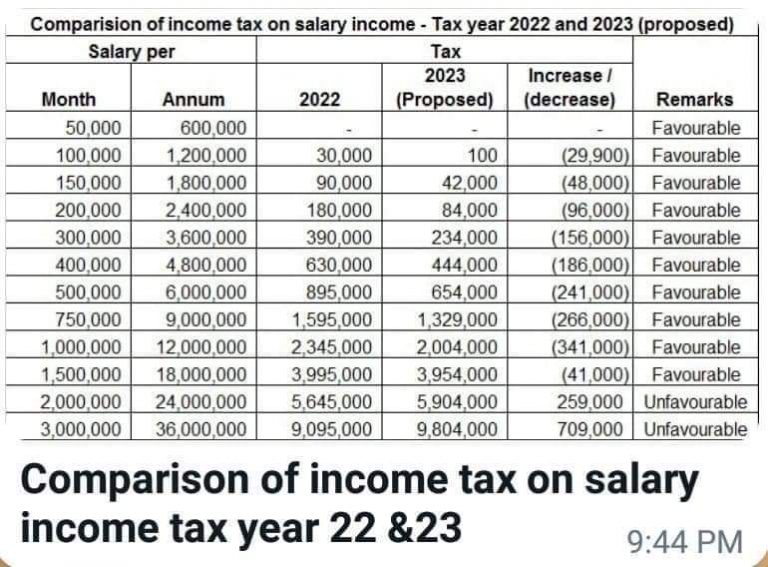

Tax Brackets

The tax brackets for 2024 and 2025 are as follows:

| Income Range (Filing Status) | 2024 Tax Rate | 2025 Tax Rate |

|---|---|---|

| Single (0-$11,250) | 10% | 10% |

| Single ($11,251-$44,725) | 12% | 12% |

| Single ($44,726-$92,775) | 22% | 22% |

| Single ($92,776-$147,050) | 24% | 24% |

| Single ($147,051-$248,300) | 32% | 32% |

| Single ($248,301-$556,350) | 35% | 35% |

| Single (Over $556,350) | 37% | 37% |

Standard Deductions

The standard deduction is a specific amount of income that is deducted from your taxable income before taxes are calculated. The standard deductions for 2024 and 2025 are as follows:

| Filing Status | 2024 Standard Deduction | 2025 Standard Deduction |

|---|---|---|

| Single | $13,850 | $14,250 |

| Married Filing Jointly | $27,700 | $28,500 |

| Married Filing Separately | $13,850 | $14,250 |

| Head of Household | $20,800 | $21,300 |

Personal Exemptions

Personal exemptions are no longer allowed under the TCJA. Prior to 2018, taxpayers could claim a personal exemption for themselves, their spouse, and each dependent. However, these exemptions were phased out beginning in 2018 and are no longer available for 2024 and 2025.

Other Tax Provisions

In addition to the tax brackets, standard deductions, and personal exemptions, there are a number of other tax provisions that affect your income tax liability. These provisions include:

- Child Tax Credit: The Child Tax Credit provides a tax credit for each qualifying child under the age of 17. The credit is phased out for high-income taxpayers.

- Earned Income Tax Credit: The Earned Income Tax Credit is a refundable tax credit for low- and moderate-income working individuals and families.

- Retirement Savings Contributions: Contributions to traditional IRAs and 401(k) plans are tax-deductible. Withdrawals from these accounts in retirement are taxed as ordinary income.

- Capital Gains and Losses: Capital gains and losses from the sale of assets are taxed at different rates depending on the type of asset and the holding period.

Tax Planning

Understanding the income tax rates and other tax provisions can help you plan your finances and minimize your tax liability. Some common tax planning strategies include:

- Maximize your retirement savings contributions: Contributions to traditional IRAs and 401(k) plans reduce your taxable income and can help you save for retirement.

- Take advantage of tax credits: The Child Tax Credit and Earned Income Tax Credit can provide significant tax savings for eligible taxpayers.

- Itemize your deductions: If your itemized deductions exceed the standard deduction, you may be able to reduce your taxable income.

- Consider tax-advantaged investments: Investments in municipal bonds and certain types of life insurance policies can provide tax-free or tax-deferred income.

Conclusion

The income tax rates for 2024 and 2025 are set by the Tax Cuts and Jobs Act of 2017. The tax brackets, standard deductions, and personal exemptions have been adjusted for inflation. By understanding the tax rates and other tax provisions, you can plan your finances and minimize your tax liability.

Closure

Thus, we hope this article has provided valuable insights into Income Tax Rates for 2024 and 2025: A Comprehensive Overview. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin