1, Oct 2023

Home Price Predictions 2030: A Comprehensive Outlook

Home Price Predictions 2030: A Comprehensive Outlook

Related Articles: Home Price Predictions 2030: A Comprehensive Outlook

- Paris 2024: The City Of Light Prepares To Host The Games Of The XXXIV Olympiad

- 2025 FIFA Club World Cup: A Comprehensive Preview

- Super Why! 2015 DVD: An Enchanting Journey Into The World Of Literacy

- 2025 BMW X5 50e: A Vision Of Electrified Luxury And Performance

- 2025: The World Enslaved

Introduction

With great pleasure, we will explore the intriguing topic related to Home Price Predictions 2030: A Comprehensive Outlook. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Home Price Predictions 2030: A Comprehensive Outlook

Home Price Predictions 2030: A Comprehensive Outlook

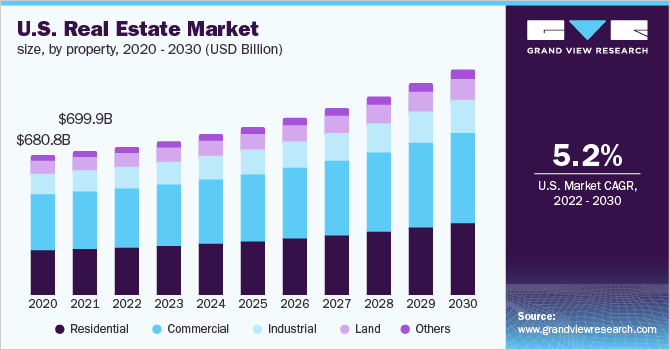

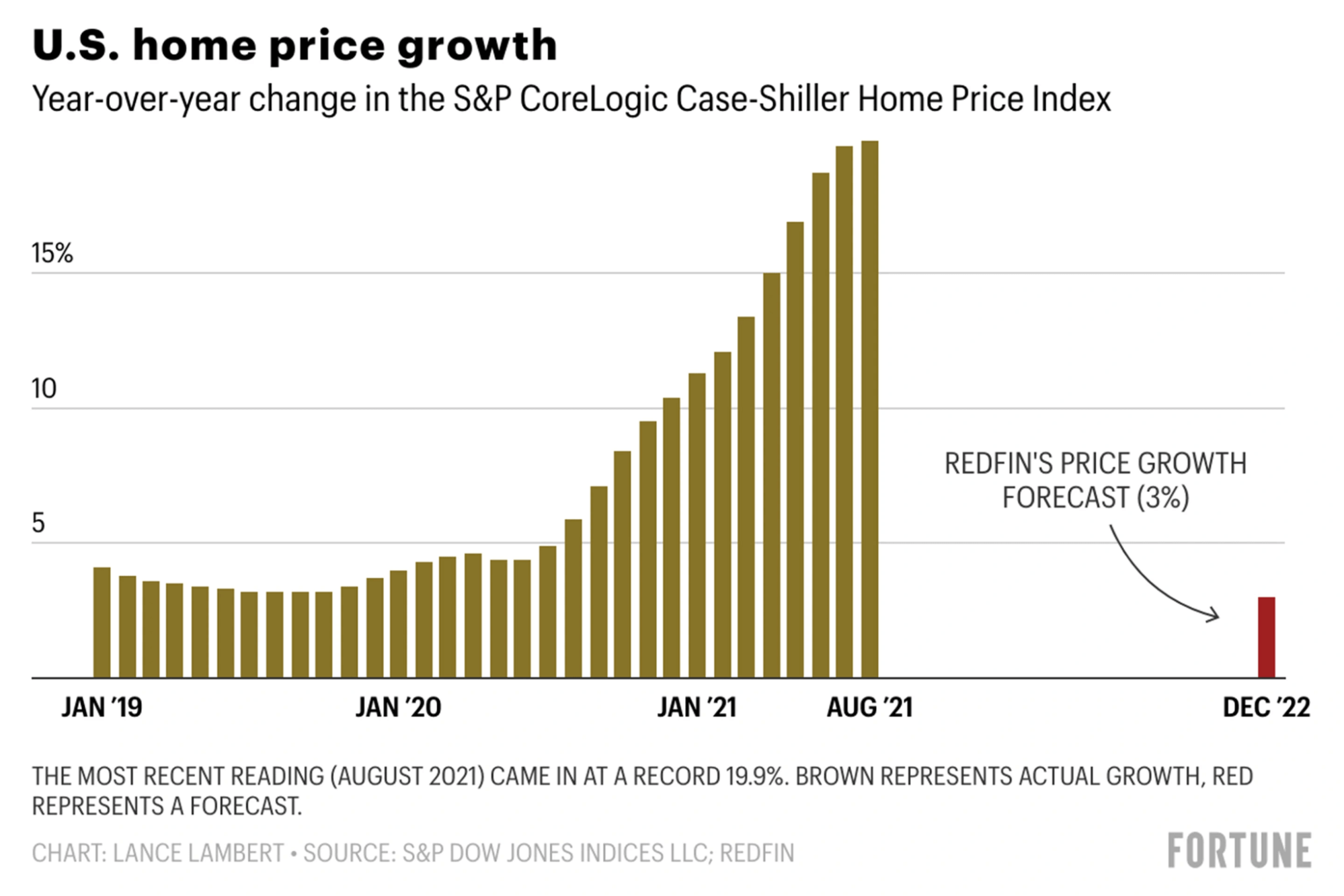

The housing market is a complex and ever-changing landscape, influenced by a multitude of factors. Predicting future home prices is a challenging task, but it is essential for homeowners, investors, and policymakers to make informed decisions. This article delves into the intricacies of home price predictions for 2030, examining key market trends, economic forecasts, and expert insights.

Market Trends Shaping Home Prices

- Population Growth: The population of the United States is projected to grow by 7.4% between 2020 and 2030, reaching approximately 369 million. This population growth will drive demand for housing, particularly in urban areas.

- Millennial Homeownership: Millennials are the largest generation in American history, and they are starting to enter the homebuying market. Millennials are expected to account for a significant portion of home purchases in the coming years.

- Urbanization: The trend towards urbanization is expected to continue, with more people moving to cities for job opportunities, education, and cultural amenities. This will increase demand for housing in urban areas.

- Low Inventory: The supply of homes for sale has been historically low in recent years. This shortage of inventory has put upward pressure on home prices and is likely to continue in the coming years.

- Rising Construction Costs: The cost of building new homes has been rising due to factors such as labor shortages, supply chain disruptions, and increased material costs. This will make it more expensive to build new homes, which could further constrain supply and support home price growth.

Economic Factors Influencing Home Prices

- Interest Rates: Interest rates have a significant impact on home prices. Higher interest rates make it more expensive to finance a mortgage, which can reduce demand for homes and lead to lower prices.

- Economic Growth: A strong economy leads to higher incomes and more job opportunities, which can increase demand for housing and boost home prices.

- Inflation: Inflation erodes the value of money, which can lead to higher home prices as buyers seek to protect their wealth by investing in real estate.

- Government Policies: Government policies, such as tax incentives for homebuyers or regulations on housing development, can influence home prices.

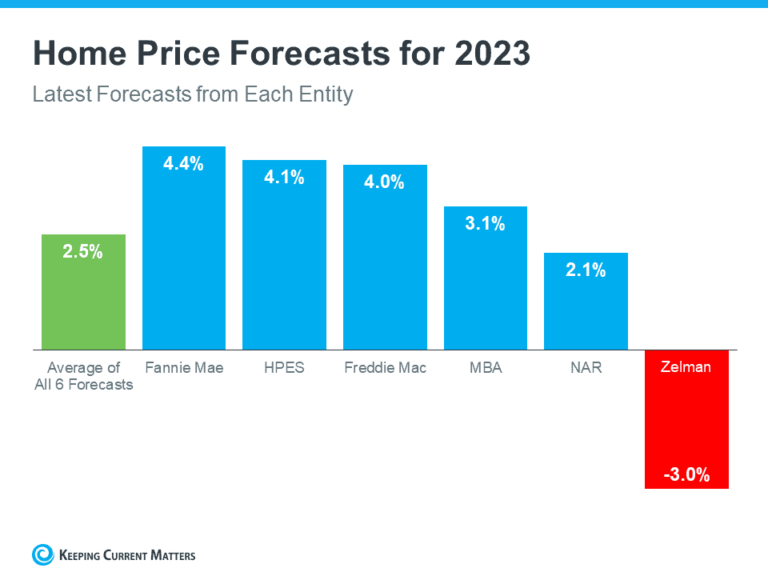

Expert Predictions and Forecasts

- National Association of Realtors (NAR): The NAR predicts that home prices will continue to rise in 2030, albeit at a slower pace than in recent years. They forecast a 3.5% annual increase in home prices over the next decade.

- Zillow: Zillow’s home price forecast for 2030 is more optimistic, predicting an annual increase of 4.1% over the next decade. Zillow cites strong population growth and low inventory as key drivers of home price appreciation.

- CoreLogic: CoreLogic predicts that home prices will rise by 2.5% per year over the next decade. They believe that the market will remain competitive, with demand outpacing supply in many areas.

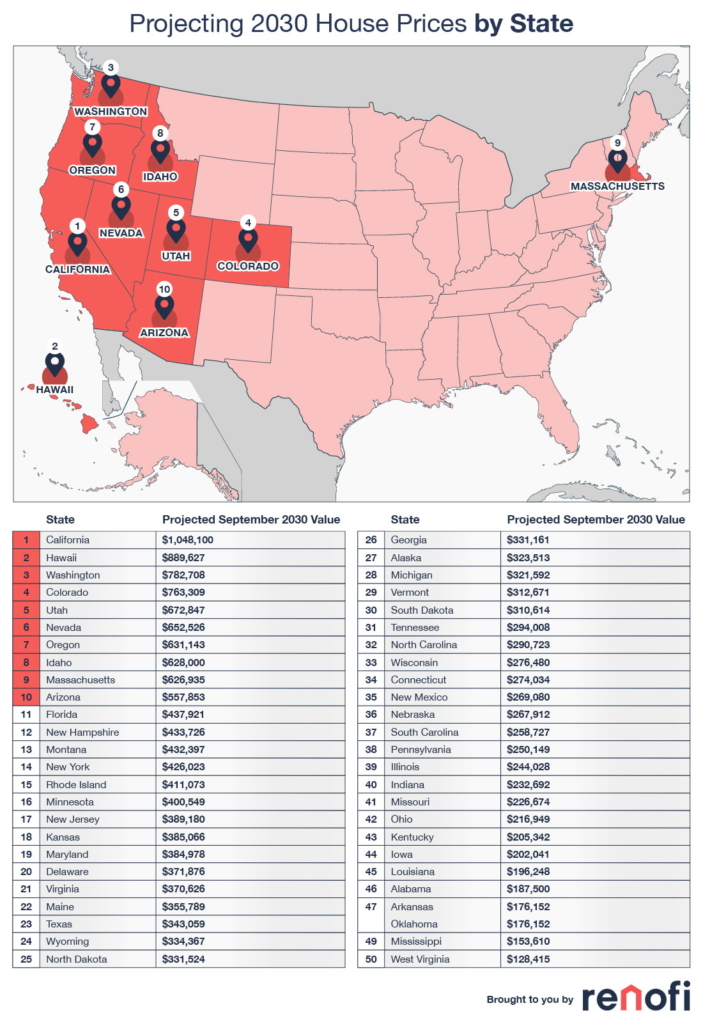

Regional Variations in Home Price Predictions

Home price predictions vary significantly by region. Factors such as population growth, economic growth, and local housing market dynamics will influence home price appreciation in different parts of the country.

- Sun Belt States: Sun Belt states, such as Florida, Texas, and Arizona, are expected to see strong home price growth due to population inflows and favorable economic conditions.

- Coastal Cities: Coastal cities, such as New York, Los Angeles, and San Francisco, will likely continue to experience high home prices due to limited land supply and strong demand.

- Rust Belt States: Rust Belt states, such as Michigan, Ohio, and Pennsylvania, may see more modest home price growth due to slower population growth and economic challenges.

Implications for Homeowners and Investors

- Homeowners: Homeowners should expect to see their home values increase in the coming years, albeit at a slower pace than in recent years. This appreciation can build equity and provide financial security.

- Investors: Investors should consider the potential for home price appreciation when making investment decisions. However, they should also be aware of the risks associated with investing in real estate, such as market downturns and fluctuations in interest rates.

Conclusion

Predicting home prices in 2030 is a complex undertaking, but by understanding key market trends, economic factors, and expert forecasts, individuals can make informed decisions about their housing investments. While home prices are likely to continue to rise over the next decade, the pace of appreciation may vary by region and will be influenced by a variety of factors. By staying informed about the housing market and considering their individual circumstances, homeowners and investors can navigate the complexities of homeownership and real estate investing in the years to come.

Closure

Thus, we hope this article has provided valuable insights into Home Price Predictions 2030: A Comprehensive Outlook. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin