13, Aug 2023

Form 202 Texas Nonprofit Corporation

Form 202 Texas Nonprofit Corporation

Related Articles: Form 202 Texas Nonprofit Corporation

- African Cup Of Nations Qualification: A Comprehensive Overview

- VKSU Exam Form 2025: A Comprehensive Guide For Aspiring Candidates

- 2025 Subaru Outback Interior: Redefining Adventure And Comfort

- Will 2024 Be A Good Year To Buy A Car?

- DV Lottery 2025 Registration Start Date: Everything You Need To Know

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Form 202 Texas Nonprofit Corporation. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Form 202 Texas Nonprofit Corporation

Form 202 Texas Nonprofit Corporation

Introduction

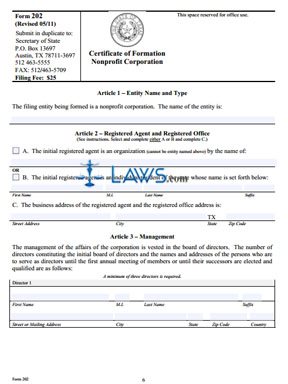

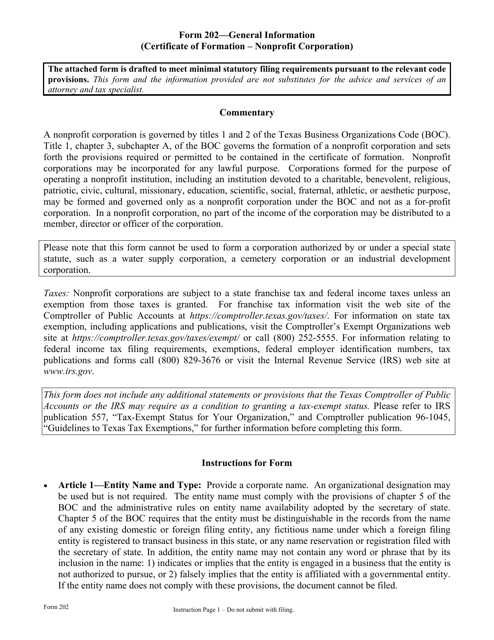

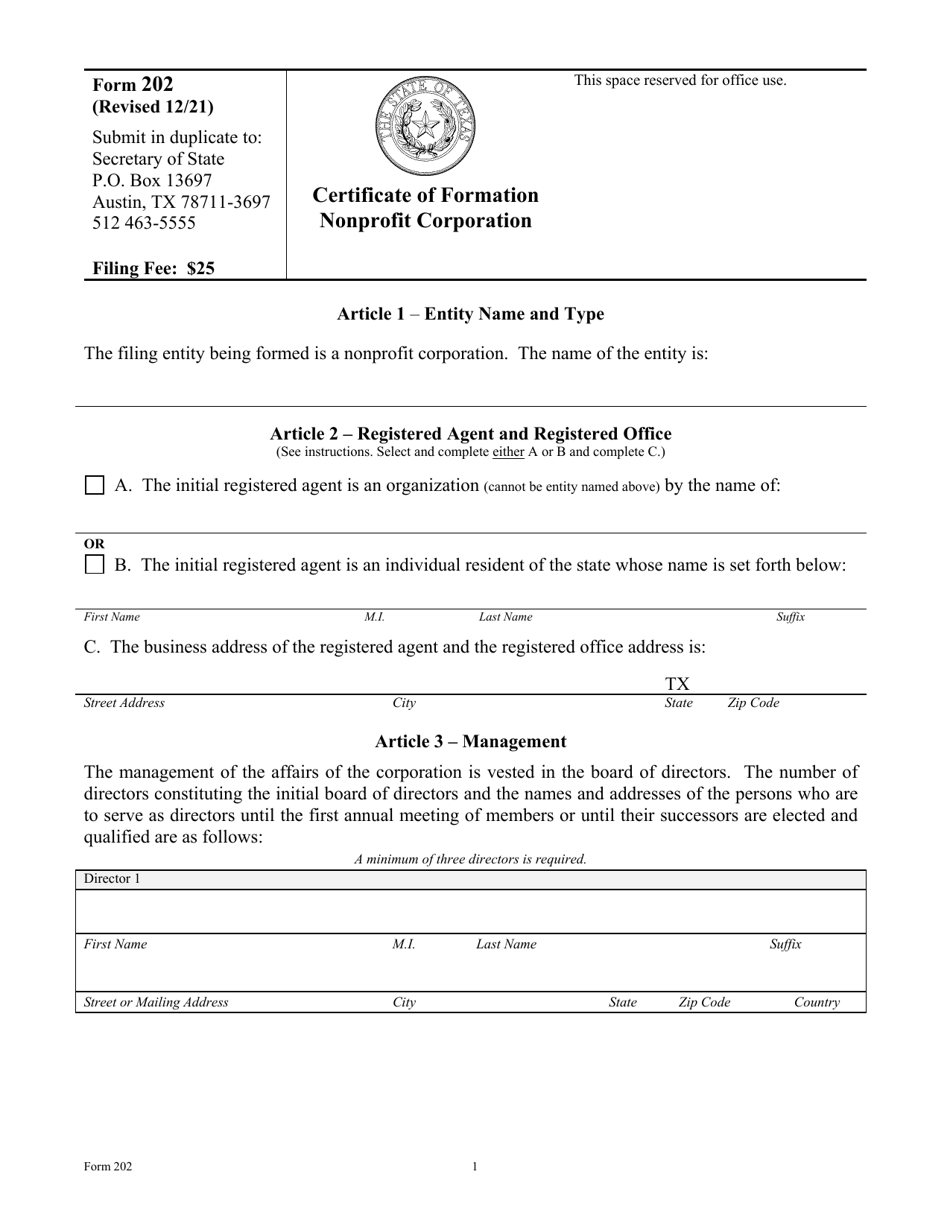

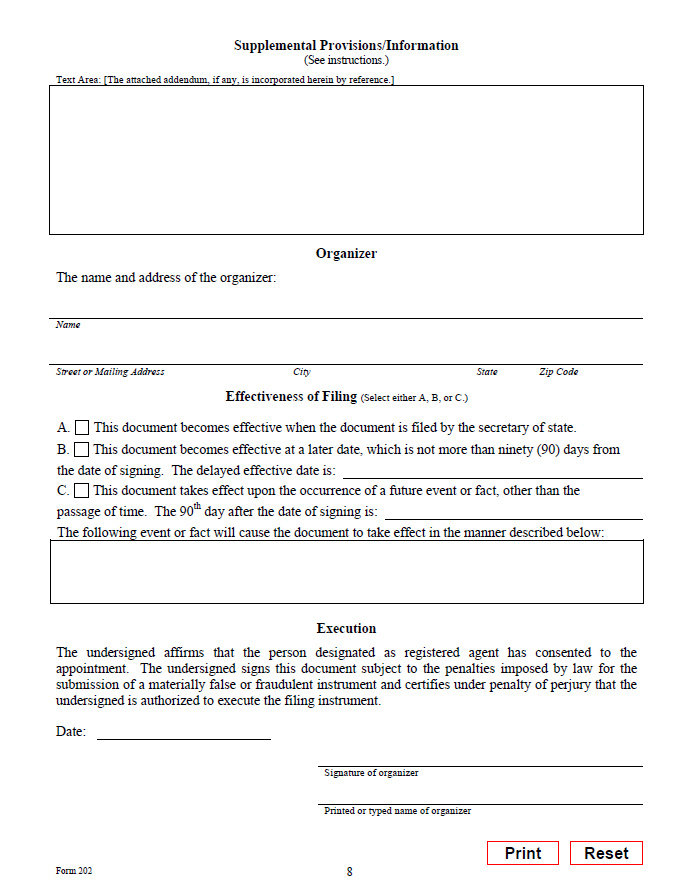

Form 202 is a document filed with the Texas Secretary of State to establish a nonprofit corporation in the state of Texas. This form provides essential information about the corporation, including its name, purpose, registered agent, and directors. Filing Form 202 is the first step in the process of forming a nonprofit corporation in Texas.

Who Needs to File Form 202?

Form 202 must be filed by any group or organization that wishes to establish a nonprofit corporation in Texas. This includes:

- Charitable organizations

- Religious organizations

- Educational institutions

- Social welfare organizations

- Professional associations

- Business leagues

Information Required on Form 202

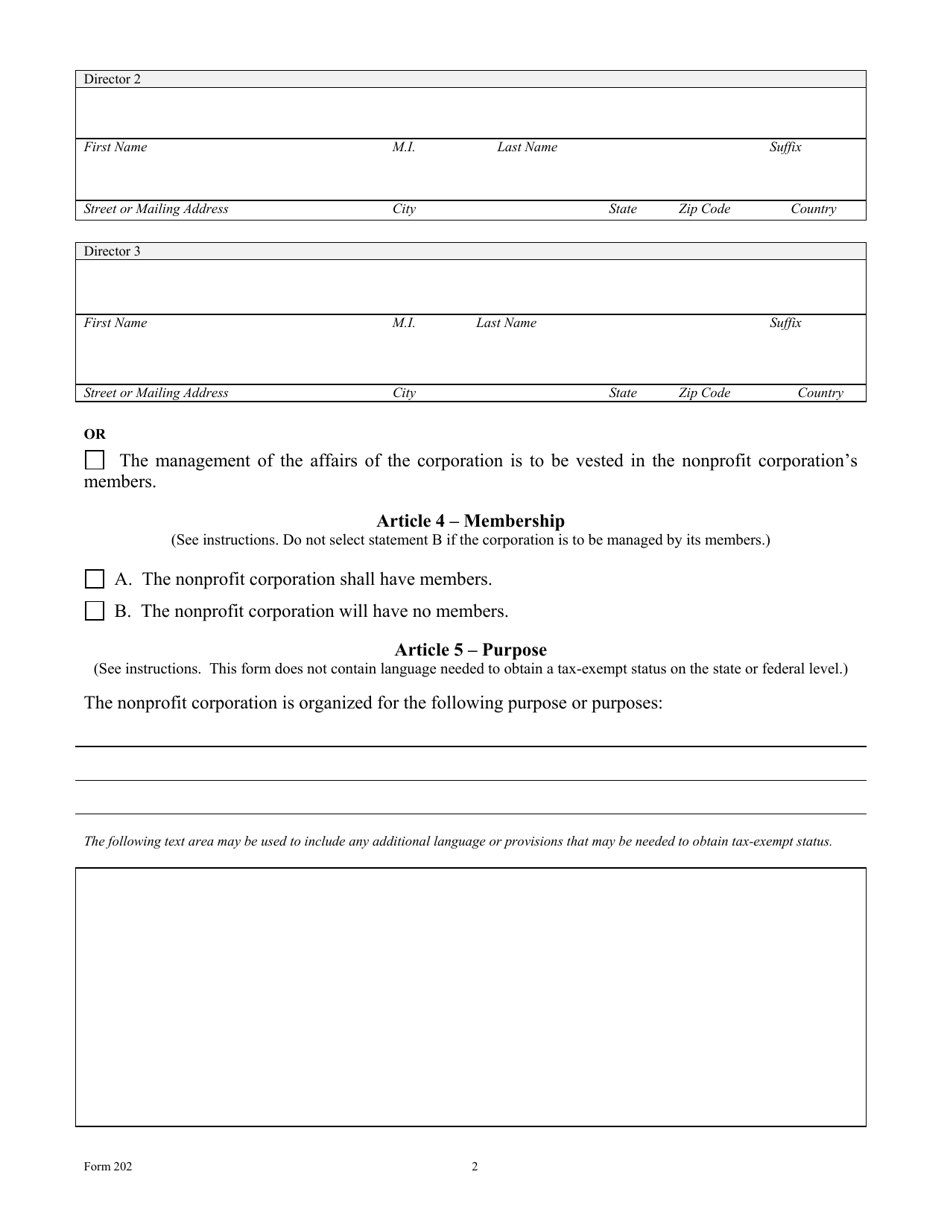

Form 202 requires the following information:

- Name of the Corporation: The name of the corporation must be unique and not already in use by another entity in Texas.

- Purpose of the Corporation: The purpose of the corporation must be stated in clear and concise language.

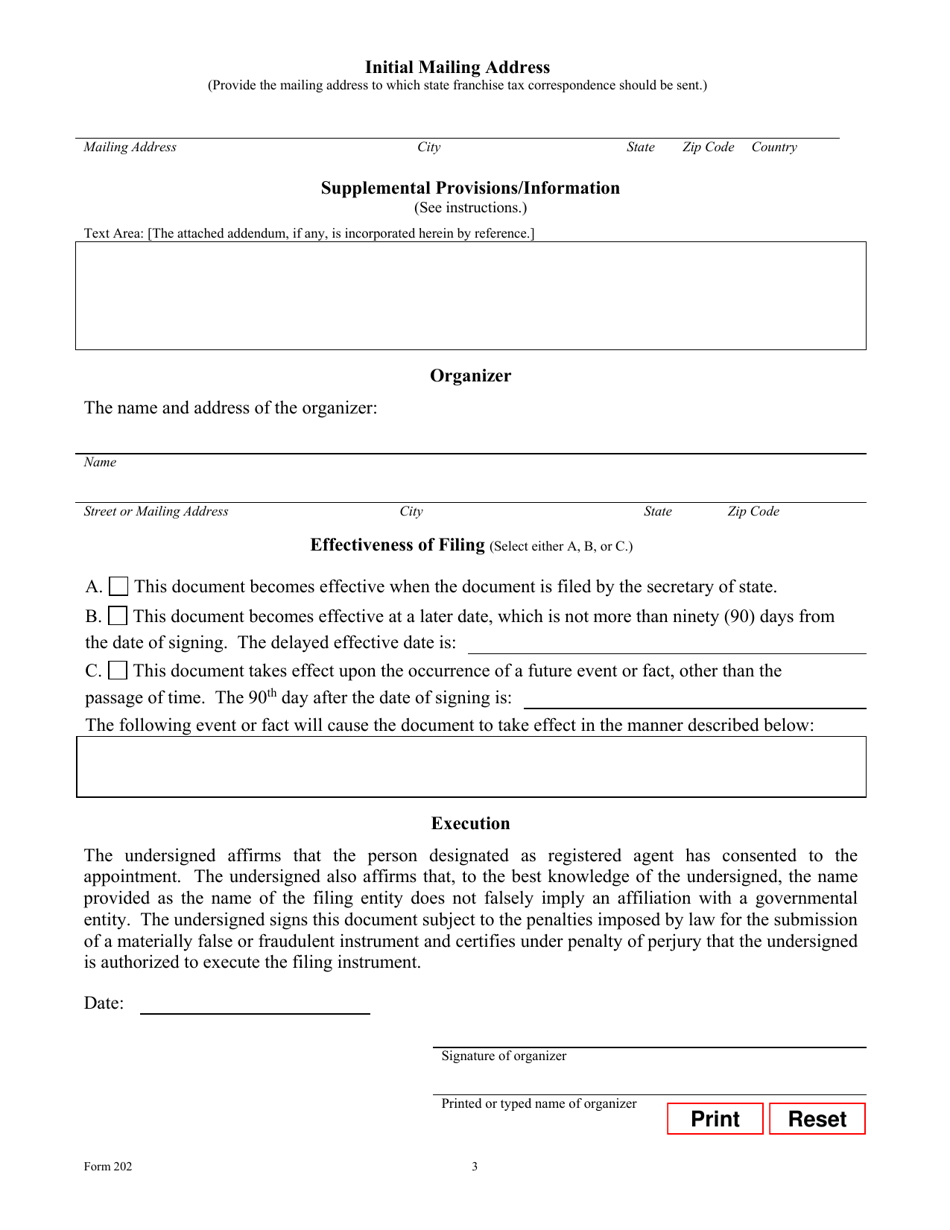

- Registered Agent: The registered agent is the individual or entity that will receive legal documents on behalf of the corporation. The registered agent must have a physical address in Texas.

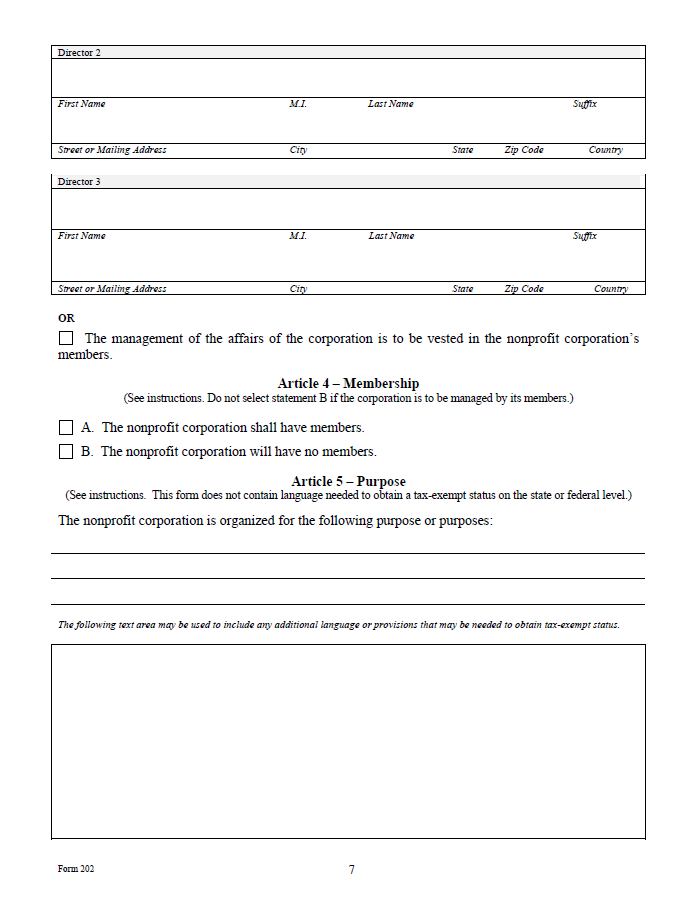

- Directors: The names and addresses of the corporation’s initial directors must be listed.

- Incorporators: The names and addresses of the individuals who are forming the corporation must be listed.

Filing Instructions

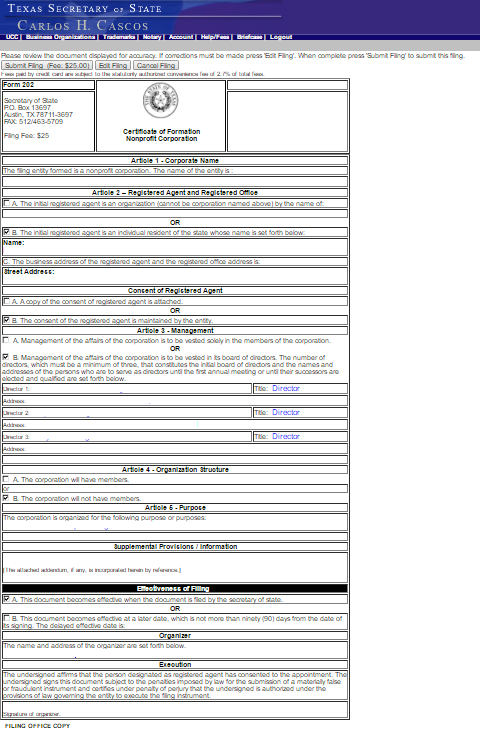

Form 202 can be filed online or by mail. The filing fee is $25.

- Online Filing: Form 202 can be filed online through the Texas Secretary of State’s website. The website provides step-by-step instructions for completing the form and submitting it electronically.

- Mail Filing: Form 202 can be mailed to the following address:

Texas Secretary of State

Corporations Division

P.O. Box 13697

Austin, TX 78711-3697

Processing Time

The Texas Secretary of State typically processes Form 202 within 2-3 business days. Once the form has been processed, the corporation will receive a Certificate of Formation. The Certificate of Formation is proof that the corporation has been legally established in Texas.

Additional Considerations

- Bylaws: In addition to filing Form 202, nonprofit corporations in Texas are also required to adopt bylaws. Bylaws are the internal rules and regulations that govern the operation of the corporation.

- Federal Tax Exemption: After filing Form 202, nonprofit corporations must also apply for federal tax exemption by filing Form 1023 with the Internal Revenue Service (IRS).

- Annual Reports: Nonprofit corporations in Texas are required to file annual reports with the Texas Secretary of State. Annual reports provide information about the corporation’s activities and financial status.

Conclusion

Form 202 is an essential document for establishing a nonprofit corporation in Texas. By providing information about the corporation’s name, purpose, registered agent, and directors, Form 202 helps to ensure that the corporation is properly organized and compliant with state law.

Closure

Thus, we hope this article has provided valuable insights into Form 202 Texas Nonprofit Corporation. We appreciate your attention to our article. See you in our next article!

- 0

- By admin