26, Jan 2024

Federal Reserve Holidays 2025: A Comprehensive Guide

Federal Reserve Holidays 2025: A Comprehensive Guide

Related Articles: Federal Reserve Holidays 2025: A Comprehensive Guide

- BlackRock LifePath Index 2025 Fund K: A Comprehensive Guide

- Jerry Easter 2025: A Celebration Of Innovation And Inclusivity

- 2025 Audi A6 E-tron: The Future Of Luxury Electric Sedans

- Will 2024 Be A Good Year To Buy A Car?

- The 2025 Dodge Durango: A Beast Of A Family SUV

Introduction

With great pleasure, we will explore the intriguing topic related to Federal Reserve Holidays 2025: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Federal Reserve Holidays 2025: A Comprehensive Guide

Federal Reserve Holidays 2025: A Comprehensive Guide

Introduction

The Federal Reserve System, often referred to as the Fed, is the central bank of the United States. It plays a crucial role in regulating the monetary system, setting interest rates, and ensuring the stability of the financial system. Like any other financial institution, the Fed observes certain holidays throughout the year, during which its offices are closed. These holidays are designated by the Board of Governors of the Federal Reserve System and are applicable to all Federal Reserve Banks and branches.

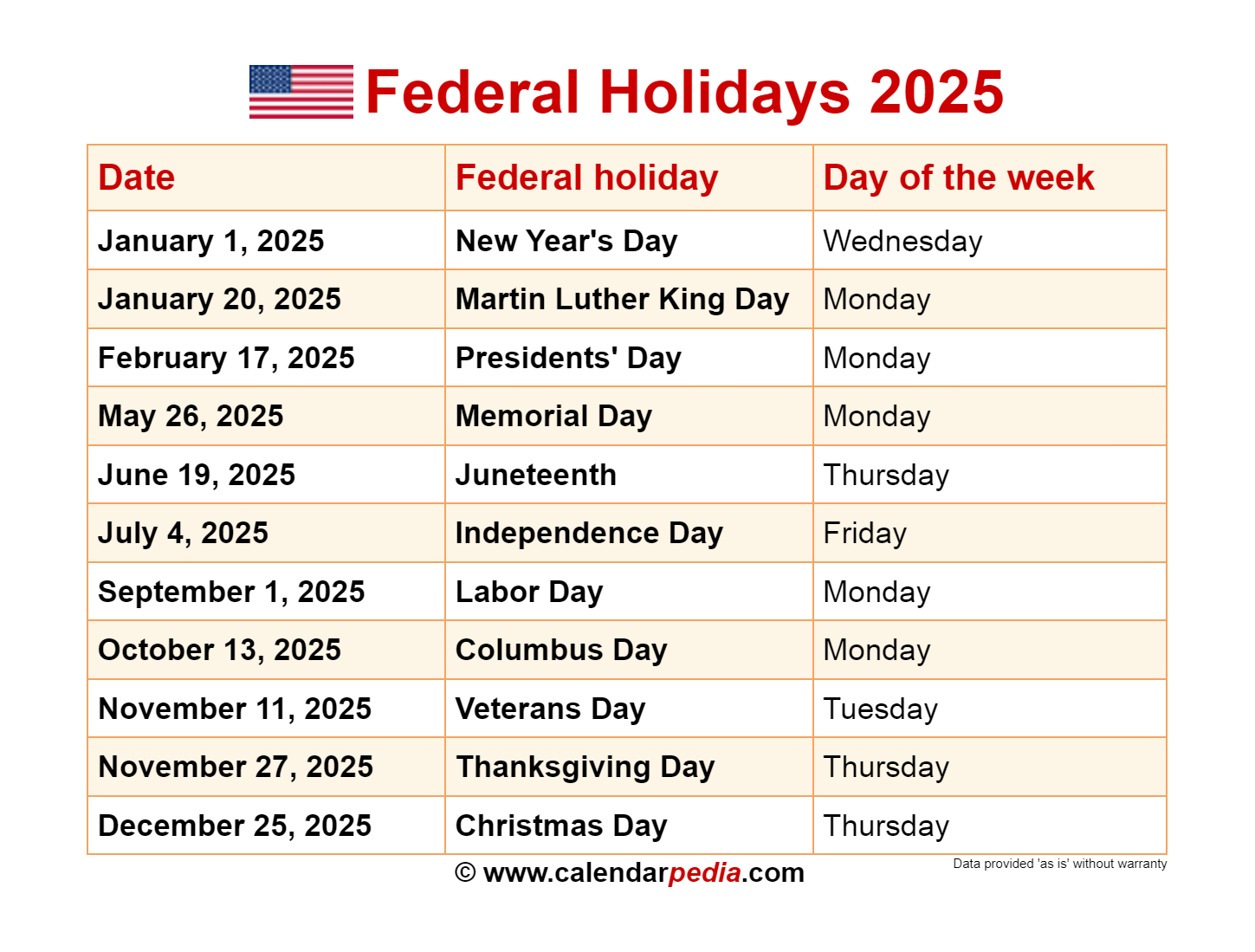

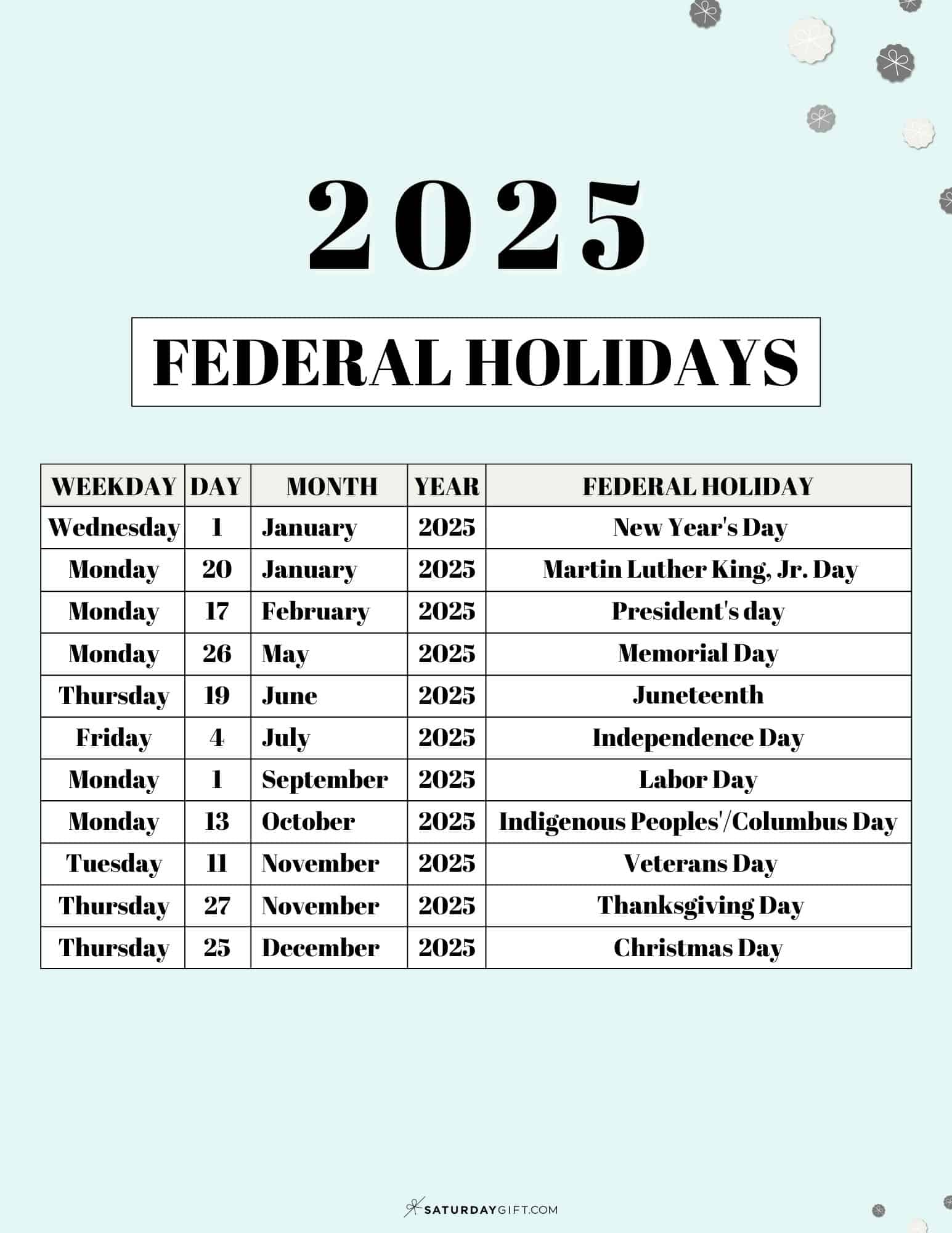

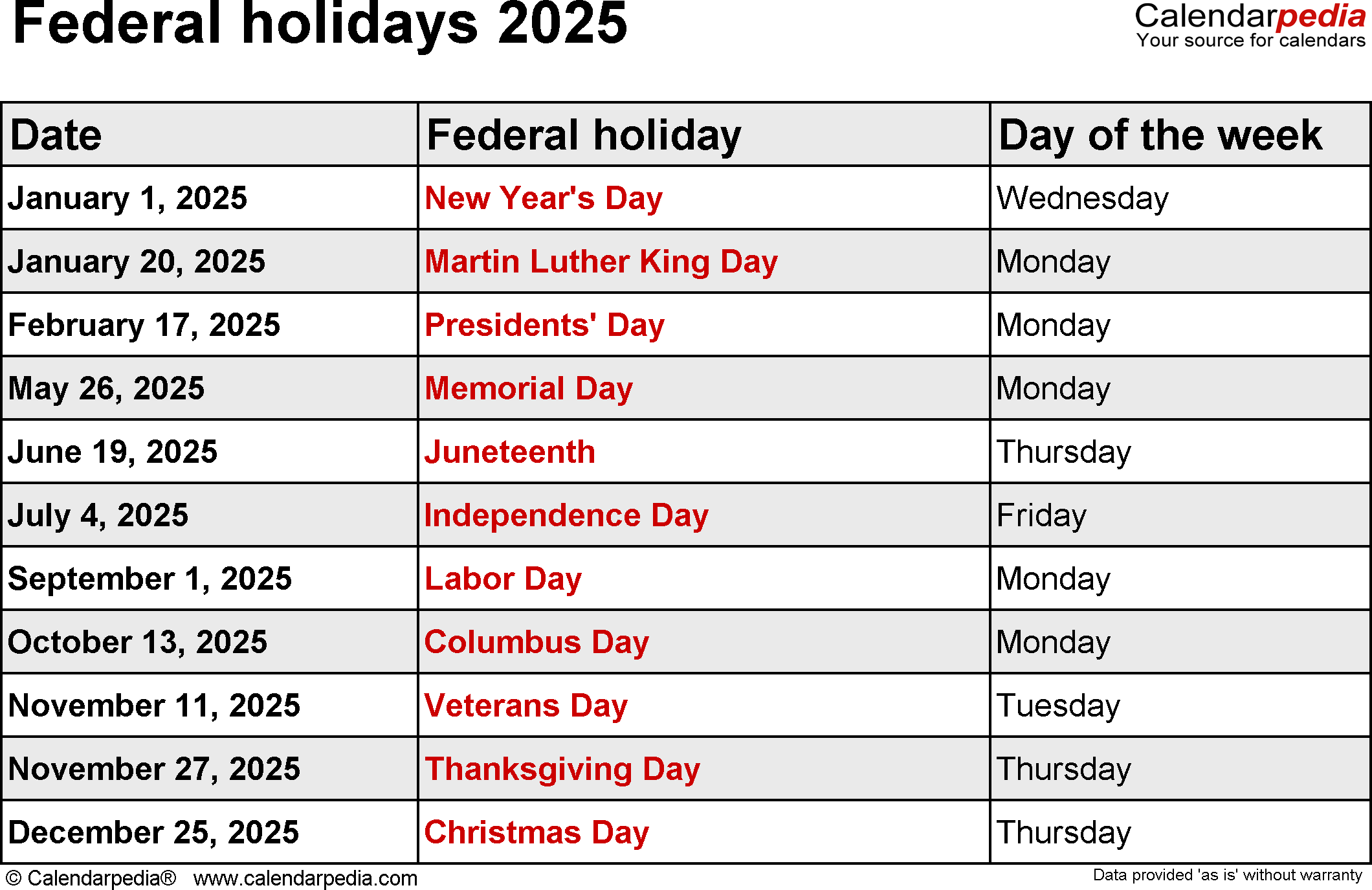

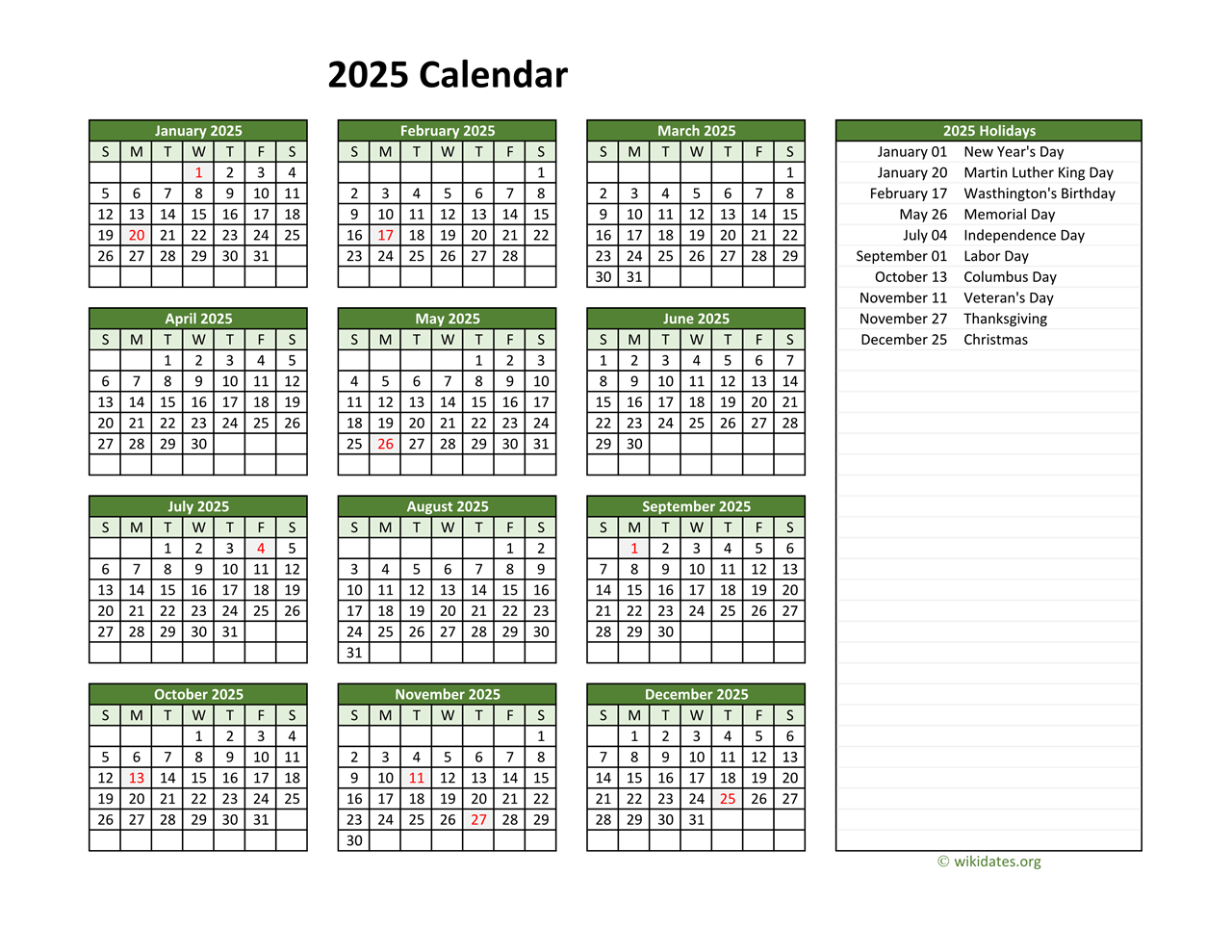

2025 Federal Reserve Holidays

The following is a list of Federal Reserve holidays for 2025:

- New Year’s Day: Thursday, January 1

- Martin Luther King Jr. Day: Monday, January 20

- Presidents’ Day: Monday, February 17

- Good Friday: Friday, April 18

- Memorial Day: Monday, May 26

- Juneteenth National Independence Day: Thursday, June 19

- Independence Day: Friday, July 4

- Labor Day: Monday, September 1

- Columbus Day: Monday, October 13

- Veterans Day: Tuesday, November 11

- Thanksgiving Day: Thursday, November 27

- Christmas Day: Thursday, December 25

Exceptions

There are a few exceptions to the above list of Federal Reserve holidays. The Federal Reserve Bank of Richmond observes Lee-Jackson Day on January 19, while the Federal Reserve Bank of Atlanta observes Confederate Memorial Day on April 28.

Impact on Financial Markets

Federal Reserve holidays have a significant impact on financial markets. On these days, the Fed’s offices are closed, and most financial transactions are suspended. This can lead to reduced liquidity and increased volatility in the markets.

Planning for Federal Reserve Holidays

Businesses and individuals who rely on financial markets should be aware of Federal Reserve holidays and plan accordingly. This may involve adjusting trading schedules, delaying transactions, or making arrangements for alternative sources of liquidity.

Conclusion

Federal Reserve holidays are an important part of the calendar for financial institutions and market participants. By being aware of these holidays and their potential impact, businesses and individuals can minimize disruptions and ensure smooth operations during these periods.

Additional Information

In addition to the official Federal Reserve holidays, there may be additional days when Federal Reserve offices are closed due to inclement weather or other unforeseen circumstances. These closures are typically announced in advance and will be posted on the Fed’s website.

The Fed’s website also provides a calendar of upcoming holidays and a list of past holiday closures. This information can be accessed at the following link: https://www.federalreserve.gov/aboutthefed/holidays.htm

Frequently Asked Questions

Q: Are all Federal Reserve Banks closed on holidays?

A: Yes, all Federal Reserve Banks and branches are closed on Federal Reserve holidays.

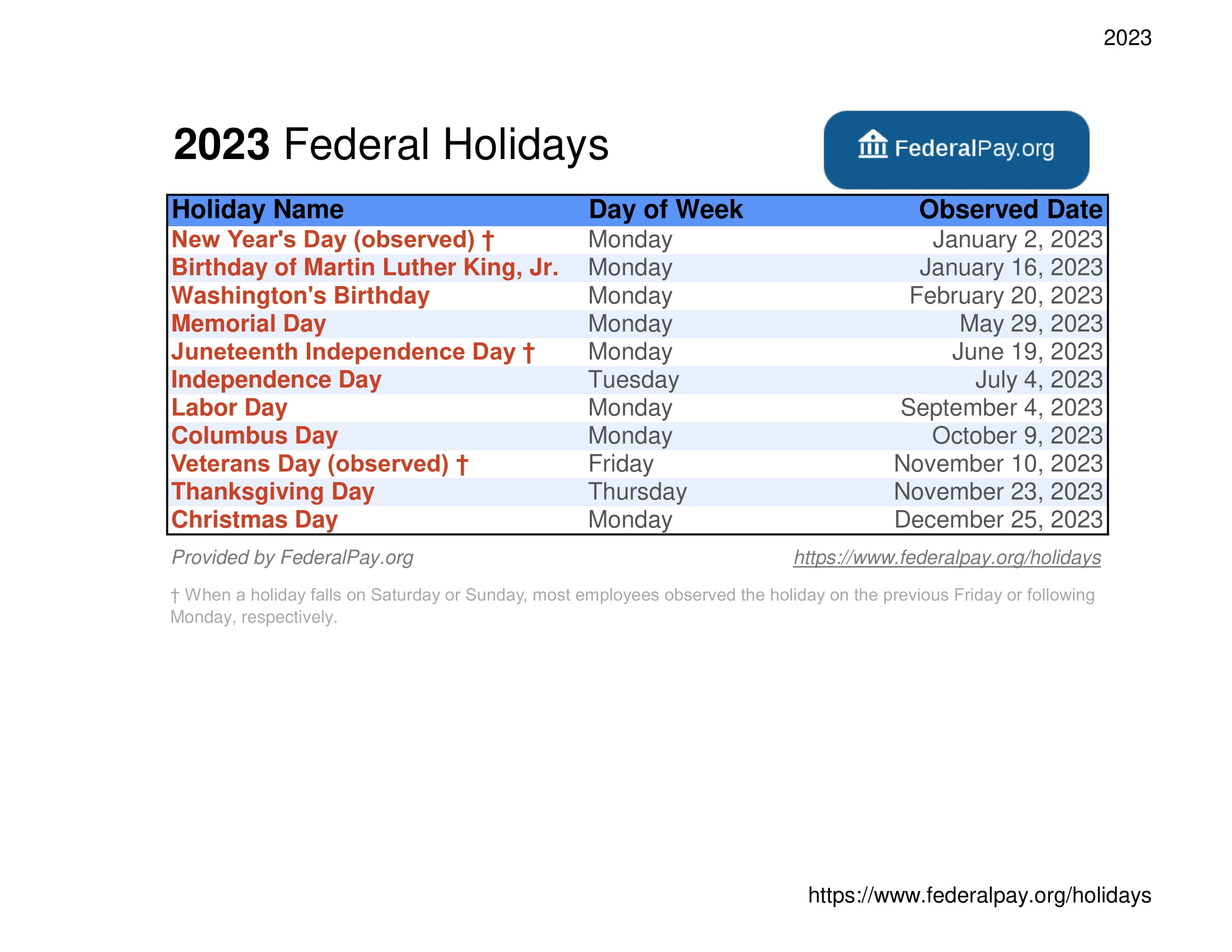

Q: What happens if a Federal Reserve holiday falls on a weekend?

A: If a Federal Reserve holiday falls on a Saturday, the holiday is observed on the preceding Friday. If it falls on a Sunday, the holiday is observed on the following Monday.

Q: Can I still make electronic payments on Federal Reserve holidays?

A: Some electronic payments may still be processed on Federal Reserve holidays, but it is best to check with your financial institution for specific details.

Q: What is the impact of Federal Reserve holidays on interest rates?

A: Federal Reserve holidays do not typically have a direct impact on interest rates. However, the reduced liquidity and increased volatility in the markets during these periods can indirectly affect interest rate movements.

Closure

Thus, we hope this article has provided valuable insights into Federal Reserve Holidays 2025: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin