22, Feb 2024

Expected Interest Rates In 2025: A Comprehensive Outlook

Expected Interest Rates in 2025: A Comprehensive Outlook

Related Articles: Expected Interest Rates in 2025: A Comprehensive Outlook

- 2025 Public Holidays In New South Wales: A Comprehensive Guide

- 2025 Willow Pond Way, Grafton, WI: A Luxurious Waterfront Retreat

- Embark On An Unforgettable Adventure: Princess Cruises To The Panama Canal In 2025

- 2025 Ram 1500: A Towing Behemoth

- 2025 School Calendar Queensland

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Expected Interest Rates in 2025: A Comprehensive Outlook. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Expected Interest Rates in 2025: A Comprehensive Outlook

Expected Interest Rates in 2025: A Comprehensive Outlook

Introduction

Interest rates play a pivotal role in the global economy, influencing investment decisions, consumption patterns, and economic growth. As we approach 2025, it becomes imperative to forecast expected interest rates to navigate the financial landscape effectively. This article provides a comprehensive outlook on the anticipated interest rate trajectory in 2025, considering various economic factors and expert projections.

Current Interest Rate Environment

Currently, interest rates are at historically low levels due to the ongoing COVID-19 pandemic and accommodative monetary policies implemented by central banks worldwide. The Federal Reserve (Fed) has maintained its benchmark interest rate near zero, and the European Central Bank (ECB) has set its deposit rate at -0.5%.

Factors Influencing Interest Rates

Several factors will shape expected interest rates in 2025, including:

- Economic Growth: A strong economic recovery from the pandemic is expected to drive up interest rates as demand for credit increases.

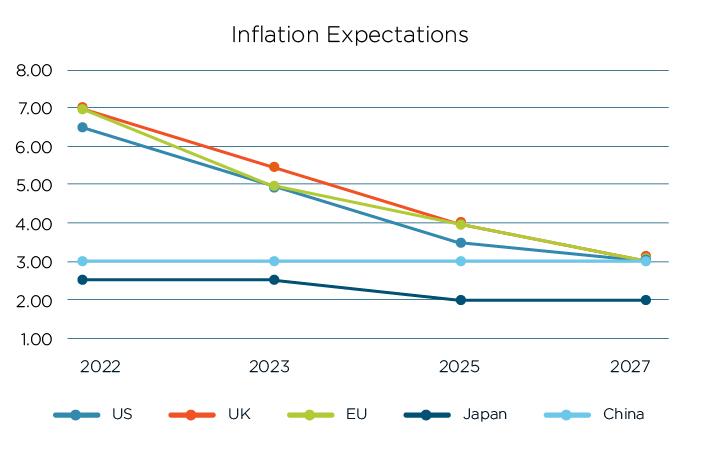

- Inflation: Rising inflation can prompt central banks to raise interest rates to curb price pressures.

- Fiscal Policy: Government spending and borrowing can influence interest rates, with increased fiscal stimulus leading to higher rates.

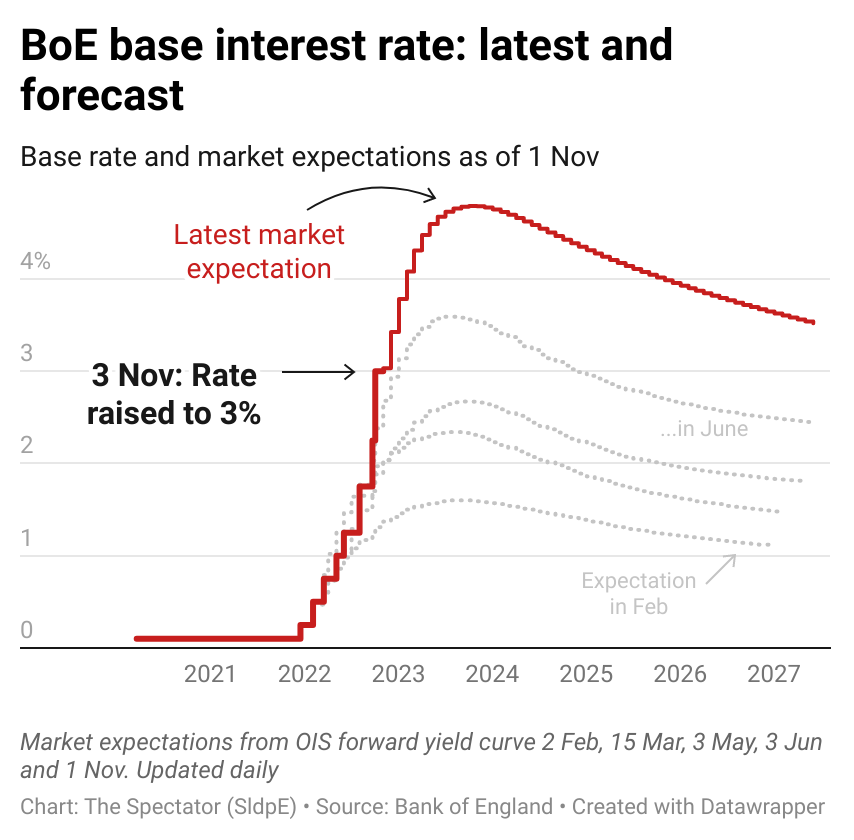

- Monetary Policy: Central bank actions, such as quantitative easing or rate hikes, will directly impact interest rates.

- Global Economic Conditions: The health of the global economy can affect interest rates in individual countries.

Expert Projections

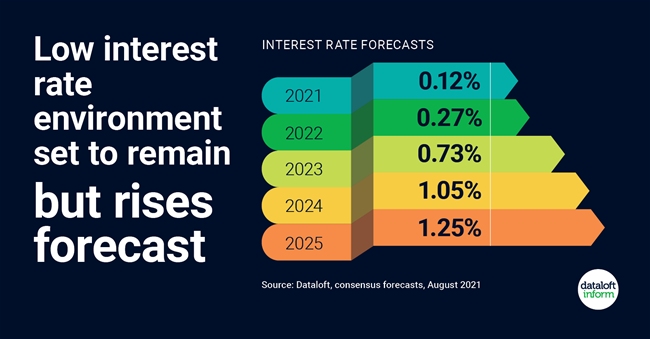

Economists and financial analysts have provided various projections for interest rates in 2025:

- Goldman Sachs: Forecasts a gradual rise in Fed funds rate to 2.25% by the end of 2025.

- Citigroup: Predicts a moderate increase in ECB deposit rate to -0.25% by 2025.

- Bank of America: Anticipates a return to pre-pandemic interest rate levels in 2025, with the Fed funds rate reaching 2.5%.

Implications for Investors and Businesses

The expected rise in interest rates in 2025 has significant implications for investors and businesses:

- Fixed-Income Investments: Investors in bonds and other fixed-income securities will likely experience lower returns as interest rates rise.

- Variable-Rate Debt: Businesses with variable-rate debt will face higher interest payments as rates increase.

- Consumer Spending: Higher interest rates can reduce consumer spending by making it more expensive to borrow.

- Corporate Investment: Increased borrowing costs can dampen corporate investment and economic growth.

Risks and Uncertainties

While the expected interest rate trajectory provides guidance, it is important to acknowledge potential risks and uncertainties:

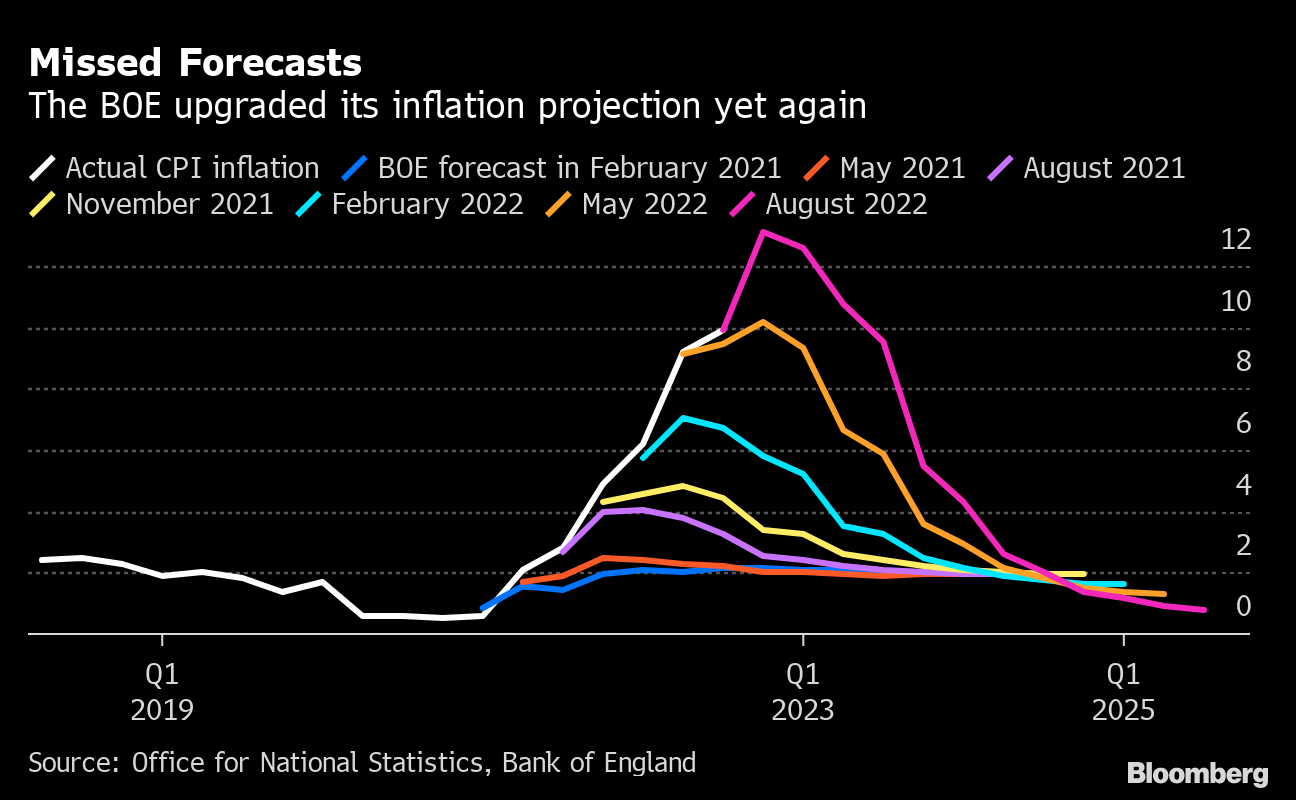

- Inflation: Unforeseen inflationary pressures could force central banks to raise rates more aggressively.

- Economic Shocks: A recession or other economic downturn could lead to lower interest rates.

- Geopolitical Events: Global conflicts or trade disputes can impact economic growth and interest rates.

- Central Bank Actions: Central banks may adjust their monetary policies in response to changing economic conditions.

Conclusion

The expected interest rate trajectory in 2025 is influenced by a complex interplay of economic factors and expert projections. While gradual increases are anticipated, risks and uncertainties remain. Investors and businesses should monitor economic developments and adjust their strategies accordingly. By understanding the potential interest rate environment, they can position themselves for success in the years ahead.

Closure

Thus, we hope this article has provided valuable insights into Expected Interest Rates in 2025: A Comprehensive Outlook. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin