20, Mar 2024

BlackRock LifePath Index 2025 Fund K: A Comprehensive Guide

BlackRock LifePath Index 2025 Fund K: A Comprehensive Guide

Related Articles: BlackRock LifePath Index 2025 Fund K: A Comprehensive Guide

- Biweekly Payroll Calendar 2025

- Election Day 2025: A Comprehensive Guide To The Date, Candidates, And Key Issues

- Good Friday 2025 Songs: A Contemplative Playlist For The Day Of Reflection

- Live At Lakewood Ranch: An Unparalleled Lifestyle Experience

- The Jubilee Of Young People 2025: A Global Gathering For Faith And Hope

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to BlackRock LifePath Index 2025 Fund K: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about BlackRock LifePath Index 2025 Fund K: A Comprehensive Guide

BlackRock LifePath Index 2025 Fund K: A Comprehensive Guide

Introduction

In the realm of retirement planning, it is crucial to make informed decisions that can help secure a comfortable financial future. BlackRock, a global investment management corporation, offers a range of target-date funds designed to simplify the investment process and align with investors’ retirement timelines. One such fund is the BlackRock LifePath Index 2025 Fund K, which is specifically tailored for individuals approaching retirement in or around 2025.

Target-Date Funds: A Retirement Planning Tool

Target-date funds are investment funds that automatically adjust their asset allocation based on the investor’s age and proximity to retirement. As the investor nears retirement, the fund gradually shifts its portfolio towards more conservative investments, such as bonds, to reduce risk and preserve capital. This automated approach can help investors stay on track with their retirement goals without the need for constant monitoring and adjustments.

BlackRock LifePath Index 2025 Fund K: An Overview

The BlackRock LifePath Index 2025 Fund K is a target-date fund designed for individuals who plan to retire in or around 2025. The fund invests in a diversified portfolio of domestic and international stocks, bonds, and other assets. It is managed by BlackRock’s experienced investment team, which utilizes a rigorous index-based investment approach.

Investment Strategy

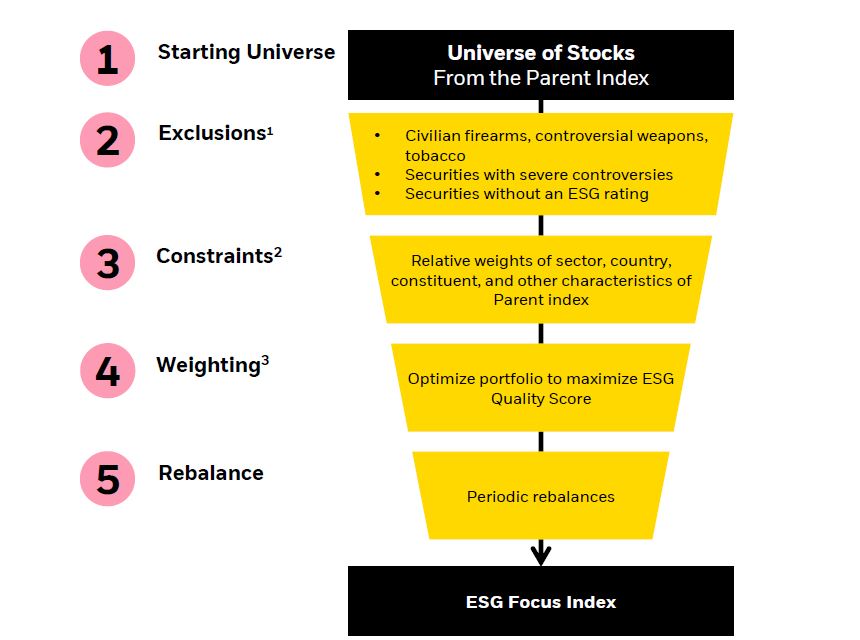

The BlackRock LifePath Index 2025 Fund K follows a passive investment strategy, meaning it tracks a predetermined market index. This index is designed to provide a balanced exposure to different asset classes and sectors, while maintaining a moderate risk profile. As the investor approaches retirement, the fund gradually reduces its exposure to equities and increases its allocation to fixed income investments.

Asset Allocation

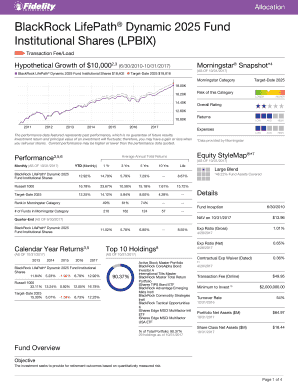

The asset allocation of the BlackRock LifePath Index 2025 Fund K is as follows:

- Stocks (58.3%): Includes a mix of domestic and international stocks, providing exposure to growth potential.

- Bonds (36.7%): Comprises a diversified portfolio of government, corporate, and international bonds, offering stability and income.

- Other (5%): Includes alternative investments, such as real estate and commodities, for diversification purposes.

Risk Profile

The BlackRock LifePath Index 2025 Fund K has a moderate risk profile. This means that the fund is subject to fluctuations in the financial markets, but the risk is managed through diversification and a gradual shift towards more conservative investments as the investor approaches retirement.

Fees and Expenses

The BlackRock LifePath Index 2025 Fund K has an expense ratio of 0.09%, which is relatively low compared to similar target-date funds. The expense ratio covers the fund’s operating costs, including management fees and administrative expenses.

Suitability

The BlackRock LifePath Index 2025 Fund K is suitable for individuals who:

- Plan to retire in or around 2025

- Seek a diversified and professionally managed investment portfolio

- Are comfortable with a moderate level of risk

- Understand that investments can fluctuate in value

Conclusion

The BlackRock LifePath Index 2025 Fund K is a well-rounded target-date fund that offers investors a convenient and efficient way to prepare for retirement. Its diversified portfolio, index-based investment approach, and moderate risk profile make it an attractive option for individuals nearing retirement. By investing in this fund, investors can simplify their retirement planning and potentially achieve their financial goals.

Additional Information

- The BlackRock LifePath Index 2025 Fund K is available through various investment platforms, including 401(k) plans, IRAs, and brokerage accounts.

- The fund’s minimum investment amount is $1,000.

- Investors should carefully consider their individual circumstances and investment objectives before investing in any target-date fund.

- Past performance is not a guarantee of future results.

Closure

Thus, we hope this article has provided valuable insights into BlackRock LifePath Index 2025 Fund K: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin