2, Aug 2023

Bitcoin Price Forecast: 2025, 2030, And Beyond

Bitcoin Price Forecast: 2025, 2030, and Beyond

Related Articles: Bitcoin Price Forecast: 2025, 2030, and Beyond

- 2025 Calendar: A Revolutionary Approach To Timekeeping

- Daylight Saving Time’s Demise In 2025: A Comprehensive Examination

- 2025 Honda Accord Type R: A Symphony Of Power And Precision

- How To Sync Your Phone And Calendar: A Comprehensive Guide

- MLB All-Star Game 2025: Secure Your Tickets For The Baseball Extravaganza

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Bitcoin Price Forecast: 2025, 2030, and Beyond. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Bitcoin Price Forecast: 2025, 2030, and Beyond

Bitcoin Price Forecast: 2025, 2030, and Beyond

Introduction

Bitcoin, the enigmatic cryptocurrency, has captivated the financial world with its meteoric rise and unprecedented volatility. As the industry matures and adoption expands, investors and analysts eagerly seek insights into Bitcoin’s future trajectory. This comprehensive analysis explores the Bitcoin price forecast for 2025, 2030, and beyond, examining key factors shaping its price movements and providing informed projections.

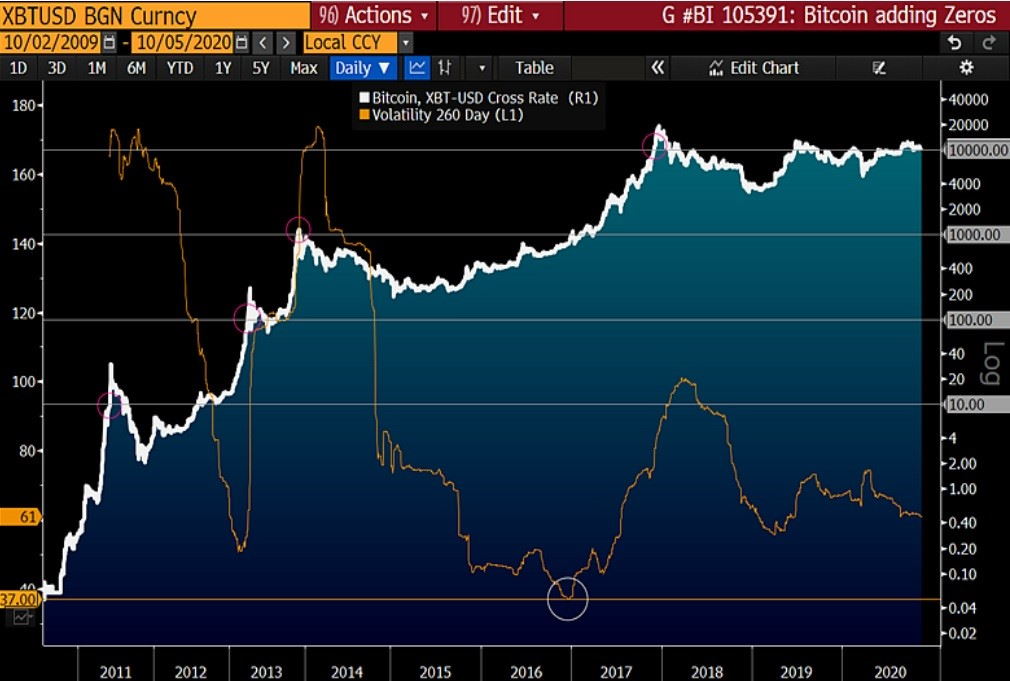

Historical Performance and Market Dynamics

Bitcoin’s price history reveals a rollercoaster ride of exponential growth, sharp corrections, and periods of consolidation. Since its inception in 2009, the cryptocurrency has experienced several bull and bear markets, driven by factors such as market sentiment, technological advancements, and regulatory developments.

The limited supply of Bitcoin, capped at 21 million coins, creates a unique supply-demand dynamic. As demand increases, particularly during periods of heightened investor interest, the price tends to rise. Conversely, when market sentiment turns bearish or supply outstrips demand, the price can experience significant declines.

Factors Influencing Bitcoin Price

Numerous factors contribute to Bitcoin’s price movements, including:

- Halving Events: Every four years, Bitcoin’s block reward, the amount of Bitcoin miners receive for validating transactions, is halved. These events reduce the issuance rate, potentially affecting supply and demand dynamics.

- Institutional Adoption: The entry of institutional investors, such as hedge funds and corporations, into the cryptocurrency market can provide significant liquidity and price support.

- Regulatory Landscape: Regulatory developments, both favorable and unfavorable, can impact Bitcoin’s price by influencing investor confidence and market stability.

- Technological Advancements: Innovations in blockchain technology, such as the Lightning Network and sidechains, can improve Bitcoin’s scalability, security, and use cases, potentially driving demand and price appreciation.

- Economic Conditions: Bitcoin has exhibited a degree of correlation with traditional financial markets, particularly during periods of economic uncertainty or inflation.

2025 Price Forecast

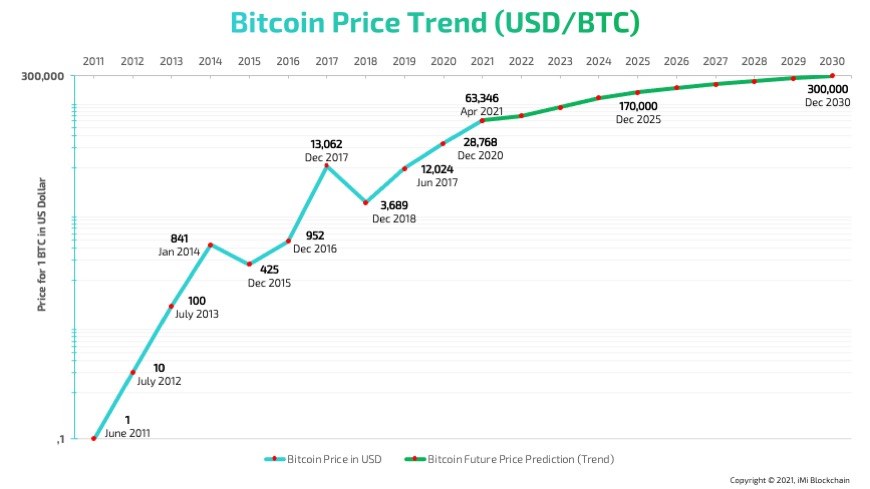

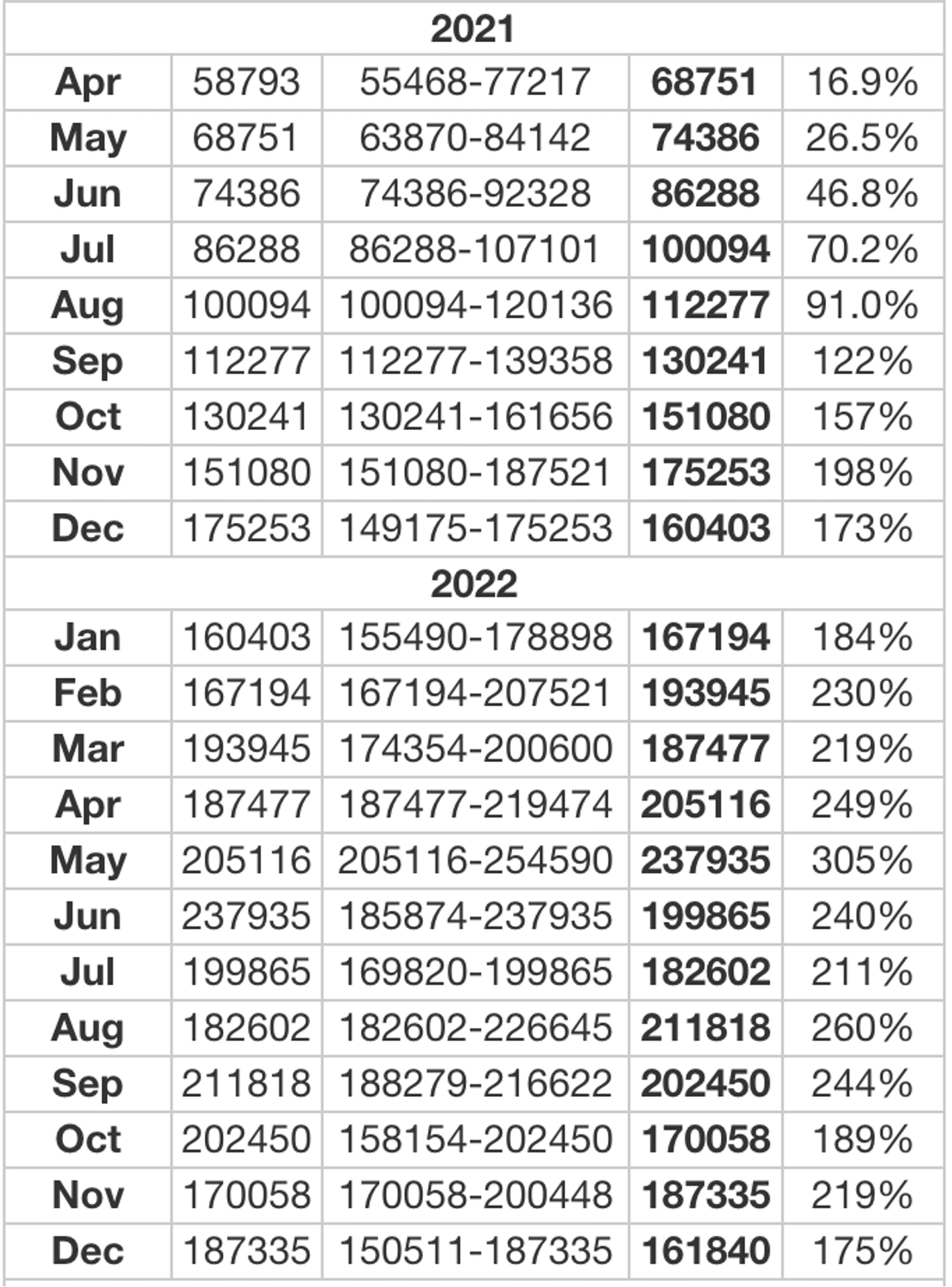

Predicting Bitcoin’s price with certainty is challenging, but informed estimates can be made based on historical trends and current market conditions. By 2025, Bitcoin is projected to reach a price range between $100,000 and $250,000.

This forecast is supported by several factors:

- Continued institutional adoption and mainstream acceptance

- Technological advancements and increased utility

- Halving event in 2024, reducing supply

- Growing demand from emerging markets

2030 Price Forecast

Extending the forecast to 2030, Bitcoin’s price is anticipated to continue its upward trajectory, potentially reaching $500,000 to $1 million.

Factors contributing to this projected growth include:

- Widespread adoption as a global reserve asset

- Technological maturity and scalability improvements

- Increasing demand from investors seeking diversification and inflation hedge

- Additional halving events in 2028 and 2032, further reducing supply

Beyond 2030

Predicting Bitcoin’s price beyond 2030 becomes increasingly speculative, but the cryptocurrency’s potential for long-term growth remains significant. By the end of the decade, Bitcoin could potentially reach $1 million to $5 million or even higher.

Factors supporting this long-term bullish outlook include:

- Mass adoption as a global currency

- Technological advancements and innovation

- Growing acceptance by central banks and governments

Risks and Considerations

While the Bitcoin price forecast for 2025, 2030, and beyond appears promising, it’s crucial to acknowledge potential risks and uncertainties. These include:

- Regulatory setbacks or bans

- Technological challenges and security breaches

- Market manipulation or fraud

- Competition from alternative cryptocurrencies

Conclusion

Bitcoin’s price forecast for 2025, 2030, and beyond is influenced by a complex interplay of factors, including market dynamics, technological advancements, and regulatory developments. Based on historical trends and current market conditions, informed estimates suggest significant growth potential, with Bitcoin potentially reaching $100,000 to $250,000 by 2025 and $500,000 to $1 million by 2030. While long-term projections become increasingly speculative, the potential for Bitcoin to become a globally accepted currency and store of value remains substantial. However, investors should be aware of potential risks and exercise due diligence before making investment decisions.

Closure

Thus, we hope this article has provided valuable insights into Bitcoin Price Forecast: 2025, 2030, and Beyond. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin