11, Sep 2023

Apple Stock Price By 2025: A Comprehensive Analysis

Apple Stock Price by 2025: A Comprehensive Analysis

Related Articles: Apple Stock Price by 2025: A Comprehensive Analysis

- John Wick: Chapter 5 – The Final Chapter

- Upcoming Interior Design Trends To Watch For In 2025

- Pokémon Gen 10: Countdown To 2025

- K2025 Filter: A Comprehensive Analysis For Enhanced Respiratory Protection

- Ash Wednesday 2025: A Day Of Reflection, Repentance, And Renewal

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Apple Stock Price by 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Apple Stock Price by 2025: A Comprehensive Analysis

Apple Stock Price by 2025: A Comprehensive Analysis

Introduction

Apple Inc., the global technology behemoth, has consistently captivated the attention of investors, analysts, and tech enthusiasts alike. Its revolutionary products, such as the iPhone, iPad, and Mac, have transformed industries and shaped the way we interact with technology. As the company continues to innovate and expand its ecosystem, the question of "What will Apple’s stock price be by 2025?" remains a topic of intense speculation. This comprehensive analysis will delve into the factors that could influence Apple’s stock performance and provide a well-rounded projection for its share price in the years to come.

Historical Performance and Key Drivers

Over the past decade, Apple’s stock price has experienced remarkable growth, consistently outperforming the broader market. The company’s relentless innovation, strong brand recognition, and loyal customer base have been key drivers of this success. In 2022, Apple’s stock reached an all-time high of $182.94, solidifying its position as one of the most valuable companies in the world.

Future Growth Prospects

Apple’s future growth prospects are closely tied to its ability to maintain its leadership in key markets, such as smartphones, tablets, and personal computers. The company’s continued investment in research and development, coupled with its strong brand equity, positions it well to capitalize on emerging technologies and evolving consumer trends.

5G and the Internet of Things (IoT)

The advent of 5G technology and the proliferation of IoT devices are expected to create significant opportunities for Apple. 5G’s faster speeds and lower latency will enable new applications and services that could enhance the functionality of Apple’s devices. By integrating IoT capabilities into its products, Apple can create a more connected and seamless user experience.

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are rapidly transforming industries, and Apple is well-positioned to leverage these technologies to enhance its products and services. AI-powered features, such as facial recognition and natural language processing, can improve the user experience and create new revenue streams.

Apple Services

Apple’s services segment, which includes the App Store, iCloud, and Apple Music, has become a significant contributor to the company’s revenue. As the digital economy continues to expand, Apple is expected to continue to invest in its services offerings, providing recurring revenue streams and diversifying its business model.

Apple Car

Rumors and speculation surrounding Apple’s potential entry into the automotive market have been circulating for years. If Apple were to launch an electric vehicle, it could disrupt the industry and create a new growth engine for the company. However, the development and production of a car is a complex and capital-intensive endeavor, and it remains to be seen if Apple will commit to this project.

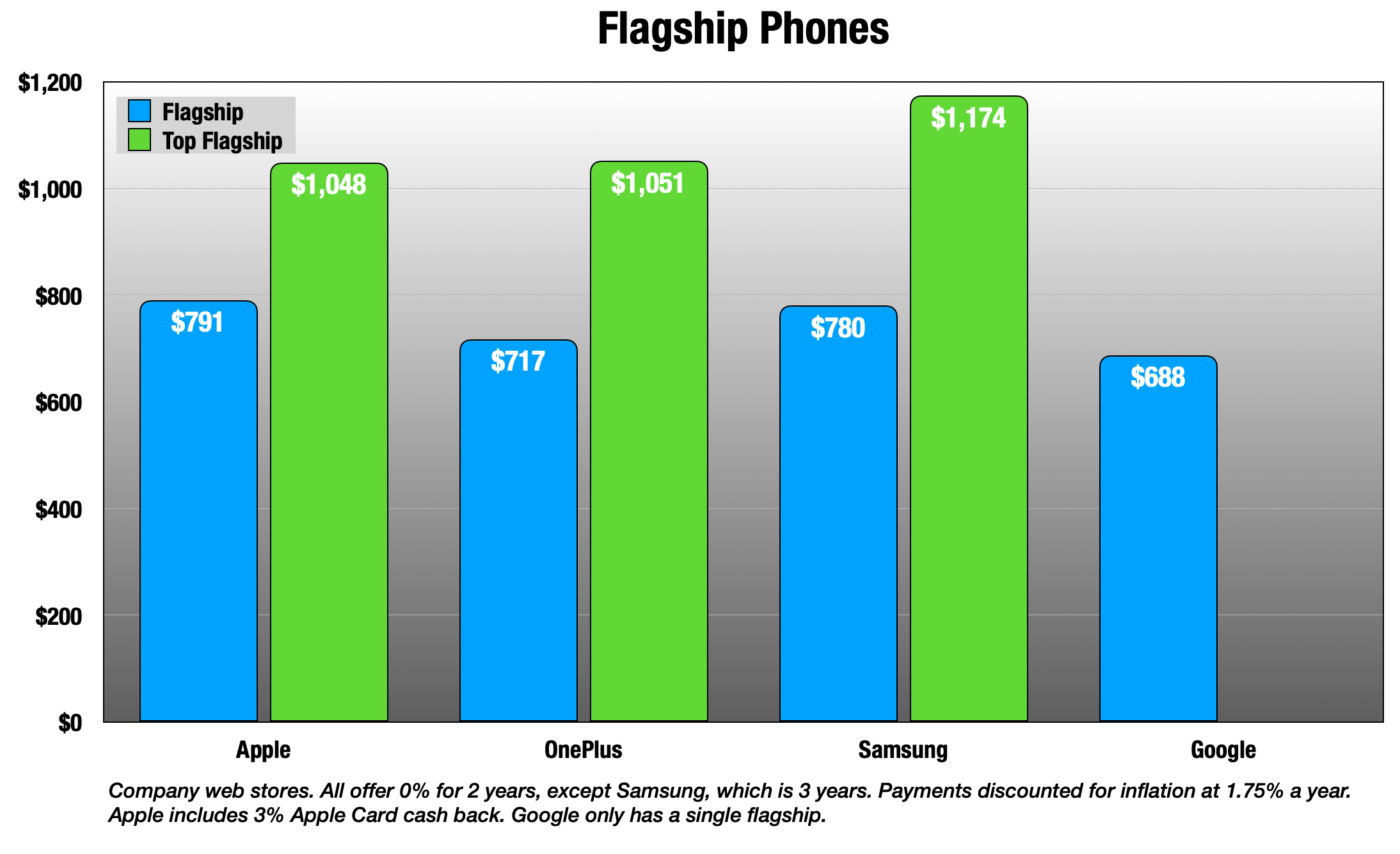

Competition and Market Share

Apple faces intense competition from other technology giants, such as Samsung, Google, and Amazon. In the smartphone market, Apple’s share has declined slightly in recent years, but the company remains the dominant player in the premium segment. In the tablet and personal computer markets, Apple continues to hold significant market share, but it faces growing competition from low-cost and feature-rich devices.

Financial Analysis

Apple’s financial performance has been consistently strong, with the company reporting record revenue and earnings in recent quarters. The company’s gross margins have remained high, indicating its pricing power and brand strength. Apple has also generated significant cash flow, which it has used to invest in research and development, acquisitions, and share buybacks.

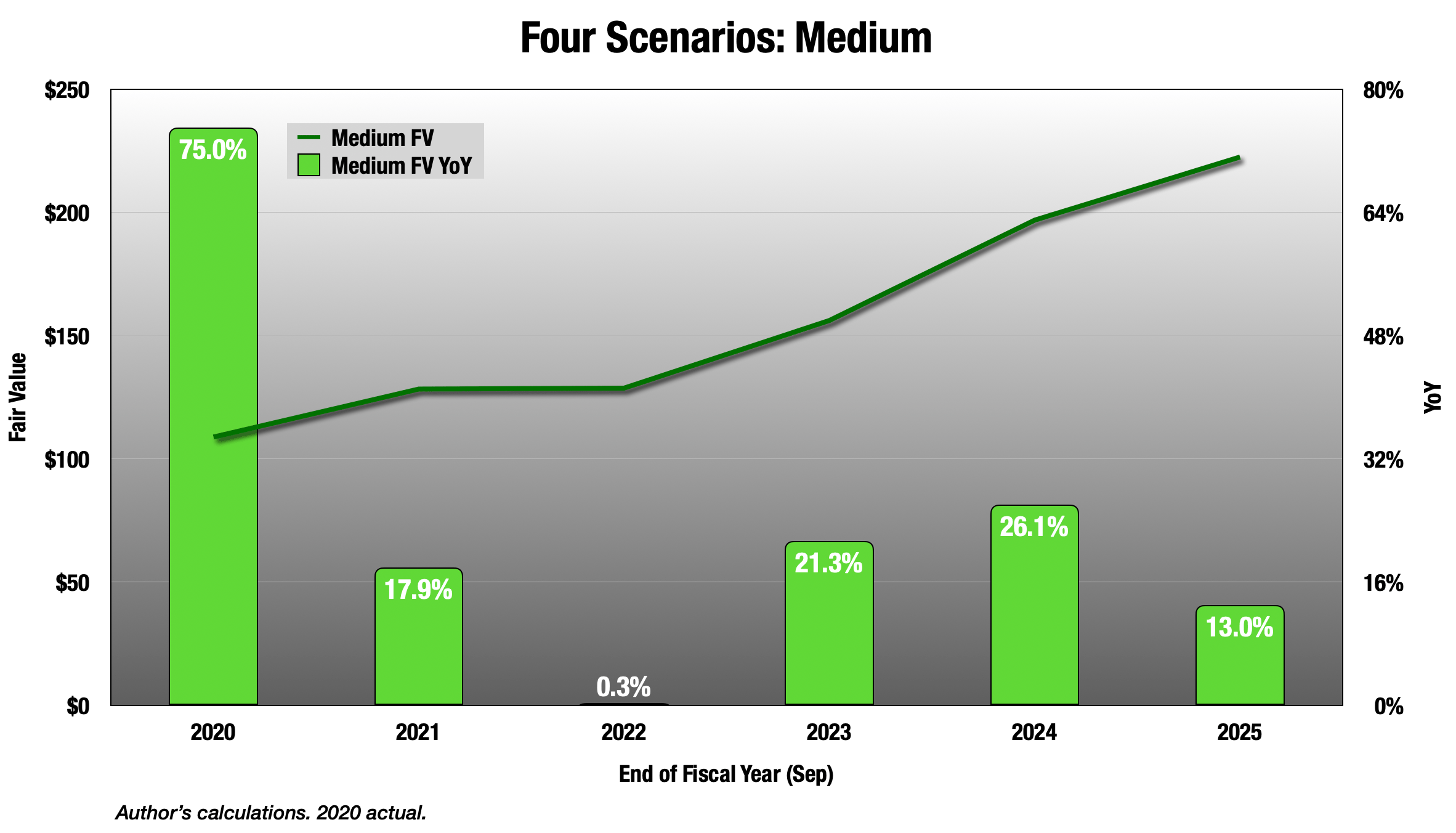

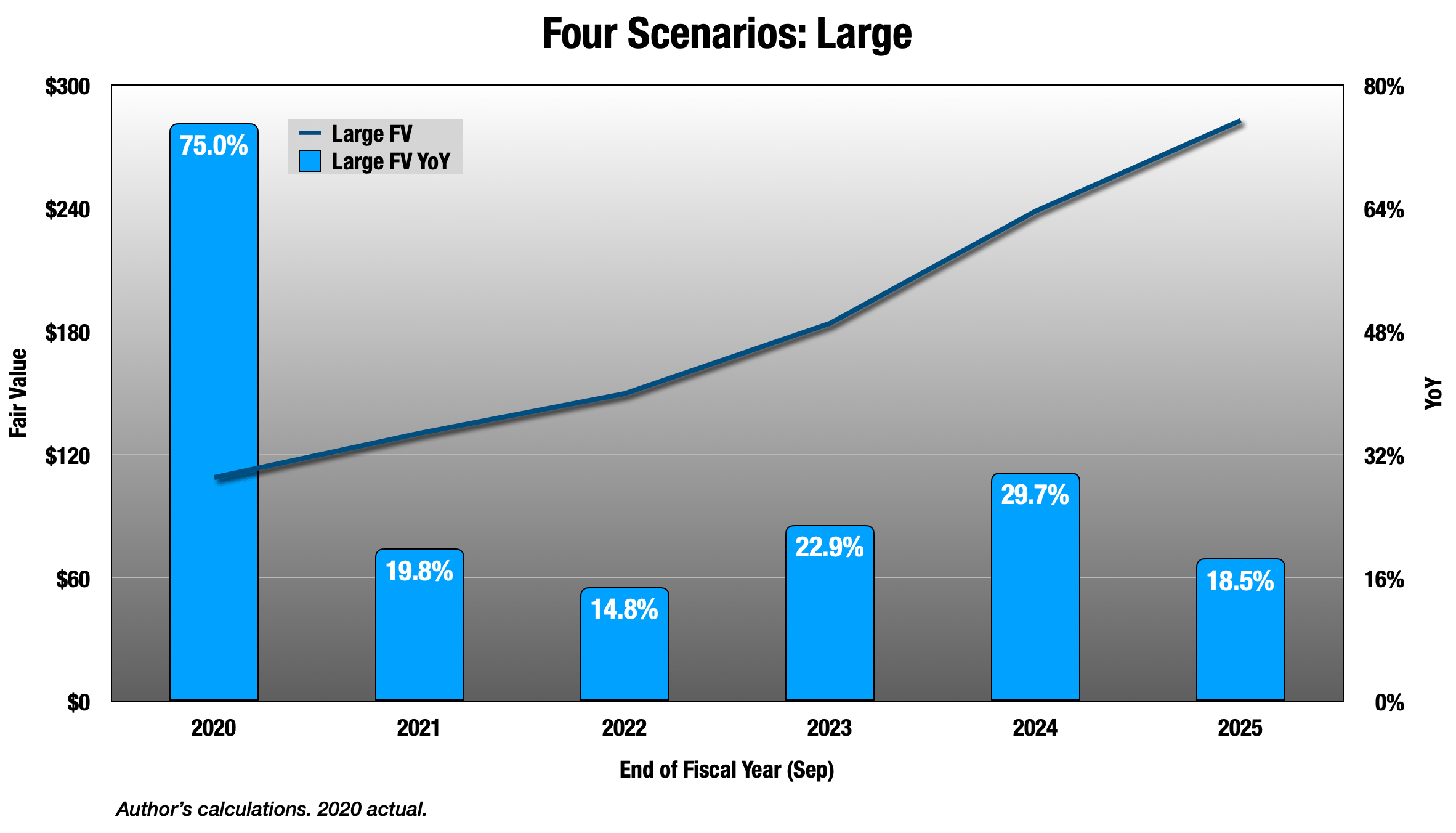

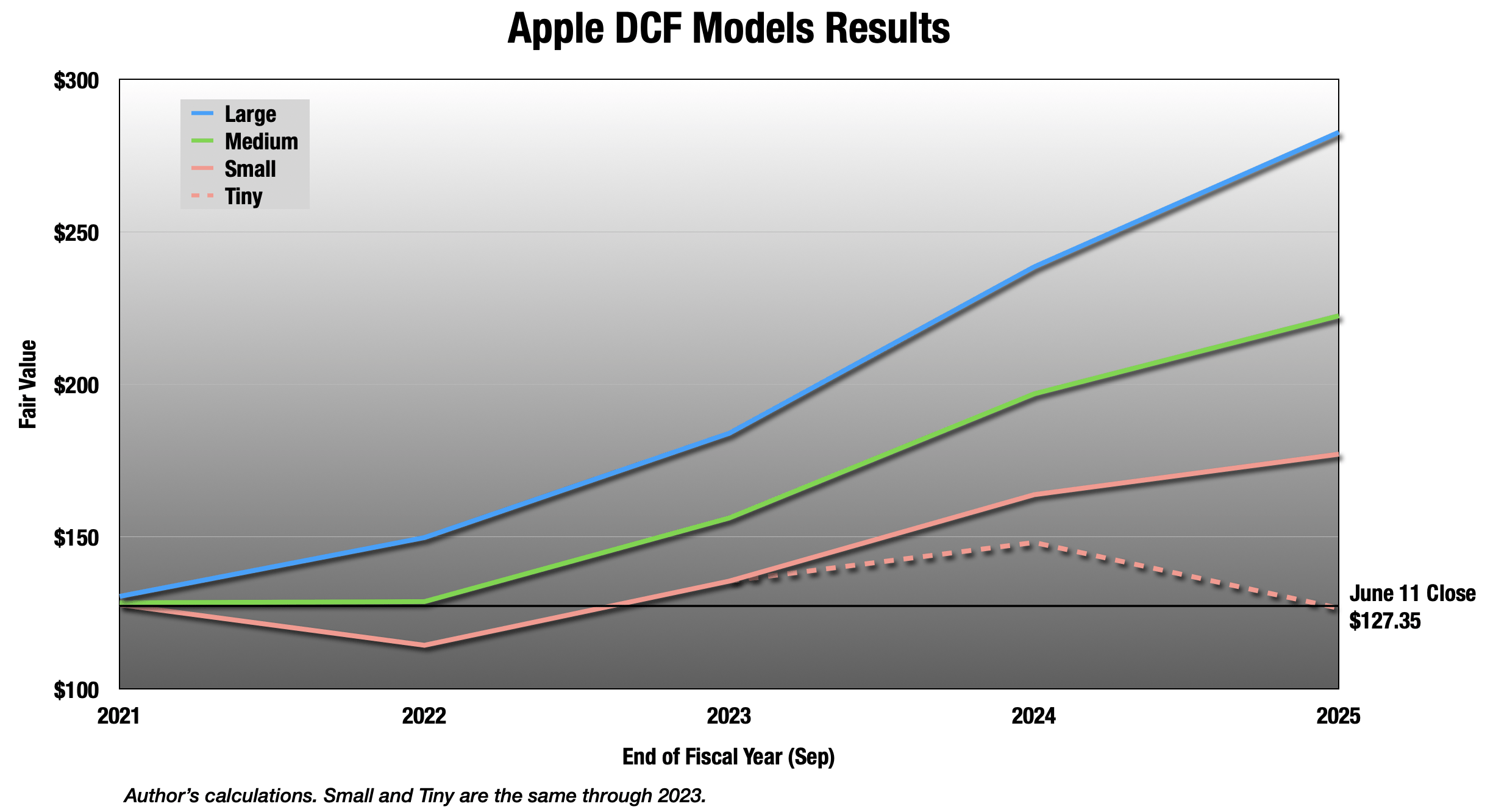

Valuation and Projection

Based on the factors discussed above, analysts have provided varying projections for Apple’s stock price by 2025. Some analysts are bullish on the company’s prospects, citing its strong brand, loyal customer base, and potential for growth in emerging technologies. Others are more cautious, expressing concerns about competition and the potential for disruption in the automotive industry.

According to a recent survey of analysts, the average target price for Apple’s stock by 2025 is $225. This represents a potential upside of approximately 23% from its current price. However, it is important to note that these projections are subject to change and should not be considered as guaranteed returns.

Risks and Challenges

While Apple has a strong track record of success, it is not immune to risks and challenges. The company faces intense competition from other technology companies, and it is constantly under pressure to innovate and deliver new products and services. Apple also faces geopolitical risks, such as trade tensions and supply chain disruptions. Additionally, the company’s reliance on a few key products, such as the iPhone, could make it vulnerable to changes in consumer preferences or technological advancements.

Conclusion

Apple’s stock price by 2025 is a subject of intense speculation, and analysts have provided varying projections based on their assessment of the company’s growth prospects, competition, and financial performance. The consensus among analysts suggests that Apple’s stock has the potential to continue to perform well in the coming years, with an average target price of $225 by 2025. However, it is important to recognize that these projections are subject to change and should not be considered as guaranteed returns. Investors should carefully consider the risks and challenges associated with investing in Apple before making any investment decisions.

Closure

Thus, we hope this article has provided valuable insights into Apple Stock Price by 2025: A Comprehensive Analysis. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin