9, Mar 2024

Amazon Stock Future Price 2025: A Comprehensive Analysis

Amazon Stock Future Price 2025: A Comprehensive Analysis

Related Articles: Amazon Stock Future Price 2025: A Comprehensive Analysis

- 2025 Lexus GX: A Pinnacle Of Luxury And Off-Road Prowess

- 2025 Nissan Murano: The Ultimate Guide To Black Elegance

- Replacing The HP LaserJet 2025 Toner Cartridge: A Comprehensive Guide

- KDA Price Prediction 2025: A Comprehensive Analysis

- Flying Cars: Poised To Take Flight By 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Amazon Stock Future Price 2025: A Comprehensive Analysis. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about Amazon Stock Future Price 2025: A Comprehensive Analysis

Amazon Stock Future Price 2025: A Comprehensive Analysis

Introduction

Amazon, the e-commerce behemoth, has consistently outperformed the broader market in recent years, making it a favorite among investors. As the company continues to expand its offerings and reach new markets, analysts and investors alike are eagerly anticipating the future trajectory of its stock price. This article will delve into a comprehensive analysis of Amazon’s stock future price, exploring key factors that could influence its performance in the years leading up to 2025.

Historical Performance and Market Outlook

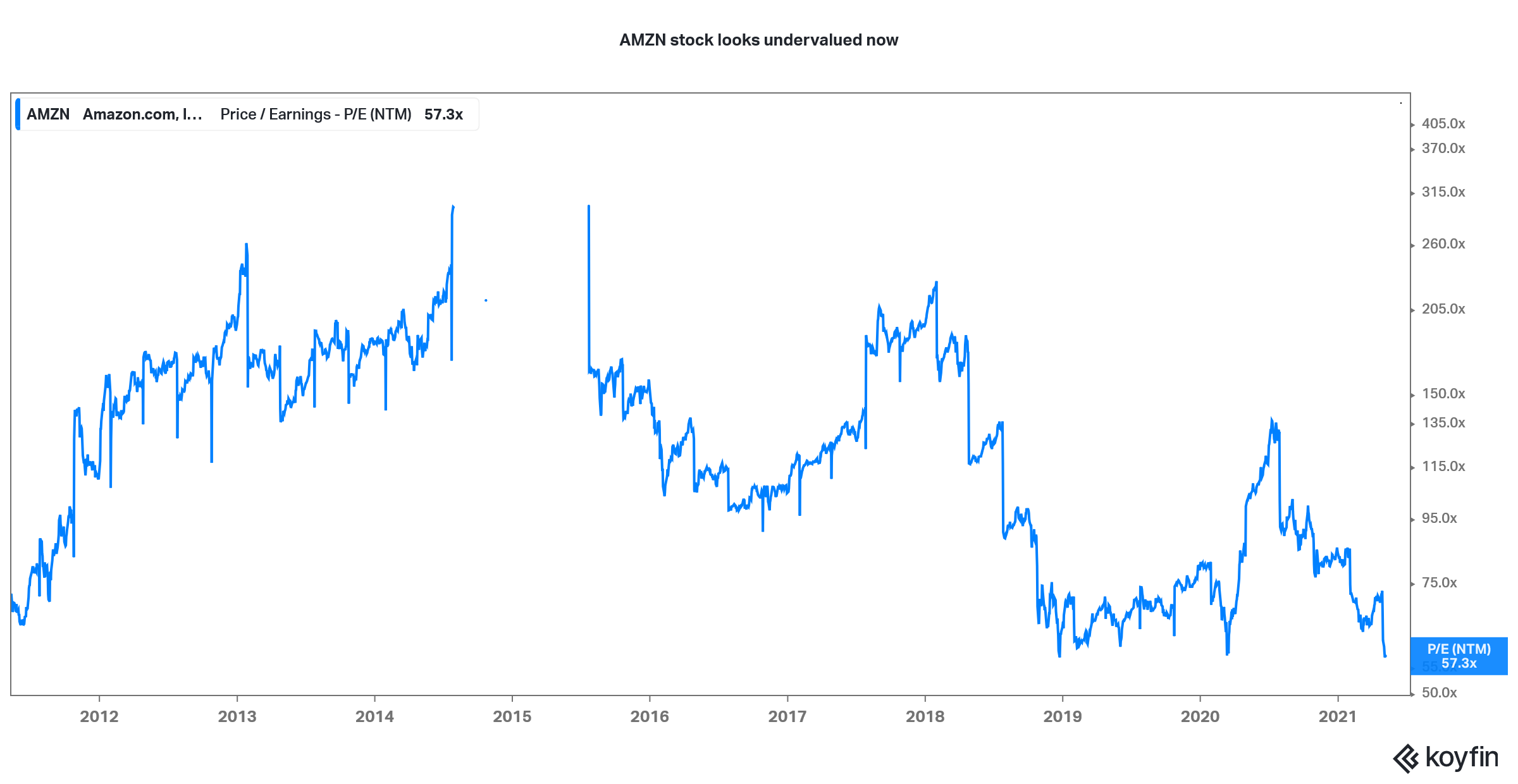

Over the past decade, Amazon’s stock has exhibited remarkable growth, delivering an average annual return of over 30%. The company’s consistent revenue growth, fueled by its dominant position in e-commerce and its expansion into cloud computing, has been a major driver of this impressive performance.

Looking ahead, the outlook for Amazon remains positive. The global e-commerce market is projected to continue growing at a healthy pace, and Amazon is well-positioned to capitalize on this trend. Additionally, the company’s investments in cloud computing, artificial intelligence, and healthcare are expected to further diversify its revenue streams and drive long-term growth.

Key Factors Influencing Future Stock Price

Several key factors are likely to shape Amazon’s stock future price in the coming years:

-

E-commerce Growth: The continued expansion of the global e-commerce market will remain a major growth driver for Amazon. As more consumers shift their shopping habits online, the company is poised to capture a significant share of this market.

-

Cloud Computing: Amazon Web Services (AWS) has emerged as a dominant player in the cloud computing industry. The growing demand for cloud services, particularly from businesses, is expected to continue fueling AWS’s growth and contribute to Amazon’s overall revenue and profitability.

-

Artificial Intelligence (AI): Amazon has invested heavily in AI, which is expected to transform various aspects of its business. From improving customer experience to enhancing supply chain efficiency, AI is seen as a key growth driver for the company in the years to come.

-

Healthcare: Amazon’s recent foray into healthcare, through its acquisition of PillPack and its partnership with Berkshire Hathaway and JPMorgan Chase, has the potential to disrupt the industry and create new revenue streams for the company.

-

Competition: Amazon faces intense competition from both traditional retailers and other e-commerce players. The company’s ability to maintain its competitive edge and innovate will be crucial for its future success.

Analyst Estimates and Market Sentiment

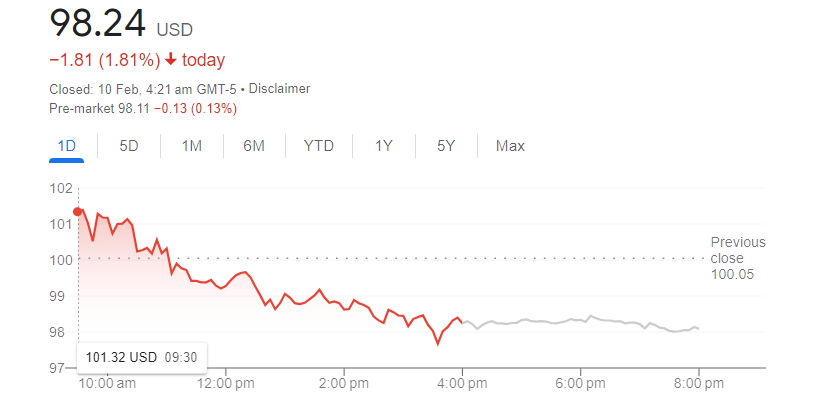

Analysts are generally bullish on Amazon’s stock future price. According to a recent survey, the average analyst target price for Amazon is $4,500, representing an upside potential of over 50% from its current price.

Market sentiment towards Amazon remains positive, with investors recognizing the company’s strong growth prospects and its ability to disrupt multiple industries. The company’s track record of innovation and its large and loyal customer base have instilled confidence in investors.

Potential Risks and Challenges

Despite the positive outlook, Amazon faces several potential risks and challenges that could impact its stock future price:

-

Regulatory Scrutiny: Amazon has come under increasing scrutiny from regulators, particularly in the areas of antitrust and privacy. Any adverse regulatory actions could have a negative impact on the company’s operations and stock price.

-

Economic Downturn: A prolonged economic downturn could lead to a decline in consumer spending, which could hurt Amazon’s e-commerce business.

-

Increased Competition: Amazon’s dominance in e-commerce could attract more competition from both traditional retailers and other online players, which could erode its market share.

-

Labor Issues: Amazon has faced criticism for its labor practices, including its treatment of warehouse workers. Negative publicity surrounding labor issues could damage the company’s reputation and lead to increased costs.

Stock Price Forecast for 2025

Based on the analysis of key factors, analyst estimates, and market sentiment, it is reasonable to forecast that Amazon’s stock future price in 2025 will be in the range of $5,000 to $6,000. This represents an annualized growth rate of approximately 15-20% from its current price.

The strong growth prospects in e-commerce, cloud computing, and AI, coupled with the company’s track record of innovation and its large customer base, support this bullish outlook. However, it is important to note that this forecast is subject to the aforementioned risks and challenges, and actual results may vary.

Investment Strategy

Given the positive outlook for Amazon’s stock future price, investors may consider the following investment strategy:

-

Long-Term Investment: Amazon is a suitable investment for long-term investors with a horizon of 5 years or more. The company’s strong growth prospects and ability to disrupt multiple industries make it an attractive stock to hold for the long haul.

-

Dollar-Cost Averaging: To mitigate the risk of market fluctuations, investors can employ a dollar-cost averaging strategy, where they invest a fixed amount of money in Amazon stock at regular intervals.

-

Diversification: While Amazon is a promising investment, it is important to diversify one’s portfolio by investing in a mix of stocks, bonds, and other asset classes.

Conclusion

Amazon’s stock future price is poised for continued growth in the years leading up to 2025. The company’s dominant position in e-commerce, its expansion into cloud computing and AI, and its potential to disrupt healthcare make it a compelling investment for long-term investors. However, it is important to be aware of the potential risks and challenges that could impact the company’s performance and to invest accordingly.

Closure

Thus, we hope this article has provided valuable insights into Amazon Stock Future Price 2025: A Comprehensive Analysis. We appreciate your attention to our article. See you in our next article!

- 0

- By admin