23, Jan 2024

ACA Subsidy Repayment Caps For 2025: A Comprehensive Overview

ACA Subsidy Repayment Caps for 2025: A Comprehensive Overview

Related Articles: ACA Subsidy Repayment Caps for 2025: A Comprehensive Overview

- 2025 Ram 1500 Ramcharger Hybrid: A New Era Of Electrified Pickup Performance

- Infiniti QX80 Interior 2025: A Luxurious Oasis Of Comfort And Technology

- 2025 Jaguars: A Vision For The Future

- 2025 Lexus GX: A Pinnacle Of Luxury And Off-Road Prowess

- Mid-Winter Classic 2025: A Spectacle Of Hockey Excellence

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to ACA Subsidy Repayment Caps for 2025: A Comprehensive Overview. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about ACA Subsidy Repayment Caps for 2025: A Comprehensive Overview

ACA Subsidy Repayment Caps for 2025: A Comprehensive Overview

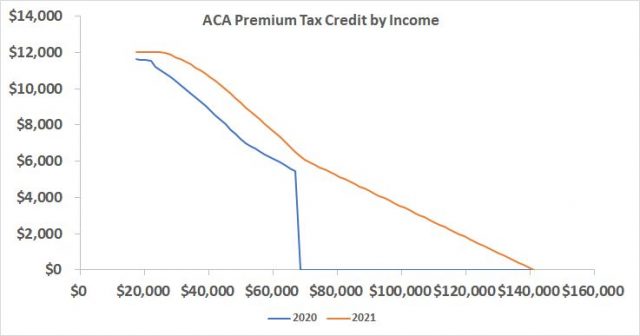

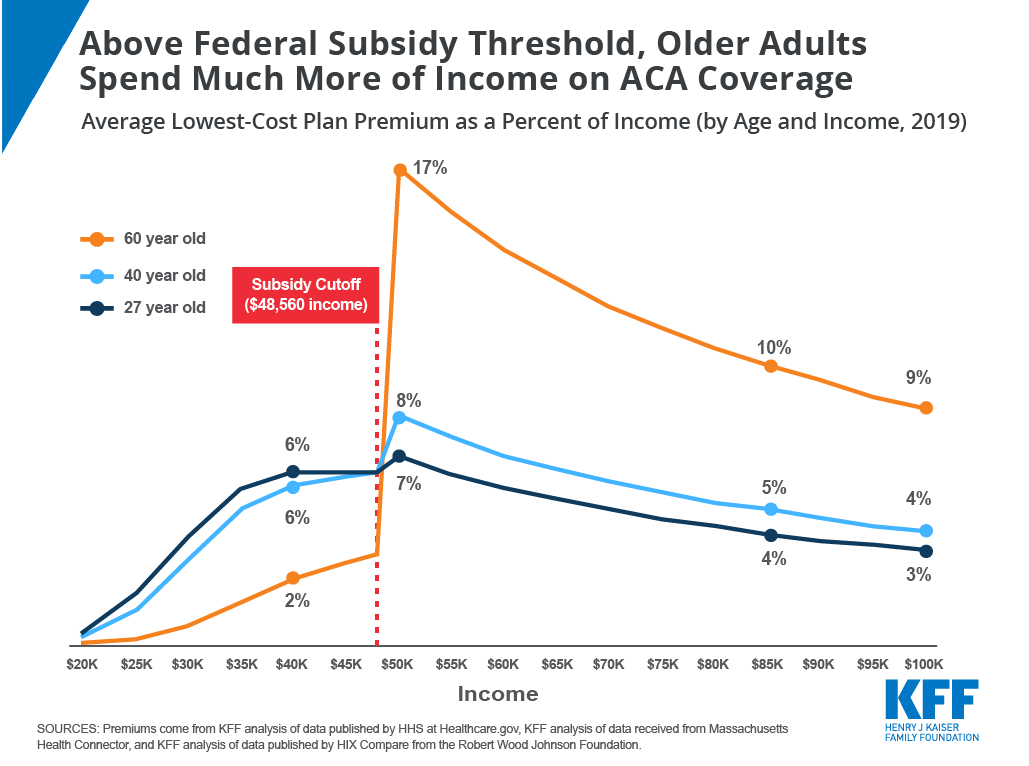

The Affordable Care Act (ACA), also known as Obamacare, has undergone significant changes since its inception in 2010. One of the most notable alterations is the introduction of subsidy repayment caps for individuals who receive premium tax credits to purchase health insurance through the Health Insurance Marketplace. These caps, which were first implemented in 2019, limit the amount of subsidies individuals can receive in a given year.

In 2025, the subsidy repayment caps will be adjusted to reflect changes in the cost of health insurance premiums. This article provides a comprehensive overview of the ACA subsidy repayment caps for 2025, including eligibility criteria, calculation methods, and implications for individuals receiving premium tax credits.

Eligibility Criteria for Subsidy Repayment Caps

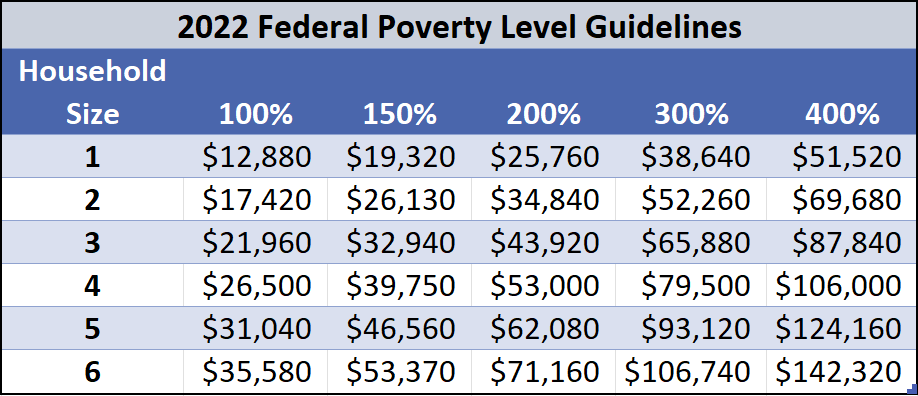

The subsidy repayment caps apply to individuals who receive premium tax credits to purchase health insurance through the Health Insurance Marketplace. To be eligible for premium tax credits, individuals must meet certain income and citizenship requirements.

- Income Eligibility: Individuals must have an annual household income that is between 100% and 400% of the federal poverty level (FPL). For 2025, the FPL is $13,590 for an individual and $27,750 for a family of four.

- Citizenship Requirements: Individuals must be U.S. citizens or legal residents to be eligible for premium tax credits.

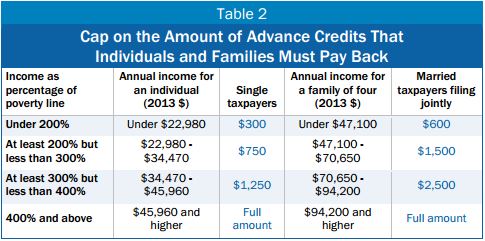

Calculation of Subsidy Repayment Caps

The subsidy repayment caps are calculated based on the individual’s income and the cost of the second-lowest-cost silver plan (SLCSP) in their area. The SLCSP is a benchmark plan used to determine the amount of premium tax credits an individual is eligible to receive.

For individuals with incomes below 250% of the FPL, the subsidy repayment cap is equal to the difference between the premium tax credit received and the cost of the SLCSP. For individuals with incomes between 250% and 400% of the FPL, the subsidy repayment cap is equal to the difference between the premium tax credit received and the cost of the SLCSP, multiplied by a phase-out factor.

Phase-Out Factor

The phase-out factor is a percentage that is used to reduce the subsidy repayment cap for individuals with incomes between 250% and 400% of the FPL. The phase-out factor increases as income increases. For 2025, the phase-out factor ranges from 15% to 30%.

Implications for Individuals Receiving Premium Tax Credits

The subsidy repayment caps can have a significant impact on individuals who receive premium tax credits. Individuals who exceed the subsidy repayment cap may be required to repay a portion of the premium tax credits they received. This repayment can be made through taxes owed or by direct payment to the Internal Revenue Service (IRS).

The subsidy repayment caps can also affect the amount of premium tax credits individuals receive in subsequent years. Individuals who exceed the subsidy repayment cap in one year may have their premium tax credits reduced in the following year.

Exceptions to the Subsidy Repayment Caps

There are a few exceptions to the subsidy repayment caps. Individuals who meet the following criteria are not subject to the caps:

- Individuals who are enrolled in a qualified health plan through their employer

- Individuals who are eligible for Medicaid or CHIP

- Individuals who are Native Americans or Alaska Natives

- Individuals who are members of a health care sharing ministry

Conclusion

The ACA subsidy repayment caps for 2025 will affect individuals who receive premium tax credits to purchase health insurance through the Health Insurance Marketplace. Individuals who exceed the subsidy repayment cap may be required to repay a portion of the premium tax credits they received. It is important for individuals who receive premium tax credits to be aware of the subsidy repayment caps and to plan accordingly.

Additional Resources

- ACA Subsidy Repayment Caps

- IRS Publication 974: Premium Tax Credits

- Kaiser Family Foundation: ACA Subsidy Repayment Caps

Closure

Thus, we hope this article has provided valuable insights into ACA Subsidy Repayment Caps for 2025: A Comprehensive Overview. We appreciate your attention to our article. See you in our next article!

- 0

- By admin