10, Jan 2024

2025 Tax Brackets Due In April 2026: What You Need To Know

2025 Tax Brackets Due in April 2026: What You Need to Know

Related Articles: 2025 Tax Brackets Due in April 2026: What You Need to Know

- Star Wars Battlefront 3: A Glimpse Into The Future Of Epic Galactic Warfare

- 2025 Ram 1500 EV: Unveiling The Future Of Electric Pickup Trucks

- DV Lottery 2025 Registration: A Comprehensive Guide

- Shore Towers: A Monument To Modernism On The Astoria Waterfront

- 2025 Ram 1500 Engines: Powertrain Options And Performance Upgrades

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 2025 Tax Brackets Due in April 2026: What You Need to Know. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 Tax Brackets Due in April 2026: What You Need to Know

2025 Tax Brackets Due in April 2026: What You Need to Know

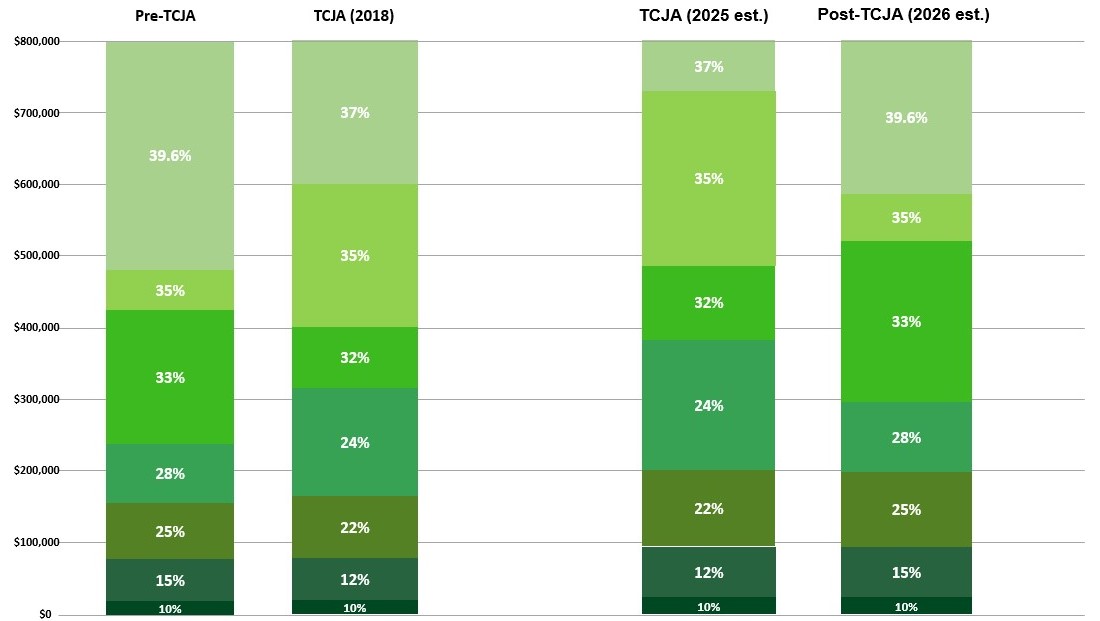

The Internal Revenue Service (IRS) has released the 2025 tax brackets, which will be used to calculate taxes for the 2024 tax year. These brackets reflect the adjustments for inflation that are made annually. The 2025 tax brackets are as follows:

| Filing Status | Taxable Income | Marginal Tax Rate |

|---|---|---|

| Single | $0 – $13,850 | 10% |

| Single | $13,851 – $53,999 | 12% |

| Single | $54,000 – $86,575 | 22% |

| Single | $86,576 – $164,925 | 24% |

| Single | $164,926 – $209,425 | 32% |

| Single | $209,426 – $541,850 | 35% |

| Single | $541,851 – $1,083,700 | 37% |

| Single | Over $1,083,700 | 39.6% |

| Married Filing Jointly | $0 – $27,700 | 10% |

| Married Filing Jointly | $27,701 – $107,999 | 12% |

| Married Filing Jointly | $108,000 – $173,150 | 22% |

| Married Filing Jointly | $173,151 – $329,850 | 24% |

| Married Filing Jointly | $329,851 – $418,850 | 32% |

| Married Filing Jointly | $418,851 – $1,083,700 | 35% |

| Married Filing Jointly | $1,083,701 – $2,167,400 | 37% |

| Married Filing Jointly | Over $2,167,400 | 39.6% |

| Head of Household | $0 – $20,800 | 10% |

| Head of Household | $20,801 – $83,200 | 12% |

| Head of Household | $83,201 – $112,550 | 22% |

| Head of Household | $112,551 – $209,425 | 24% |

| Head of Household | $209,426 – $287,050 | 32% |

| Head of Household | $287,051 – $541,850 | 35% |

| Head of Household | $541,851 – $1,083,700 | 37% |

| Head of Household | Over $1,083,700 | 39.6% |

The 2025 tax brackets are slightly wider than the 2024 tax brackets, which means that taxpayers will pay slightly less in taxes in 2025. For example, a single taxpayer with a taxable income of $50,000 will pay $5,800 in taxes in 2025, compared to $5,850 in 2024.

The 2025 tax brackets are due in April 2026. This means that taxpayers will have until April 15, 2026, to file their 2024 tax returns.

Here are some additional things to keep in mind about the 2025 tax brackets:

- The standard deduction for 2025 is $13,850 for single filers and $27,700 for married couples filing jointly.

- The personal exemption for 2025 is $4,400.

- The child tax credit for 2025 is $2,000 per child.

If you have any questions about the 2025 tax brackets, you should consult with a tax professional.

Additional Information

The following links provide additional information about the 2025 tax brackets:

Closure

Thus, we hope this article has provided valuable insights into 2025 Tax Brackets Due in April 2026: What You Need to Know. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin