10, Nov 2023

2025 Lifetime Gift Tax Exemption: What You Need To Know

2025 Lifetime Gift Tax Exemption: What You Need to Know

Related Articles: 2025 Lifetime Gift Tax Exemption: What You Need to Know

- The Next Federal Election In Canada: A Comprehensive Outlook

- MLB All-Star Game 2025: Secure Your Tickets For The Baseball Extravaganza

- 2025 Honda Accord Type R: A Symphony Of Power And Precision

- ESPN’s 2025 Basketball Rankings: A Comprehensive Analysis

- JO 2024: Dates For Volunteer Applications

Introduction

With great pleasure, we will explore the intriguing topic related to 2025 Lifetime Gift Tax Exemption: What You Need to Know. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 Lifetime Gift Tax Exemption: What You Need to Know

2025 Lifetime Gift Tax Exemption: What You Need to Know

The lifetime gift tax exemption is a crucial aspect of estate planning. It allows individuals to transfer assets to others during their lifetime without incurring gift taxes. This exemption is adjusted periodically to keep pace with inflation, and the next adjustment is set to take effect in 2025.

What is the Lifetime Gift Tax Exemption?

The lifetime gift tax exemption is the total amount of money or property that an individual can give away during their lifetime without paying gift taxes. This exemption is separate from the estate tax exemption, which applies to assets transferred upon death.

Current Lifetime Gift Tax Exemption

For 2023 and 2024, the lifetime gift tax exemption is $12.92 million per individual. This means that individuals can give away up to $12.92 million in cash, property, or other assets during their lifetime without triggering any gift taxes.

2025 Lifetime Gift Tax Exemption

The Tax Cuts and Jobs Act of 2017 temporarily doubled the lifetime gift tax exemption to $11.7 million per individual. However, this increase is set to expire on December 31, 2025. As a result, the lifetime gift tax exemption will revert to its pre-2018 level of $5 million per individual in 2026.

Implications of the 2025 Exemption Reduction

The reduction in the lifetime gift tax exemption in 2026 will have significant implications for estate planning. Individuals who have already used a portion of their increased exemption may need to consider additional strategies to reduce their taxable estate.

Strategies to Minimize Gift Taxes

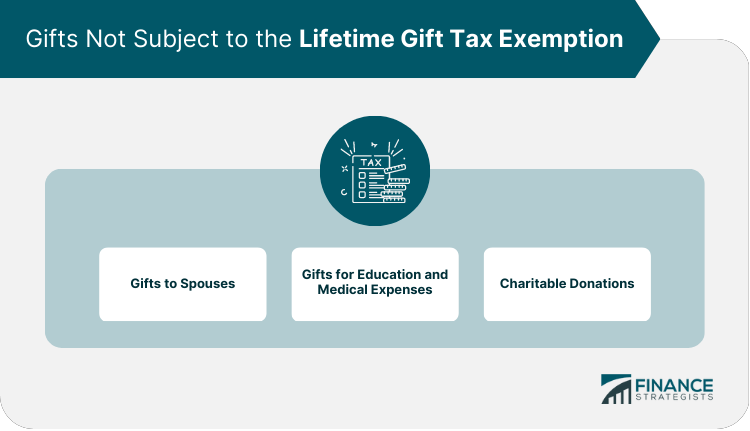

There are several strategies that individuals can use to minimize gift taxes, including:

- Making annual exclusion gifts: Each year, individuals can give up to $17,000 per person without incurring gift taxes. This exemption can be used to gradually transfer assets to family members or other beneficiaries over time.

- Using the marital deduction: Married couples can transfer unlimited assets between each other without triggering gift taxes. This allows spouses to equalize their estates and reduce the overall tax liability.

- Establishing trusts: Trusts can be used to transfer assets to beneficiaries while retaining some control over the property. Trusts can also provide tax benefits, such as the generation-skipping transfer tax exemption.

Planning for the 2025 Exemption Reduction

Individuals who are approaching the lifetime gift tax exemption should consider taking steps to minimize the impact of the 2025 reduction. Some strategies include:

- Making gifts before 2026: Individuals who anticipate exceeding the $5 million lifetime gift tax exemption in 2026 should consider making gifts before the exemption reverts to its lower level.

- Utilizing the annual exclusion: Individuals can maximize their annual exclusion gifts by making gifts to multiple individuals each year.

- Exploring trusts: Trusts can be used to transfer assets to beneficiaries while avoiding gift taxes. Individuals should consider establishing trusts before the lifetime gift tax exemption is reduced.

Conclusion

The 2025 lifetime gift tax exemption reduction will have a significant impact on estate planning. Individuals who are approaching the current lifetime gift tax exemption should consider taking steps to minimize the impact of the reduction. By utilizing available strategies, such as making annual exclusion gifts, using the marital deduction, and establishing trusts, individuals can reduce their overall tax liability and ensure that their assets are transferred to their desired beneficiaries in a tax-efficient manner.

Closure

Thus, we hope this article has provided valuable insights into 2025 Lifetime Gift Tax Exemption: What You Need to Know. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin