21, Feb 2024

2025 IRMAA Brackets For Medicare Premiums: A Comprehensive Guide

2025 IRMAA Brackets for Medicare Premiums: A Comprehensive Guide

Related Articles: 2025 IRMAA Brackets for Medicare Premiums: A Comprehensive Guide

- Royal Troon To Host 2025 Open Championship

- Popular Now On Bing 2025: A Glimpse Into The Future Of Search

- The New Volkswagen Bus 2024: A Modern Classic Reborn

- Embark On An Unforgettable Christmas Cruise Adventure In 2025

- The Future Of Work In 2035: A Transformative Landscape

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 2025 IRMAA Brackets for Medicare Premiums: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 IRMAA Brackets for Medicare Premiums: A Comprehensive Guide

2025 IRMAA Brackets for Medicare Premiums: A Comprehensive Guide

Introduction

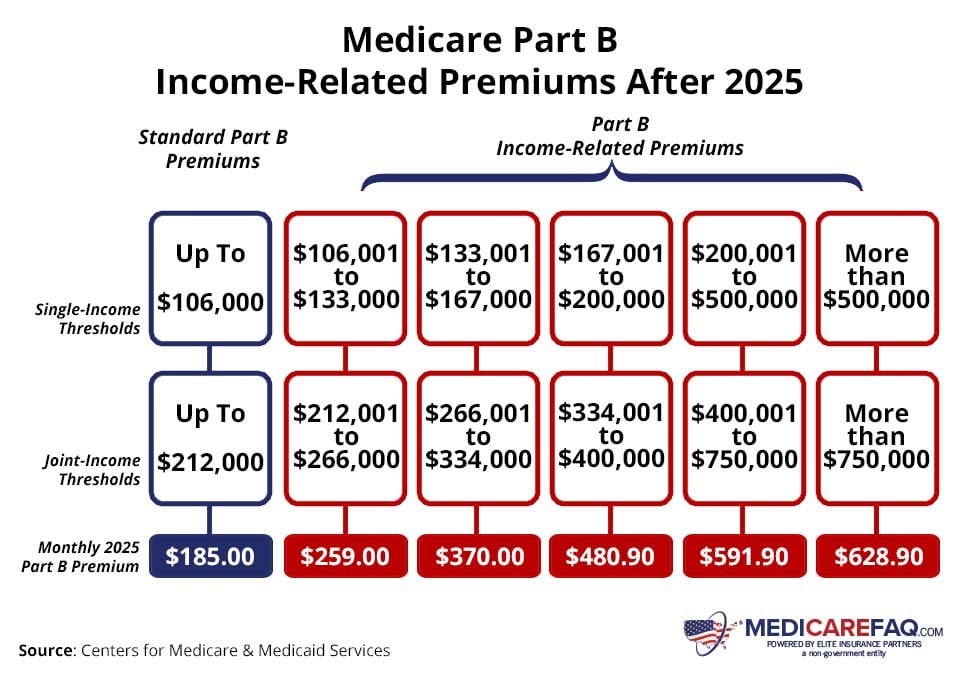

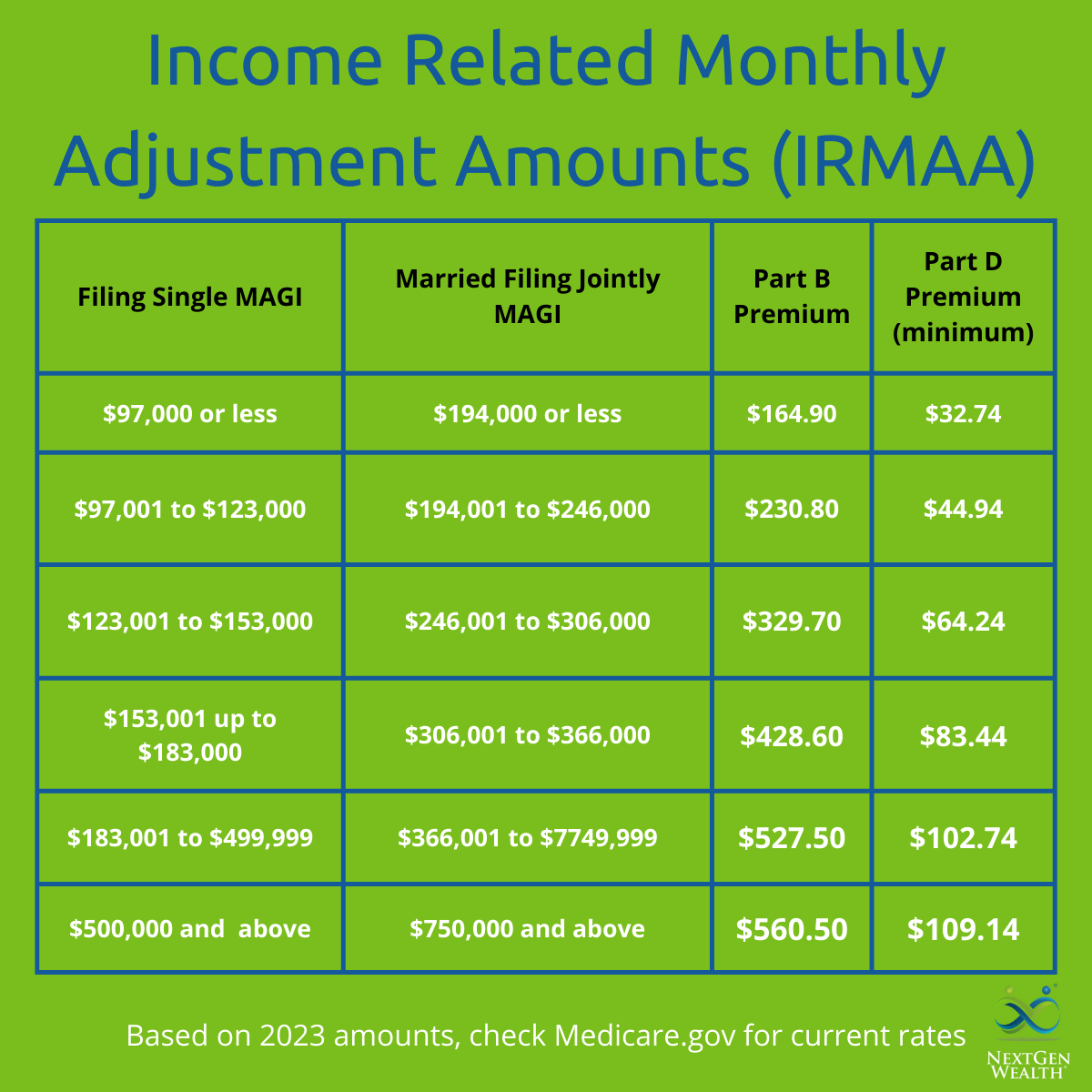

The Income-Related Monthly Adjustment Amount (IRMAA) is a surcharge added to Medicare Part B and Part D premiums for individuals with higher incomes. IRMAA brackets are adjusted annually to account for inflation and changes in income levels. For 2025, the IRMAA brackets have been updated, affecting the amount of surcharge that high-income earners will pay for their Medicare premiums.

Understanding IRMAA

IRMAA is a mechanism to ensure that individuals with higher incomes contribute a larger share towards the cost of their Medicare coverage. The surcharge is calculated based on the individual’s modified adjusted gross income (MAGI) from two years prior. For example, the IRMAA for 2025 is based on MAGI from 2023.

2025 IRMAA Brackets

The IRMAA brackets for 2025 are as follows:

Part B Premiums

| MAGI Range | Surcharge |

|---|---|

| Up to $97,000 (Single) | $0 |

| $97,001 – $129,000 (Single) | $59.10 |

| $129,001 – $170,000 (Single) | $134.30 |

| $170,001 – $214,000 (Single) | $209.50 |

| Over $214,000 (Single) | $284.70 |

| Up to $194,000 (Married Filing Jointly) | $0 |

| $194,001 – $258,000 (Married Filing Jointly) | $59.10 |

| $258,001 – $340,000 (Married Filing Jointly) | $134.30 |

| $340,001 – $428,000 (Married Filing Jointly) | $209.50 |

| Over $428,000 (Married Filing Jointly) | $284.70 |

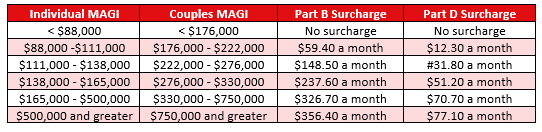

Part D Premiums

| MAGI Range | Surcharge |

|---|---|

| Up to $91,000 (Single) | $0 |

| $91,001 – $121,000 (Single) | $12.40 |

| $121,001 – $151,000 (Single) | $24.80 |

| $151,001 – $181,000 (Single) | $37.20 |

| Over $181,000 (Single) | $49.60 |

| Up to $182,000 (Married Filing Jointly) | $0 |

| $182,001 – $242,000 (Married Filing Jointly) | $12.40 |

| $242,001 – $302,000 (Married Filing Jointly) | $24.80 |

| $302,001 – $362,000 (Married Filing Jointly) | $37.20 |

| Over $362,000 (Married Filing Jointly) | $49.60 |

Impact of IRMAA

The IRMAA surcharge can significantly impact the cost of Medicare premiums for individuals with higher incomes. For example, a single individual with a MAGI of $220,000 would pay a surcharge of $284.70 for Part B and $49.60 for Part D in 2025. This would result in a total monthly premium of $207.90 for Part B and $77.10 for Part D.

Reducing IRMAA

There are limited options for reducing or eliminating IRMAA. One strategy is to reduce MAGI by contributing to tax-advantaged retirement accounts, such as 401(k)s or IRAs. However, it is important to consider the potential tax implications of this strategy.

Conclusion

The 2025 IRMAA brackets provide important information for individuals with higher incomes to estimate their Medicare premium costs. Understanding the brackets and the potential impact of IRMAA is crucial for financial planning and making informed decisions about retirement savings and investments. It is advisable to consult with a financial advisor or tax professional for personalized guidance on reducing or mitigating the impact of IRMAA.

Closure

Thus, we hope this article has provided valuable insights into 2025 IRMAA Brackets for Medicare Premiums: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin