25, Jul 2023

2025 IRMAA Brackets For Medicare Part B

2025 IRMAA Brackets for Medicare Part B

Related Articles: 2025 IRMAA Brackets for Medicare Part B

- University Of Wyoming Football Schedule 2025

- American DV Lottery 2025: A Comprehensive Guide

- Avatar 3: The Seed Bearer (2025): A Journey Into The Depths Of Pandora

- African Cup Of Nations Qualification: A Comprehensive Overview

- Tax Brackets After 2025: A Comprehensive Overview

Introduction

With great pleasure, we will explore the intriguing topic related to 2025 IRMAA Brackets for Medicare Part B. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 IRMAA Brackets for Medicare Part B

2025 IRMAA Brackets for Medicare Part B

Introduction

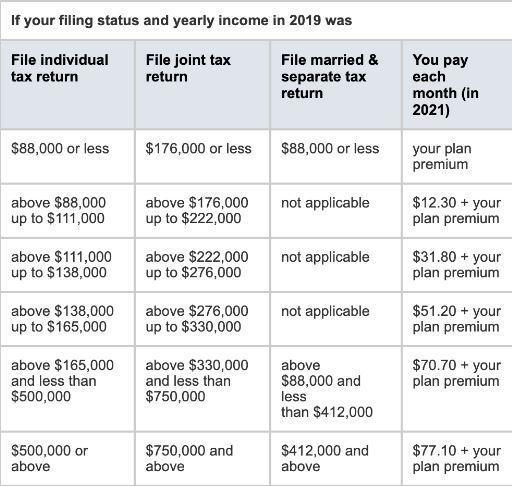

The Income-Related Monthly Adjustment Amount (IRMAA) is a surcharge applied to Medicare Part B premiums for individuals and couples with higher incomes. The IRMAA brackets are adjusted annually to reflect changes in the cost of living. For 2025, the IRMAA brackets have increased slightly compared to 2024.

IRMAA Brackets for 2025

The IRMAA brackets for 2025 are as follows:

| Filing Status | Modified Adjusted Gross Income (MAGI) | IRMAA Surcharge |

|---|---|---|

| Single | $97,000 or more | $230.80 |

| Married filing jointly | $194,000 or more | $230.80 |

| Married filing separately | $97,000 or more | $115.40 |

| Head of household | $133,000 or more | $230.80 |

Modified Adjusted Gross Income (MAGI)

The MAGI used to determine IRMAA eligibility is the same as the MAGI used to determine eligibility for premium subsidies under the Affordable Care Act. It is calculated by taking the adjusted gross income (AGI) reported on your tax return and adding back certain deductions and exclusions.

IRMAA Surcharge

The IRMAA surcharge is added to the standard Medicare Part B premium. For 2025, the standard premium is $164.90 per month. Individuals and couples subject to the IRMAA surcharge will pay the following monthly premiums:

| Filing Status | Standard Premium | IRMAA Surcharge | Total Premium |

|---|---|---|---|

| Single | $164.90 | $230.80 | $395.70 |

| Married filing jointly | $164.90 | $230.80 | $395.70 |

| Married filing separately | $164.90 | $115.40 | $280.30 |

| Head of household | $164.90 | $230.80 | $395.70 |

Who is Subject to the IRMAA Surcharge?

Individuals and couples who are enrolled in Medicare Part B and have MAGIs above the IRMAA brackets are subject to the IRMAA surcharge. The IRMAA surcharge is applied to both Part B premiums and Part B deductibles.

How to Avoid the IRMAA Surcharge

There are a few ways to avoid the IRMAA surcharge:

- Lower your MAGI: This can be done by reducing your income or increasing your deductions and exclusions.

- Enroll in a Medicare Advantage plan: Medicare Advantage plans are private health insurance plans that offer Part B coverage. Most Medicare Advantage plans do not charge an IRMAA surcharge.

- Delay enrolling in Medicare Part B: If you are not yet 65 years old, you can delay enrolling in Medicare Part B until your income is below the IRMAA brackets.

Conclusion

The IRMAA surcharge is a significant expense for individuals and couples with higher incomes. By understanding the IRMAA brackets and how to avoid the surcharge, you can save money on your Medicare Part B premiums.

Closure

Thus, we hope this article has provided valuable insights into 2025 IRMAA Brackets for Medicare Part B. We hope you find this article informative and beneficial. See you in our next article!

- 0

- By admin