12, Jan 2024

2025 Income Brackets: A Comprehensive Guide

2025 Income Brackets: A Comprehensive Guide

Related Articles: 2025 Income Brackets: A Comprehensive Guide

- Rugby World Cup: The Road To The Semi-Finals Heats Up

- Moon Knight Season 2: A Cosmic Odyssey Of Vengeance And Redemption

- The Next Year Of Jubilee: A Comprehensive Exploration

- How Long Until March 2025: A Comprehensive Countdown

- 2025 GLE Coupe: A Luxurious And Sporty SUV With Cutting-Edge Technology

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to 2025 Income Brackets: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 Income Brackets: A Comprehensive Guide

2025 Income Brackets: A Comprehensive Guide

Introduction

Income brackets are essential tools for understanding the distribution of income within a population. They provide a snapshot of the economic landscape and can be used to inform policy decisions and track progress towards economic goals. In this article, we will explore the 2025 income brackets, examining their implications for individuals and society as a whole.

Methodology

The income brackets presented in this article are based on the latest available data from the U.S. Census Bureau. The data is collected through the American Community Survey (ACS), which is a large-scale household survey conducted annually. The ACS collects information on a wide range of topics, including income, poverty, and health insurance.

The income brackets are defined using the median income for all households in the United States. The median income is the point at which half of all households earn more than that amount and half earn less. The income brackets are then calculated by dividing the median income by 20.

2025 Income Brackets

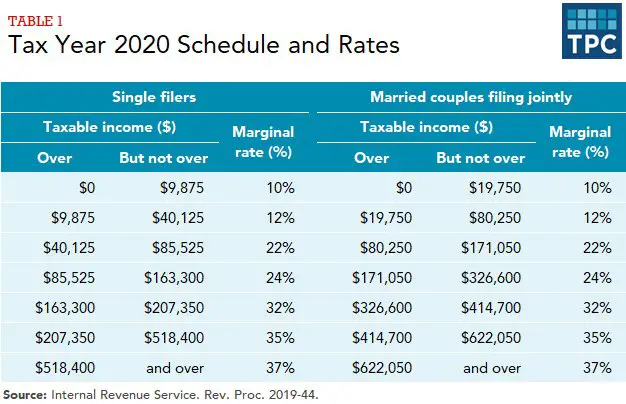

The following table shows the 2025 income brackets for all households in the United States:

| Income Bracket | Annual Income Range |

|---|---|

| Lowest 20% | $0 – $26,500 |

| Second 20% | $26,501 – $39,750 |

| Middle 20% | $39,751 – $59,625 |

| Fourth 20% | $59,626 – $89,400 |

| Highest 20% | $89,401 and above |

Implications of the Income Brackets

The income brackets have a number of implications for individuals and society as a whole.

- Economic inequality: The income brackets highlight the significant disparities in income that exist in the United States. The highest 20% of households earn more than five times as much as the lowest 20% of households. This inequality can have a number of negative consequences, such as reduced social mobility, increased poverty, and political polarization.

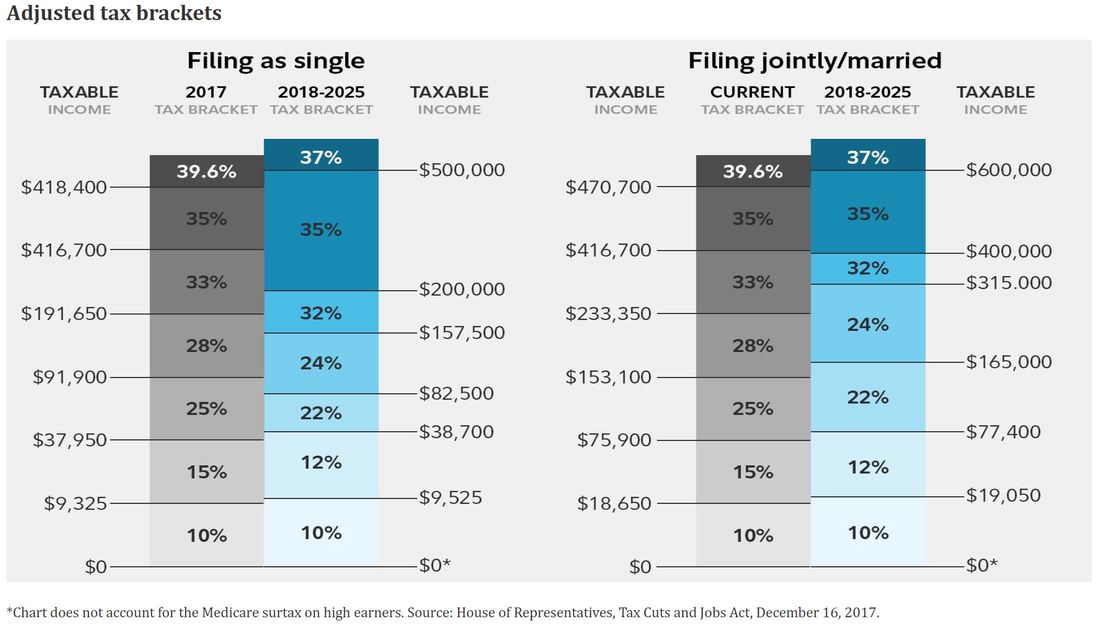

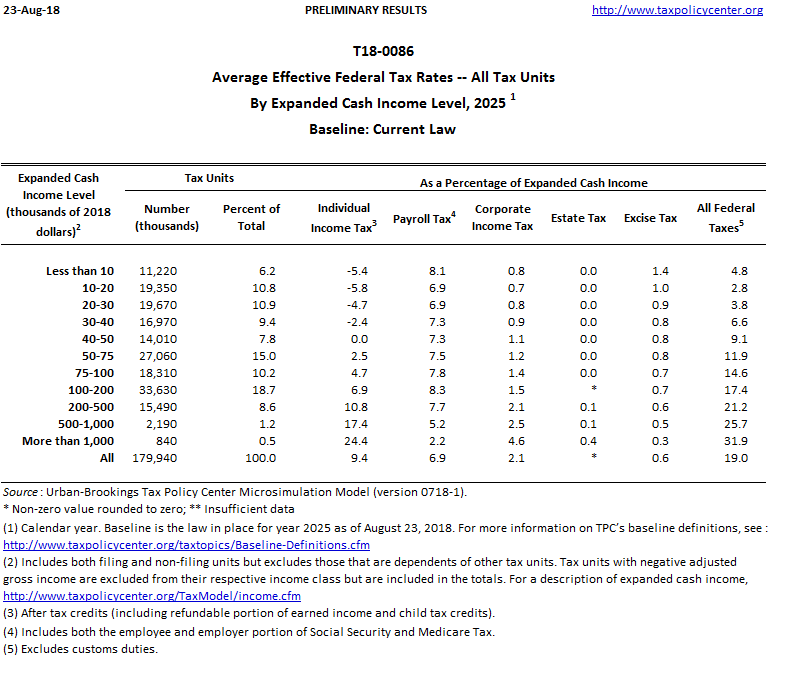

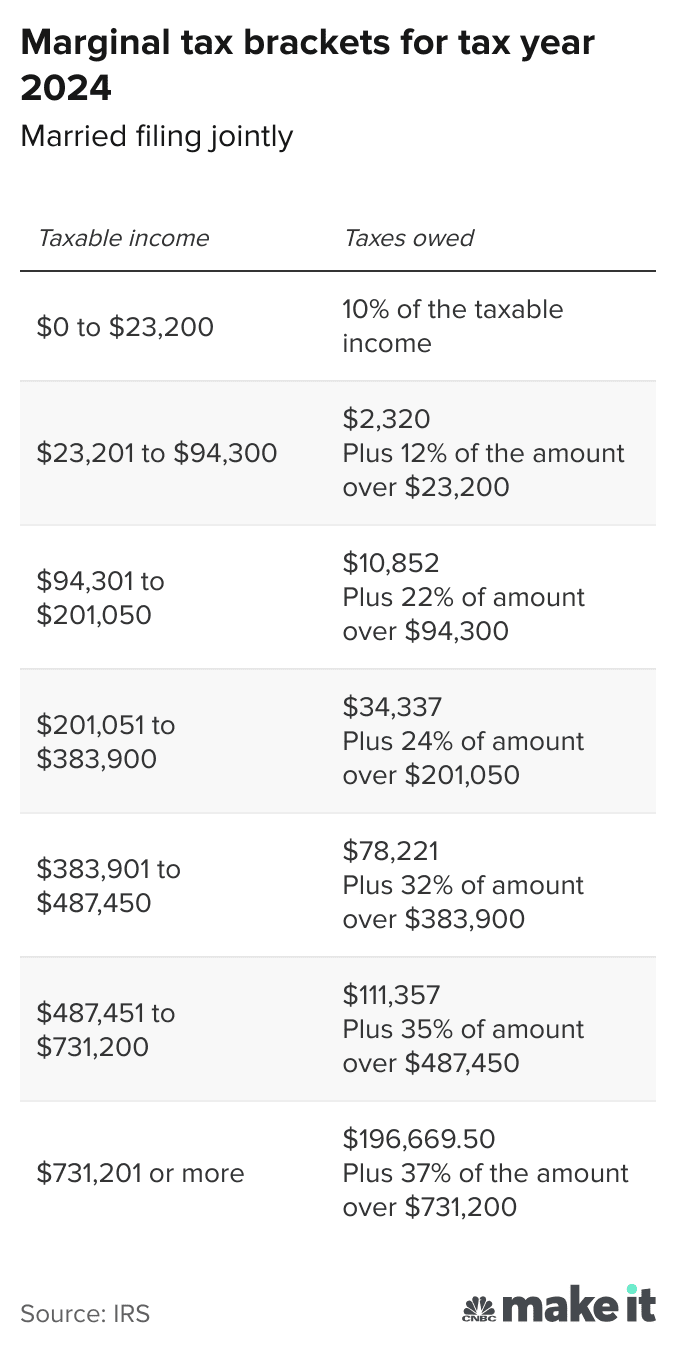

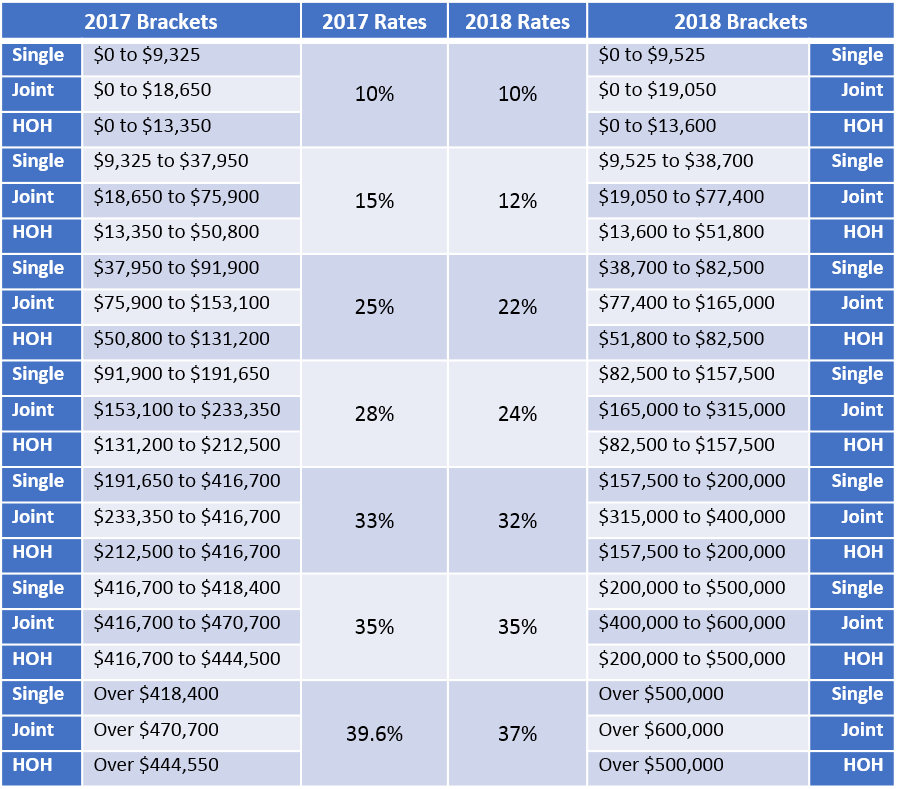

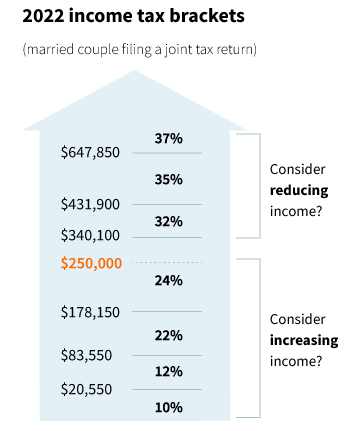

- Tax policy: The income brackets are used to determine tax rates. Households in higher income brackets pay a higher percentage of their income in taxes. This can have a significant impact on their disposable income and their ability to save and invest.

- Social programs: The income brackets are also used to determine eligibility for social programs. Households in lower income brackets are more likely to qualify for programs such as Medicaid, food stamps, and housing assistance. These programs can provide a vital safety net for low-income families.

Conclusion

The 2025 income brackets provide a valuable snapshot of the distribution of income in the United States. They highlight the significant disparities in income that exist and have a number of implications for individuals and society as a whole. Understanding the income brackets is essential for policymakers and researchers who are working to address economic inequality and promote economic mobility.

Closure

Thus, we hope this article has provided valuable insights into 2025 Income Brackets: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!

- 0

- By admin