2, May 2024

2025 401(k) Catch-Up Contributions: Plan Now To Maximize Retirement Savings

2025 401(k) Catch-Up Contributions: Plan Now to Maximize Retirement Savings

Related Articles: 2025 401(k) Catch-Up Contributions: Plan Now to Maximize Retirement Savings

- 2025 Honda S2000: A Revival Of An Iconic Sports Car

- The 2025 BMW M5: A Glimpse Into The Future Of Performance

- 2025 Can-Am Defender Limited: The Ultimate Side-by-Side For Adventure And Utility

- Jerry Easter 2025: A Celebration Of Innovation And Inclusivity

- 2025 Aston Martin: A Vision Of The Future

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to 2025 401(k) Catch-Up Contributions: Plan Now to Maximize Retirement Savings. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Video about 2025 401(k) Catch-Up Contributions: Plan Now to Maximize Retirement Savings

2025 401(k) Catch-Up Contributions: Plan Now to Maximize Retirement Savings

As you approach retirement, it’s crucial to have a comprehensive financial plan in place to ensure a secure and comfortable future. One essential component of retirement planning is maximizing your 401(k) contributions, especially if you’re over the age of 50. In 2025, the catch-up contribution limits for 401(k) plans will increase, providing an excellent opportunity to boost your retirement savings.

What are 401(k) Catch-Up Contributions?

Catch-up contributions are additional contributions that individuals aged 50 or older can make to their 401(k) plans. These contributions are in addition to the regular contribution limits and are designed to help older workers save more for retirement.

2025 Catch-Up Contribution Limits

For 2025, the catch-up contribution limit for 401(k) plans will increase to $7,500. This means that individuals aged 50 or older can contribute up to $7,500 in catch-up contributions in addition to the regular contribution limit of $22,500.

Benefits of Catch-Up Contributions

Maximizing your 401(k) contributions, including catch-up contributions, offers several benefits:

- Increased Retirement Savings: Catch-up contributions allow you to save more for retirement, which can help you reach your financial goals faster.

- Tax Savings: 401(k) contributions are made on a pre-tax basis, reducing your current taxable income and potentially saving you money on taxes.

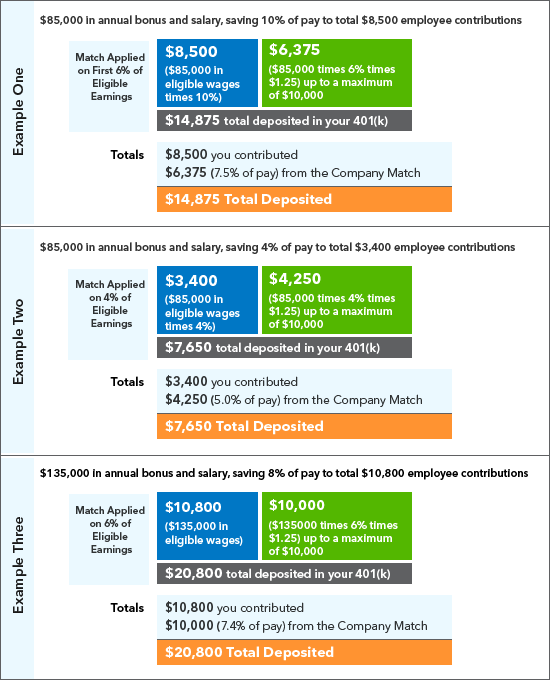

- Employer Matching: Many employers offer matching contributions to their employees’ 401(k) plans. Catch-up contributions may also be eligible for matching, further increasing your retirement savings.

How to Take Advantage of Catch-Up Contributions

To take advantage of catch-up contributions, you must meet the following criteria:

- Be at least 50 years old by the end of the calendar year.

- Participate in a 401(k) plan offered by your employer.

- Have sufficient income to cover both regular and catch-up contributions.

If you meet these criteria, you can request that your employer increase your 401(k) contributions by the catch-up contribution limit. It’s important to note that not all employers offer catch-up contributions, so be sure to check with your employer’s plan administrator.

Additional Considerations

While catch-up contributions offer significant benefits, there are a few additional considerations to keep in mind:

- RMDs: Required Minimum Distributions (RMDs) begin at age 72 for traditional 401(k) plans. Catch-up contributions are subject to RMDs like regular contributions.

- Contribution Limits: Catch-up contributions are subject to the overall 401(k) contribution limit of $66,000 for 2025.

- Income Limits: There are income limits for catch-up contributions. For 2025, the income limit for full catch-up contributions is $153,000 for single filers and $233,000 for married couples filing jointly.

Conclusion

The 2025 401(k) catch-up contribution limit increase provides a valuable opportunity to boost your retirement savings. By taking advantage of these additional contributions, you can secure a more financially secure future. If you’re over the age of 50 and eligible for catch-up contributions, it’s essential to start planning now to maximize your retirement savings. Consult with a financial advisor to determine the best strategy for your individual circumstances.

Closure

Thus, we hope this article has provided valuable insights into 2025 401(k) Catch-Up Contributions: Plan Now to Maximize Retirement Savings. We appreciate your attention to our article. See you in our next article!

- 0

- By admin